Balance Credit Loan Review 2021 – READ THIS BEFORE Applying!

Balance Credit seeks to address the various challenges that stand in the way of fast and convenient funding access.

In this review, we would like to take a look at its key strengths as well as weaknesses. By the end of it, you should have a clear picture of whether or not it is the loan service provider for you.

-

- 1. Visit the Balance Credit official website on balancecredit.com and create an account under loan application.

- 2. For the account creation process, you will need to provide your email address, create an account password and then confirm it.

- 3. Enter the loan information starting with the purpose for taking it out, your source of income and bank account details.

- 4. Once you are done filling in all the details, review the disclosures and then click “Agree and Check Your Eligibility.”

-

- 1. Visit the Balance Credit official website on balancecredit.com and create an account under loan application.

- 2. For the account creation process, you will need to provide your email address, create an account password and then confirm it.

- 3. Enter the loan information starting with the purpose for taking it out, your source of income and bank account details.

- 4. Once you are done filling in all the details, review the disclosures and then click “Agree and Check Your Eligibility.”

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

For customers in a rush to access loans, Balance Credit offers easy access to fast funding. Its target customer base consists of borrowers with less-than-ideal circumstances credit-wise. But its rates have been known to get to the triple digits. So do the benefits outweigh the costs? Let’s find out.What is Balance Credit?

Based in Chicago, Illinois, Balance Credit Personal Loans is a product of Braviant Holdings LLC. The company has been in existence since 2014 and is currently available in 10 states across the US.

It specifically targets users who need emergency cash. Its strongest selling points are the fact that it offers an easy approval process and fast access to funding. The institution’s main forte includes credit services and unsecured, personal installment loans for customers who need money fast.

Among its distinguishing factors is the fact that it offers options for both good and bad creditors. Claiming to offer a convenient alternative to title and payday loans, its funding is usually available in as little as a day.

The company makes approval decisions in a matter of seconds and does not charge early payment penalties. Its installment-loans are subject to fewer stringent criteria than traditional loans and do not necessarily require collateral.

But in much the same way as they offer lots of advantages, they have some serious downsides as well.

Pros and Cons of a Balance Credit Loan

Pros

- Fast loan approval

- Next-day funding

- Easy, online application process

- Does not require collateral

- Customers with poor credit scores can access funding

- Flexible terms of repayment

Cons

- Extremely high funding rates (e.g. 750% in Missouri)

- Only available in a handful of states

- Poor customer support

- Maximum loan amounts are $5,000 and in some states $2,500

- Lender charges high CSO fees in states where it’s not authorized to operate as a lender

- Missed payments will lead to additional fees that can increase borrowing costs significantly

- Depending on your state of residence, you may be unable to get a small loan as there are state minimum amounts

Balance Credit Loan Vs the Competition, how does it Compare?

Founded in 2014, Balance Credit is a lending company trying to make it easy to access personal loan faster by lifting the hurdles involved in the application process. The company boasts of fast loan approval process and instant access to funds with less stringent requirements. Tittlemax, Check n Go, and Advance America also focus on making loan easily accessible to at fair terms and interest rates. Here is how these providers compare to each other:

Balance Credit

- Loan limit starts from $100 to $5,000 but vary according to state of residence

- Interests rates from 99% to 720% depending on amount loaned and state of residence

- Requires minimum credit score of 300 – 700 points

- Repayments are done bi-weekly, semi-monthly, and monthly rolling out to a maximum of 2 years ( missed payments are penalised depending on state)

Titlemax

- Borrow between $2,600 to $10,000(Varies by the State, credit profile, and value of collateral)

- No credit score check

- Charges an annual interest rate of 300% on average, but can go as high as 1000%

- Loan amount should be paid after every 28 to 31 days

Check n’ Go

- Borrow from $100 to $500

- Requires a credit score of 300 to 850 points

- Fee rate starts from $10 to $30( depending on the State)

- 3 to 18 months repayment period

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- 12 months to 36 months repayment period depending on amount loaned

Ace Cash Express vs the competition, how does it compare?

Ace Cash express comes off as one of the best payday loan service providers due to their co-credit check policy. But how does it compare to equally competitive payday loan services like Speedy Cash, Check ‘n’ Go, and Advance America. We compared their borrowing limits, credit score requirements, loan costs in fees and interest, and the expected loan repayment periods. Here is the comparative guide:

Ace Cash Express

- Borrowing from $100 – $2,000 (varies by state).

- Credit score requirements of NIL (does not check)

- Fee rate on $100 starts from $25 (State dependent)

- Term of Loan 1 to 3 months

Speedy Cash

- Borrowing from $100 – $500 (varies by state).

- Credit score requirements of NIL (does not check)

- Fee rate on $100 starts from $26 (State dependent)

- Term of Loan 14 to 30 days (for payday loans)

Advance America

- Borrowing limits $100 up to $1,000

- Credit score requirements of NIL(Does not check)

- Fee rate on $100 starts from $15 (state dependent)

- Term of Loan 3 to 36 months

Check n’ Go

- Borrowing limits $100 to $1,500

- Credit Score Required 500 FICO

- Fee Rate on $100 starts from $25 (state dependent)

- Term of Loan 10 to 31 days

How does a Balance Credit loan work?

Like Advance America, the Balance Credit platform makes use of advanced technology to assist customers to access the highest level of funding possible. Thanks to its fast approval and processing, it requires little effort from the applicant and funds are accessible by the next day.

Primarily, the platform offers unsecured installment loans through its own funding sources or by means of a third-party lender. The entire application and approval process takes place online. You cannot make your application or get it processed over the phone, but you can seek assistance at any point during the application process.

Filling out the application takes approximately one minute and decisions on approval or rejection are communicated almost instantaneously. In case of approval, you will get the funds through direct deposit straight to your bank account, like you would for a business loan.

To qualify for loans on the platform, you need to have credit score of between 300 and 700. The lender does not specify a minimum annual income as part of its eligibility requirements. However, the only applicants it considers are people with a regular source of income.

It does not, however, require a bank account and does not accept joint applicants. Therefore, you do not have to be employed to qualify. Even applicants who are on welfare or those collecting unemployment can qualify.

The APR for Balance Credit loans is usually fixed but it will vary significantly from one applicant to another based on factors such as credit score. It would be wise to find out your credit score beforehand. You should also check whether there is any inaccurate or false information affecting your score and address it.

Loan amounts start from $100 and go up to $5,000. The lender offers loan terms ranging from as few as 4 months all the way to 24 months. Of course, the longer the loan term is, the higher the interest. Fortunately though, there is no penalty for making a prepayment before the loan term elapses.

Though you can get approval for your loan in a matter of minutes, in some cases it could take up to a day. Following approval, you simply need to read the terms and conditions, accept them and get the funds in your account by the next business day.

There are three repayment options, these are:

- Bi-weekly

- Semi-monthly

- Monthly

Note that you can cancel a loan application if you change your mind. However, to do so, you need to contact the team at 4:00PM CT at the latest on the same day you made the application. You can either make a call or send an email, simply requesting to cancel the application.

Since the platform does not charge any application fees, there will be no payment following the cancellation. But considering the fast loan processing times, it is imperative that you make the cancellation as soon as possible or risk being too late.

What loan products does Balance Credit offer?

- Unsecured installment loans

What other store services does Balance Credit offer?

Balance Credit does not offer any services other than personal installation loans or credit services. Customers only sign up to the platform to access these two services. Notably, you cannot take out more than a single loan at a time. But once you pay off the loan, you may be eligible for another one.

Balance Credit Account Creation and Borrowing Process

In order to access a loan on Balance Credit, here is what you need to do:

1. Visit the Balance Credit official website on balancecredit.com and create an account under loan application.

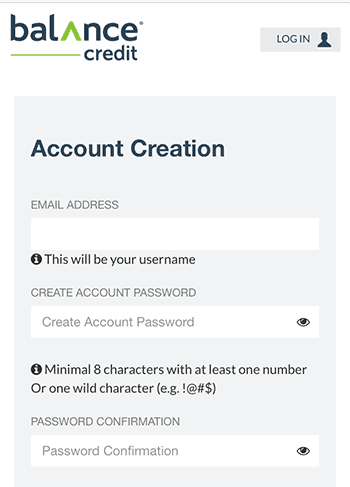

2. For the account creation process, you will need to provide your email address, create an account password and then confirm it.

Your email address will be your account username.

Fill in your personal information such as your name, address, location, phone number and social security number among others.

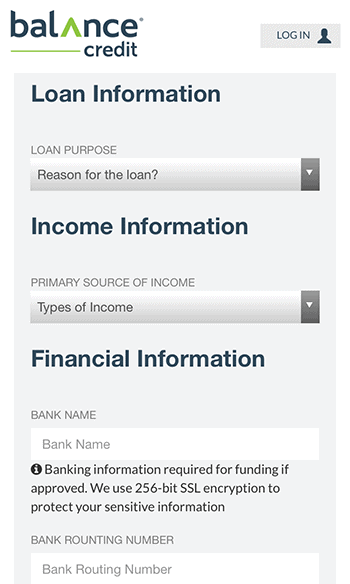

3. Enter the loan information starting with the purpose for taking it out, your source of income and bank account details.

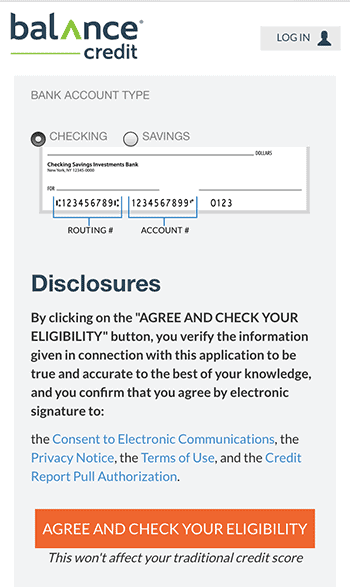

4. Once you are done filling in all the details, review the disclosures and then click “Agree and Check Your Eligibility.”

If the result for eligibility is positive, you will be in a position to select the loan amount and wait for funds processing.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Balance Credit Loan

Here are the requirements for one to be eligible for a loan from the company:

- Be at least 18 years old

- Be a US resident living in one of the states where the company operates

- Have a regular, verifiable source of income

- Credit score 300-700

After you provide this information, the lender will look at your credit score and can approve your loan in a matter of minutes. Funding will typically reflect in your account by the next day.

Information Borrowers Need to Provide to Get Balance Credit Loan

When filling out an application, you need to fill out the following information:

- Full name

- Valid email address

- Password

- Residential address

- Housing type (Own or rent)

- Phone number

- Social security number

- Date of birth

- Sources of income

- Reasons for borrowing

- Bank account details

What states are accepted for Balance Credit loans?

Balance Credit operates as a licensed Credit Services Organization (CSO) in some US states including:

For residents of Ohio and Texas, the lender works with third-party lenders and can only give a maximum of $2,500. But it is a direct lender in the rest of the states.

What are Balance Credit borrowing costs?

Borrowing costs at Balance Credit range significantly. Take a look at some of the fees:

- Rates (APR) – from 99% to 720%

- Origination fee – none

- Prepayment penalty – none

- Late payment fees – vary

Balance Credit Customer Support

You can reach Balance Credit support via phone, email or live chat on its website. They are a reliable team in terms of accessibility and reachability. However, a look at online reviews paints a negative picture.

There are lots of complaints about the response from the team. These range from the customer team not being responsive or helpful to lack of professionalism and poor communication skills.

Is it safe to borrow from Balance Credit?

Balance Credit is licensed and regulated in all the US states where it operates. It is also a well-known credit service and installment loan company. To ensure that its customer’s financial data does not end up in the wrong hands, it makes use of encryption on its website. For these reasons, it is safe to borrow funds from the lender.

Balance Credit Review Verdict

Balance Credit is a great solution for times when you are stuck in an emergency with no other way to access funding. It has a short approval process which takes place online. Furthermore, you will get almost immediate notification on whether your application has been approved or not to facilitate planning.

Moreover, the funds will typically be available within a day. Repayment arrangements are flexible and you will not be charged for prepayment.

However, as is usually the case with installment loans, the rates here are outrageous. Short-term loans are usually associated with high fees and rates, and are known to trap users in a debt cycle. Oftentimes, borrowers take out secondary loans to pay off the original ones within the required timespan.

Therefore, if you can qualify for an alternative form of funding, that could be a more cost-effective option.

Additionally, you can only access the services in 12 states, which greatly limits users in the rest of the US.

All in all, if you happen to be in one of the 12 states, and are stuck in a situation where you cannot access any other form of funding, it could be a viable option. But if you can get funding elsewhere, it would be best to avoid the outrageous fees.

If you have to take out a loan with the lender, make sure you understand all the terms and conditions before you sign the contract to avoid nasty surprises.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

💸 What does Credit Service Organization (CSO) mean?

A Credit Service Organization is one that basically provides access to credit by connecting customers with third-party lenders. Balance Credit is a CSO in two states, Ohio and Texas.

💸 If I am not employed, how can I qualify for a Balance Credit loan?

Balance Credit considers alternative sources of income such as child support payments and alimony, unemployment insurance, retirement benefits and social security benefits. If you receive regular income from any of these you may still qualify.

💸 Does applying for a loan on Balance Credit affect my credit score?

No. Balance Credit does not carry out any hard inquiries to any of the three main credit bureaus, Experian, Equifax or TransUnion. Therefore, applying for credit facilities from the lender does not affect your credit score.

💸 What type of bank account do I need to have to apply for a loan or credit with the lender?

You need to have a savings account with unlimited credit and debit privileges or a checking account so as to be eligible for a loan or credit services.

💸 What can I do if I cannot manage to make a payment on time?

If you cannot make a payment on time, consult the customer support team. They can help you make a payment extension or other suitable arrangements. Note that to avoid late payment fees, you need to contact the team 3 business days before the due date.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up