Li Auto was trading flat in US premarket trading today after posting mixed first-quarter earnings. While the company’s topline performance was better than expected, it posted a wider than expected loss.

Li Auto posted revenues of $545.7 million in the first quarter of 2021 which were higher than the $521.5 million that analysts were projecting. However, its per-share loss of 3 cents was wide than the 2 cents that analysts were expecting.

Li Auto reports mixed earnings

Li Auto’s revenues increased almost 320% year-over-year in the first quarter of 2021. However, they were lower as compared to the fourth quarter. The company’s deliveries in the first quarter were lower than the fourth quarter that took a toll on the revenues.

Automotive companies globally are grappling with a chip shortage. NIO also toned down its March production guidance due to the chip shortage and expects deliveries in the second quarter to be similar to the first quarter. Tesla meanwhile has been largely immune from the chip shortage situation and the Elon Musk run company expects deliveries to rise more than 50% this year.

NIO also posted mixed earnings

Looking at the earnings of Chinese electric vehicle makers, XPeng Motors and NIO have already released their earnings ahead of Li Auto. XPeng Motors reported stellar results and posted better than expected earnings in the quarter. NIO, like Li Auto, posted mixed earnings.

NIO reported revenues of $1.22 billion in the quarter which were higher than the $1.02 billion that analysts were expecting. While the company’s GAAP EPS of $0.48 was below the $0.81 that analysts were expecting, its non-GAAP EPS of -$0.04 was much better than the forecast estimates and was pretty close to breakeven. NIO generated positive free cash flows in the first quarter and ended the quarter with cash and cash equivalents of $7.3 billion.

Li Auto posted positive free cash flows in the quarter

Li Auto also generated positive free cash flows of $87 million in the first quarter. Its cash flows were higher than the corresponding period in 2020 when it had posted negative free cash flows. However, the cash flows were lower than what it had posted in the fourth quarter.

Li Auto posted a gross margin of 17.2% in the quarter. NIO and XPeng Motors also posted double-digit gross profit margins in the quarter.

Li Auto CEO on the earnings

Commenting on the earnings, Xiang Li, founder, chairman, and chief executive officer of Li Auto, commented, “We delivered 12,579 Li ONEs during the quarter, up 334.4% year over year. Li ONE was the second best-selling new energy SUV in China in the first quarter as our compelling product offering and superior user experience continued to delight users and boost brand awareness, while the unwavering support of our direct sales and servicing network underpinned our growth.”

Li Auto guidance

Li Auto expects to report revenues between $609 million to $651.7 million in the second quarter. The company is also forecasting deliveries between 14,500-15,500 in the quarter which would mean a year-over-year growth of 128% at the midpoint. Meanwhile, Li Auto’s revenue guidance was below street expectations.

Meanwhile, Li Auto expects its sales to reach 10,000 vehicles monthly in September which is roughly twice what it expects in the second quarter. Looking at the strong demand, electric vehicle companies are investing to ramp up their capacity.

Earlier this week, NIO also announced the doubling of its production capacity. It said, “Pursuant to the joint manufacturing arrangement, from May 2021 to May 2024, JAC will continue to manufacture the ES8, ES6, EC6, ET7 and potentially other NIO models in the pipeline.”

NIO is also expanding capacity

NIO also said that “In addition, JAC will expand its annual production capacity to 240,000 units (calculated based on 4,000 work hours per year) in order to meet the growing demand for NIO vehicles.”

Tesla already produces cars at two of its Gigafactories in Freemont and Shanghai while another two of these are coming up in Berlin and Texas.

Tesla’s CEO Elon Musk recently said that the company is also exploring setting up a plant in Russia. However, US automakers have had a tough time in the country and both Ford and General Motors have exited the market.

Li Auto could raise more capital

Li Auto raised $840 million in April from a convertible note offering. It raised cash in the US IPO last year and followed up with another round of share issuance. XPeng Motors also raised capital by selling shares in 2020 as electric vehicle companies tried to capitalize on the surging stock price while building a war chest for growth.

The company had cash and cash equivalents of $4.63 billion at the end of the first quarter. The cash does not include the proceeds from the April convertible debt. Meanwhile, Li Auto has said that it is open to raising more capital to fund its research and development expenses.

Li One

Li Auto only has a single model named Li One. It has launched the 2021 version and the management sounds optimistic. Commenting on the model, the CEO said “The model has elevated the extended range electric technology to a brand-new level, achieving an NEDC range of 1,080 kilometers and a WLTC range of 890 kilometers.”

He added, “Its energy efficiency in the fuel mode takes consumption as low as 6.05 liter per 100 kilometers based on the NEDC standard operational condition, a level that is unparalleled among large-sized four-wheel drive SUVs.”

In a piece of separate news, Neolix, an autonomous driving start-up by Li Auto has received permission to test autonomous deliveries in Beijing.

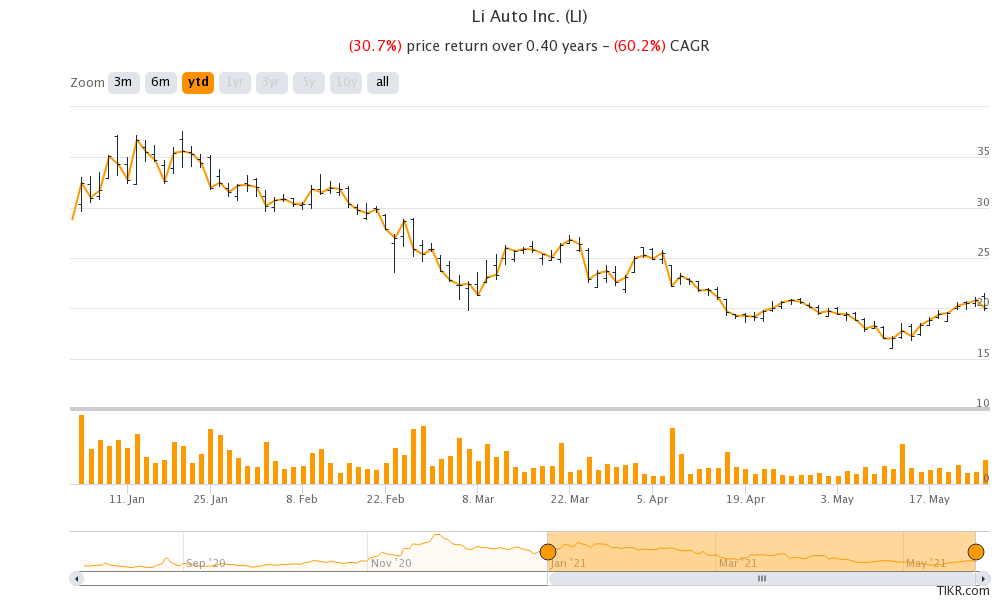

Li Auto shares were trading almost flat in the US premarket today but lost 3.9% in the regular trading yesterday. The shares are down almost 31% so far in 2021 and have a 52-week trading range of $14.31-$47.70.

You can invest in electric vehicle stocks like Li Auto through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account