Chinese electric vehicle (EV) companies including NIO (NYSE: NIO), Xpeng Motors (NYSE: XPEV), and Li Auto (NYSE: LI) have reported their July delivery reports. Here are the key takeaways from the reports.

Notably, while US-based EV companies like Tesla (NYSE: TSLA), Lucid Motors (NYSE: LCID), and Rivian (NYSE: RIVN) report their deliveries on a quarterly basis, Chinese EV companies typically provide them every month.

Key takeaways from Chinese EV companies’ July deliveries

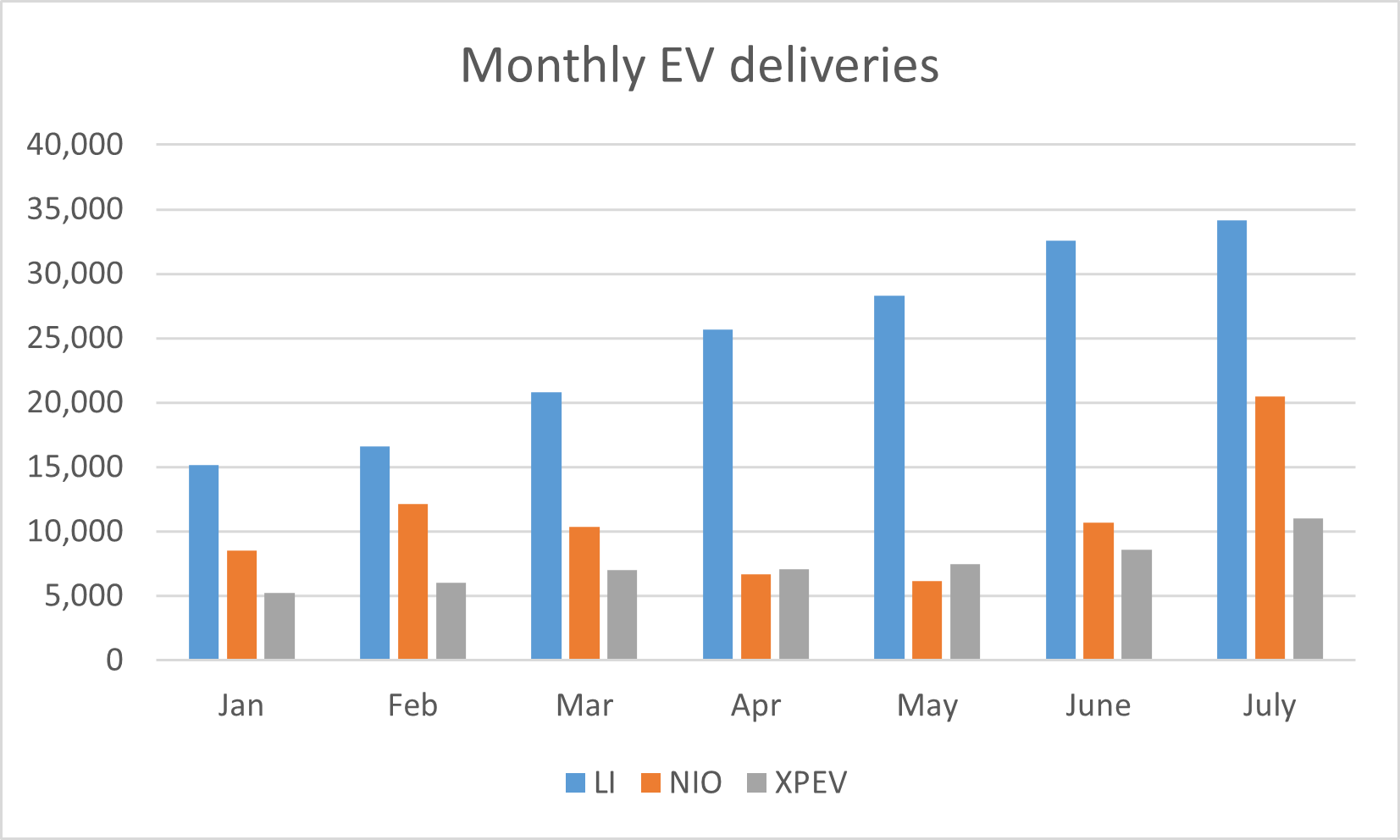

Looking at the July delivery reports of Chinese EV companies, as has been the case for the last many months, Li Auto’s deliveries surpassed both NIO and Xpeng Motors. It delivered 34,134 vehicles in July which was 227% higher than the corresponding month last year. Also, it was the second consecutive month when the company’s monthly deliveries were more than 30,000 which is no mean feat for the Chinese EV company.

The company has delivered 173,252 vehicles in the first seven months of 2023 while its cumulative deliveries reached 430,585. Xiang Li, CEO and chairman of Li Auto said, “As a preferred premium automotive brand for Chinese families, we successfully delivered our 400,000th vehicle in July, becoming the first emerging NEV manufacturer in China to achieve this milestone.”

Li Auto’s deliveries surpassed 30,000 in July also

He added, “Our three Li L series models achieved cumulative deliveries of over 200,000 vehicles since their successive launches beginning in June 2022. Li L series also consistently ranked as the top seller among SUVs priced above RMB300,000 in each month of the second quarter, establishing itself as a leader in China’s premium automotive market.”

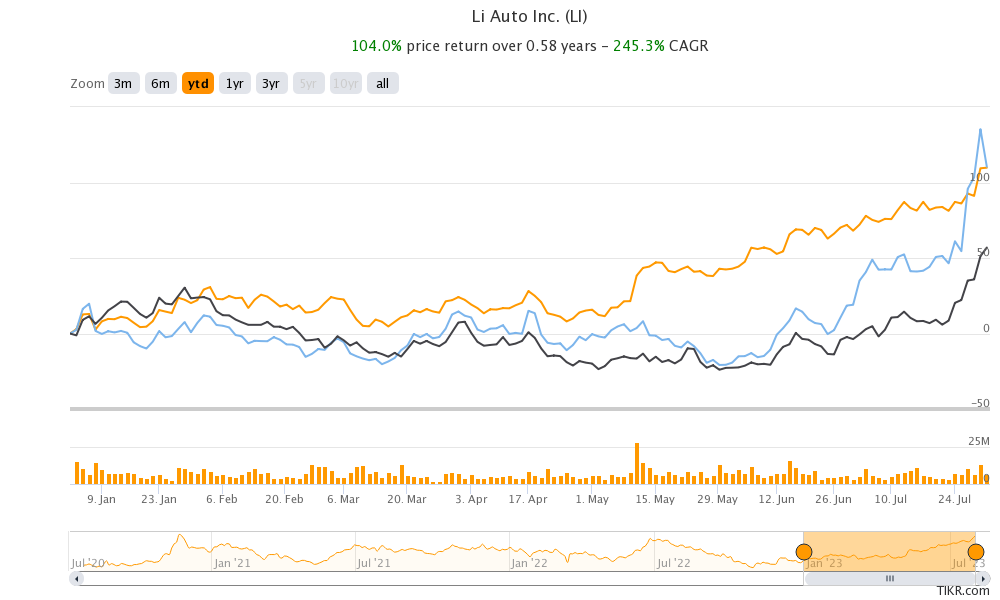

Notably, markets have also rewarded Li Auto for its strong execution and it outperformed both NIO and Xpeng Motors stock last year. Its 2023 returns are similar to Xpeng Motors – thanks to the splendid rally in the latter’s shares over the last month. However, with a YTD gain of almost 110% the stock’s returns are almost twice that of NIO.

Li Auto’s financial performance has also been better than most other Chinese EV companies as both NIO and Xpeng Motors have witnessed a steep fall in their gross margins amid lower deliveries.

The stock is trading higher in US premarket price action today as markets give a thumbs up to its July delivery report.

NIO’s deliveries more than doubled in July

NIO delivered 20,462 vehicles in July which was 104% higher than the corresponding month last year. The company’s monthly deliveries averaged just above 9,000 in the first half of 2023 and the steep rise in July deliveries is a welcome break for investors.

It delivered 75,023 cars in 2023 while the cumulative deliveries stand at 364,579. In its report, NIO said, “The deliveries of the All-New ES6, a smart electric all-round SUV, have been growing solidly since its debut in late May 2023, and exceeded 10,000 units monthly in July 2023. The All-New ES6 caters to wide-ranging journeys of users for their family, business and leisure needs.”

EV price war

Notably, NIO has built its brand as a premium Chinese EV company. However, even it had to cut vehicle prices after Tesla started a price war. Incidentally, in the US also, Ford has lowered car prices to make them competitive.

The EV price war has worsened and Ford even lowered the price of its F-150 Lightning by as much as $10,000.

Alluding to the EV price war, Ford said during the Q2 2023 earnings call, “Contribution margin and EBIT margin were both negative with pricing and volume pressures intensified, and that’s impacting all OEMs. Given the rapid and dynamic gain on the pricing environment, we no longer expect to see contribution margin breakeven for our Gen 1 products this year.”

It said, “While EV adoption is still growing, the paradigm has shifted. EV price premiums over internal combustion vehicles fell more than $3,000 in the second quarter and nearly $5,000 in first half. We expect the EV market to remain volatile until the winners and losers shake out.”

UAE invested in NIO

Last month, CYVN Holdings L.L.C., an investment vehicle majority owned by the Abu Dhabi Government invested around $740 million in NIO.

The two companies also “agreed to cooperate to jointly pursue opportunities in NIO’s international business following the closing of the Investment Transaction.”

Notably, NIO has started selling its EVs in Europe and eventually plans to enter the US market which is the world’s second-biggest automotive market after China. However, when it comes to profitability the US is the most profitable market for automakers.

Notably, oil-rich countries in the Middle East are diversifying into renewable energy and have invested in several green energy and EV ventures. Saudi Arabia is the biggest stockholder of Lucid Motors and has invested another $2.7 billion in the company over the last year.

Lucid Motors is setting up its next plant in Saudi Arabia and the kingdom has placed an order for upto 100,000 EVs with Lucid Motors.

Meanwhile, NIO stock is trading lower in US premarkets today despite reporting a steep rise in its July deliveries.

Xpeng Motors stock falls after July EV deliveries disappoint

Xpeng Motors stock is also trading sharply lower after it released its July delivery report. Notably, the negative price action post the release of delivery numbers has been more of a norm than an exception for Xpeng Motors this year.

Its monthly deliveries were below 10,000 in all the months in the first half of 2023. It delivered 11,008 EVs in July which was 28% higher than the previous month and the sixth consecutive month when its deliveries rose on a monthly basis. However, as has generally been the case over the last few months, its deliveries fell YoY in the month.

It delivered 52,443 EVs in the first seven months of 2023 which took its cumulative deliveries to 303,521. Last year, Xpeng Motors was ahead of Li Auto in terms of cumulative deliveries but after the splendid performance this year, the latter is now ahead by over 100,000 units.

Xpeng Motors launched G6 SUV

Xpeng Motors is banking on its G6 SUV – which it priced almost 20% below Tesla Model Y – to revive its fortunes. It delivered 3,900 G6 SUVs in July and added, “The strong sales momentum of G6 has led to a surge in showroom visits, which, in turn, has increased customers’ enthusiasm for other XPENG Smart EV models and the advanced smart technology equipped within.”

It emphasized, “The Company is focused on ramping up the G6’s production with its manufacturing facilities running at its full load. The Company also increased dedicated logistics resources to ensure the speed of G6 deliveries.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account