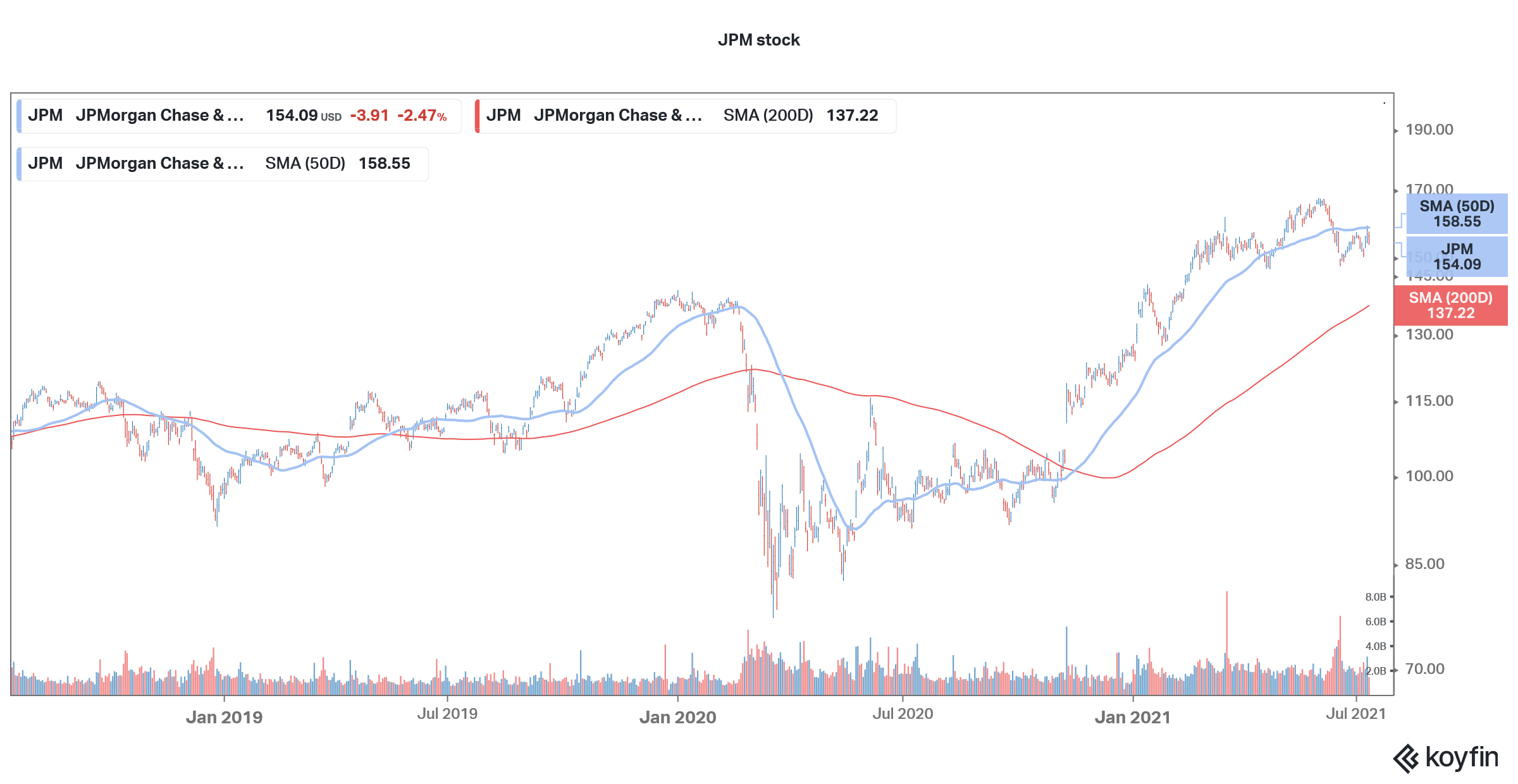

JPMorgan Chase stock was trading lower today. While America’s largest bank posted better than expected earnings, lower trading income and inflation data seem to be weighing on the sentiments.

This week, several US banks and financial institutions including Wells Fargo, Goldman Sachs, and Morgan Stanley had scheduled their earnings. Both Goldman Sachs and JPMorgan Chase reported their second-quarter earnings today and both are trading lower despite the earnings beat.

JPMorgan Chase second-quarter earnings

JPMorgan Chase reported revenues of $31.4 billion in the quarter versus estimates of $29.9 billion. The bank’s bottomline was also better than expected and it posted an EPS of $3.78 which was far ahead of the $3.21 that analysts polled by Refinitiv were expecting. Looking at the verticals, fixed income trading generated revenues of $4.1 billion in the quarter which was slightly below expectations. However, equities trading generated revenues of $2.69 which was ahead of the $2.31 billion that analysts were expecting. While its trading revenues fell 30% in the quarter, it was offset by higher investment banking revenues which came in at $3.4 billion–$300 million ahead of estimates. A strong US IPO market has helped buoy investment banking revenues for universal banks.

Jamie Dimon

Commenting on the earnings, CEO Jamie Dimon said “JPMorgan Chase delivered solid performance across our businesses as we generated over $30 billion in revenue while continuing to make significant investments in technology, people and market expansion. This quarter we once again benefited from a significant reserve release as the environment continues to improve, but as we have said before, we do not consider these core or recurring profit.”

JPMorgan Chase hiked dividend

US banks have started to increase their dividends after getting a go-ahead from the Federal Reserve. JPMorgan Chase has upwardly revised the dividends up 10 cents to $1 per quarter. Goldman Sachs, Wells Fargo, Morgan Stanley are among the other financial institutions which have increased the payout. However, Citi has kept the dividend same. The bank is in process of streamlining its business and announced the exit from several markets in a bid to concentrate on the core markets.

Analysts on JPMorgan Chase earnings

Analysts seem bullish on the bank earnings. “When you look at the results, these banks have had some blowout numbers,” said Peter Cardillo, chief market economist at Spartan Capital Securities. He added, “I think further and further into the earnings season, if we keep getting good results like what we saw for the first quarter then it will provide a cushion for the market.” Notably, the earnings of big banks like JPMorgan tend to have an impact on broader market sentiments also.

Meanwhile, the rise in the inflation data which showed the June core inflation rising 4.5% in the month dampened sentiments for bank stocks Despite the earnings beat, both Goldman Sachs and JPMorgan Chase are trading lower today.

How to invest in bank stocks

The outlook for banks like JPMorgan Chase looks positive amid the economic recovery. You can invest in bank stocks through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in financial stocks could be to invest in ETFs that invest in banks and financial stocks

Through an ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst-performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account