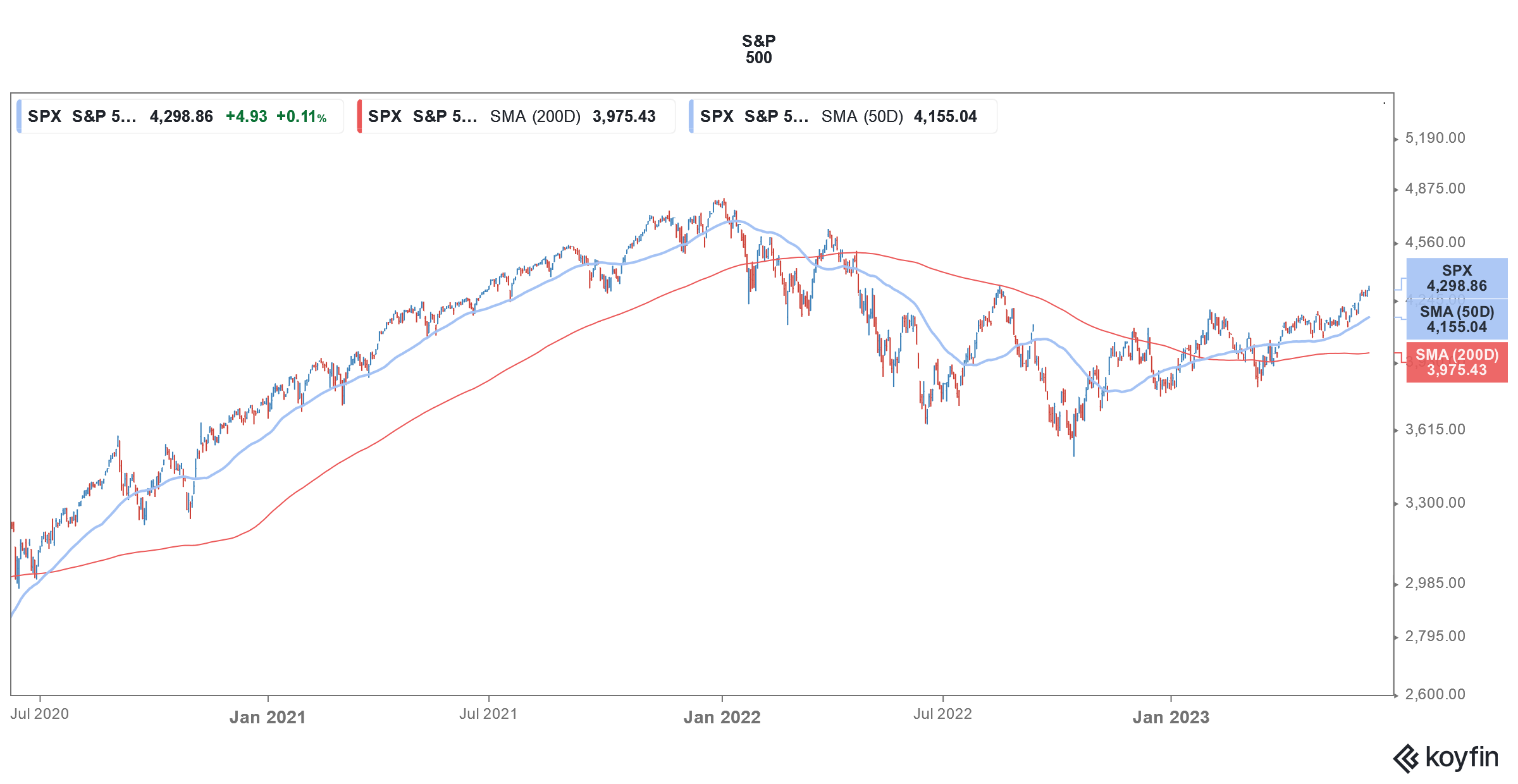

Last week, US stocks ended their bear market as the S&P 500 rose 20% from its October trough. While that might fulfill the official definition of the end of the bear markets, analysts have a nuanced view of whether we are headed for a new bull market.

Last week, Bank of America Corp.’s Savita Subramanian said that not only has the bear market ended but emphasized that the S&P 500 might rally further from these levels.

Bank of America strategist says the bear market in US stocks is over

On Friday, the S&P 500 hit 4,300 for the first time since August 2022. It is now up around 13% for the year and has closed with gains for the last four consecutive weeks. The tech-heavy Nasdaq has gained 27% – thanks to the AI euphoria.

Subramaniam, who heads the bank’s US equity and quantitative strategy said, “We believe we are back in bull territory, which might be part of what it takes to get investors enthusiastic about equities again.”

She added, “If investors feel pain in bonds, via lower returns or negative opportunity costs — likely if real rates rise from here — they should be incented to return to equities, especially equities that benefit from rising real rates.”

US companies have been on a cost-cutting spree

Subramaniam believes that the recent cost-cut exercise by US companies would help propel earnings higher. Notably, many US companies laid off workers over the last six months and have embarked on aggressive cost cuts.

Meta Platforms, which is among the top five S&P 500 gainers this year, has listed 2023 as the “year of efficiency.” While other companies might not have declared it officially, most companies have tightened their belts after the spending boom of the previous couple of years.

She added that her discussions with clients reveal that they have cash on the sidelines which they are looking to invest in stocks.

Would US stocks continue to rise?

According to Subramaniam, while tech names have led the rally in US stocks so far, the high beta and cyclical names might play catch up. She added that an equal-weighted version of the S&P 500 would outperform the market cap-weighted index.

Goldman Sachs also reiterated similar views and raised its year-end target for S&P 500 by 5% to 4,500 even as it kept the index’s EPS target unchanged at $224.

“The P/E multiple of 19x is greater than we expected, led by a few mega-cap stocks,” said Goldman Sachs chief US equity strategist David Kostin.

He added, “But prior episodes of sharply narrowing breadth have been followed by a ‘catch-up’ from a broader valuation re-rating.”

In her report, Subramaniam cited historical data and said that since 1950, “after crossing the +20% mark from the bottom, the S&P 500 continued to rise over the next 12 months 92% of the time.”

Not all share her bullishness though including Bank of America peer Michael Hartnett who is bearish on US stocks and has termed the rally in AI and tech stocks as a “bubble.”

Wells Fargo advises caution

Paul Christopher, head of global market strategy at the Wells Fargo Investment Institute is also not convinced that the rally in US stocks would sustain and said “There is likely more downside risk in stocks at this point (a.k.a. Don’t chase this equity rally).”

“Markets have been trying to convince themselves that rates were going to come down, that the Fed and central banks around the world would not hike by as much as they have,” said Christopher speaking with CNBC.

He added, “Even if the Fed stays on hold next week, we don’t think the Fed stays on hold for very long — inflation is just too sticky.” Christopher does not believe that the Fed would cut rates this year.

Notably, on multiple occasions, Fed Chair Jerome Powell has ruled out rate cuts. While the US annualized CPI dipped to 4.9% in April, it is still quite high for comfort.

Christopher added that historically, US stocks bottom on an average six months after the Fed starts cutting rates.

Fed’s June meeting is scheduled for this week

The Fed’s June meeting is scheduled for this week and CME’s Fed Watch tool shows a 26.4% probability of a 25-basis point rate hike. The remaining 73.6% of traders believe that the Fed would hold rates at the current level.

The Fed raised rates by 25 basis points in May. It was the tenth-rate hike in the ongoing tightening that started in March 2022 with a 25-basis point rate hike. The Fed graduated to a 50-basis point rate hike at the next meeting. Thereafter the US central bank raised rates by 75 basis points at four consecutive meetings before lowering the pace to 50 basis points in December.

Meanwhile, the Fed signaled a pause in the tightening cycle and the post-meeting statement omitted reference to “the Committee anticipates that some additional policy firming may be appropriate.”

Fed’s meeting and inflation data could impact US stocks

All said the current week looks quite crucial for US stocks as we’ll get the May inflation report which would be followed by the Fed’s rate hike decision. The US central bank has played party pooper multiple times over the last year.

Jim Cramer is among those who believe the Fed might surprise negatively this week and said “I’d be very surprised if Wall Street’s thrilled with next Wednesday’s Fed meeting. So prepare yourself, even as I’d love to be wrong on this,” said Cramer.

He also advised to not get “lulled into complacency” as “there’s still a lot of things that could go wrong in the market.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account