Tilray and Aphria have completed their merger that would create a marijuana powerhouse. What lies ahead for Tilray after its merger with Aphria?

The merger between Tilray and Aphria, which was announced last year, has been structured as a reverse merger as Tilray acquired Aphria, which was the larger between the two companies.

While Aphria shareholders had approved the merger earlier in April, Tilray extended the merger voting date and also lowered the quorum requirement. Ultimately the merger was completed and Tilray now also trades on the Toronto stock exchange along with its primary US listing.

Tilray starts trading on the Canadian stock exchange

As for Aphria, it has stopped trading and all existing Aphria shareholders have received 0.8381 Tilray shares for every Aphria share that they held. Meanwhile, shareholders of Aphria hold the majority stake in Tilray now. Aphria’s CEO Irwin D. Simon is the new CEO and chairman of Tilray while Brendan Kennedy, the company’s CEO before the merger has joined the board.

Commenting on the merger Simon said “Our focus now turns to execution on our highest return priorities including business integration and accelerating our global growth strategy. Covid-19 related lockdowns have presented unique challenges across Canadian and German markets.”

Irwin Simon on the merger

He added, “As these markets begin to re-open, Tilray is poised to strike and transform the industry with our highly scalable operational footprint, a curated portfolio of diverse medical and adult-use cannabis brands and products, a multi-continent distribution network, and a robust capital structure to fund our global expansion strategy and deliver sustained profitability and long-term value for our stakeholders.”

Meanwhile, now as the merger euphoria has ended the focus would shift to Tilray’s fundamentals and how the company executes on the business plans including the $81 million annual pre-tax synergies that it forecasts within the next 18 months.

Tilray is posting losses

Also, the combined entity is posting losses and investors would watch out for cues on the path to profitability. Most of the cannabis companies are posting losses but investors have been buoyed by strong topline growth and prospects of federal marijuana legalization in the US.

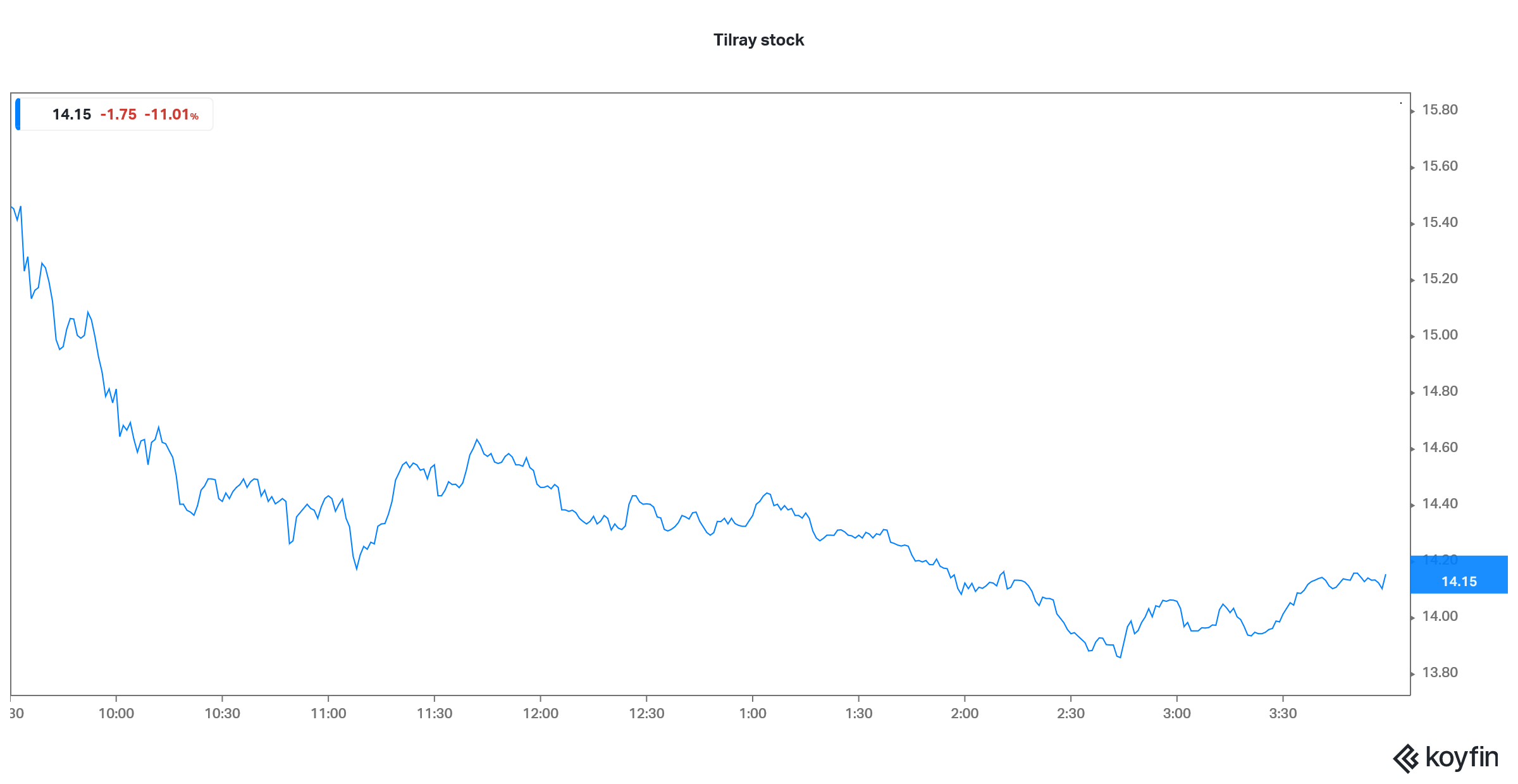

Meanwhile, while cannabis stocks soared after Joe Biden’s election as the US president and continued their uptrend after the Senate runoff in January, they have since come under pressure and all cannabis stocks have fallen sharply from their 52-week highs.

Tilray was targeted by WallStreetBets

Tilray was among the worst performer when it comes to drawdown from 52-week highs. That said, the stock had soared amid pumping by the Reddit group WallStreetBets and its stock price zoomed way above what it should have traded according to the merger ratio. As the short squeeze lived its course, Tilray stock crashed and the merger arbitrage with Aphria stock gradually disappeared.

All the stocks that were pumped by WallStreetBets including Zomedica and Sundial Growers have fallen sharply from their peaks. While a short squeeze can only influence the price action in the short term, there is a long term impact from the mania.

Reddit mania has ended

Firstly companies pumped by WallStreetBets raised a lot of capital by selling shares at high prices. The high prices were made possible only because of the WallStreetBets pumping. Secondly, short-sellers have been wary of taking bearish bets against these companies fearing another short squeeze. This would help these companies lower their cost of capital in the medium to long term.

Jefferies upgrades Tilray

Coming back to Tilray stock, while it has been falling after the merger with Aphria, Jefferies has put its weight behind the cannabis company. Jefferies analyst Owen Bennett upgraded Tilray stock from underperform to outperform while forecasting a 60% upside in the pot stock.

“For us, when Aphria and Tilray combined, it was the perfect match. In Canada, a leading portfolio of brands, supported [by] an efficient cost structure. In Europe, the market is now picking up, while Tilray’s scale and Aphria’s unique German positioning make it perfectly suited to succeed,” said the analysts in their note.

Notably, Tilray has operations in Europe as well as North America. The company sells both recreational and medical use marijuana. Curaleaf is also expanding in Europe with its acquisition of EMMAC Life Sciences.

Jefferies sees over 60% upside

Sounding a bullish note on Tilray, Jefferies said “Tilray’s BS ($372mn cash) should support a near term entry into the US while the state by state structure persists. When full federal legalization comes, infrastructure/brand equity/awareness from its wider consumer businesses (hemp-food/CBD/alcohol) will then also be advantageous.”

How to trade in cannabis stocks

Tilray stock was trading over 6% higher in US premarket trading today. More analysts might take a bullish note of Tilray stock after the merger. While all marijuana stocks have tumbled after the euphoria over legalization, we could see some recovery in cannabis companies.

You can buy Tilray stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the cannabis company could be to invest in ETFs that invest in marijuana companies

Through a marijuana ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst-performing stocks in your portfolio. The AdvisorShares Pure Cannabis ETF (YOLO) is one ETF that invests in marijuana companies.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account