The International Monetary Fund (IMF) is forecasting that oil prices will trade range-bound during 2021 as the demand for crude is likely to remain weak amid the pandemic.

According to a recent report from the Washington-based organization, oil prices could trade in a range between $40 and $50 per barrel, which means that the IMF is not expecting a dramatic comeback for oil during next year, as oil prices are already trading near those levels after rebounding off their April lows – when the price of crude traded negative as a result of an oil glut.

The institution headed by Christine Lagarde highlighted that increased demand for alternative energy sources is also playing against a recovery in the demand for oil during next year, as both consumers and businesses keep favoring environmentally friendly products and services.

The demand for oil remains well below its 2019 levels, with the International Energy Agency (IEA) recently cutting its outlook for 2020 in September down to 91.7 million barrels per day, a level that is 8.4 million barrels lower compared to last year. The agency had forecasted a reduction of 8.1 million a month ago.

Meanwhile, the Organization of the Petroleum Exporting Countries (OPEC) has provided an even gloomier outlook for crude in 2020, as the cartel expects a contraction of 9.5 million barrels per day while the organization also warned that there are still significant risks on the table that could further affect this year’s performance.

The IMF forecast for oil prices would mean that the potential upside for oil as an investment is capped at 22% based on the price of the West Texas Intermediate (WTI) benchmark today – currently trading at $41 per barrel during the European commodity trading session.

How are oil prices reacting to the news?

WTI futures are sliding 0.5% in early oil trading activity, with the US benchmark failing to climb above the $41 threshold multiple times already this month.

Oil traders seem to be reluctant to push the price higher as demand concerns continue to put a cap on the value of the commodity.

At this point, the path of least resistance seems to be down, while, from a technical standpoint, some elements are also favoring a bearish outlook for oil in the short-term.

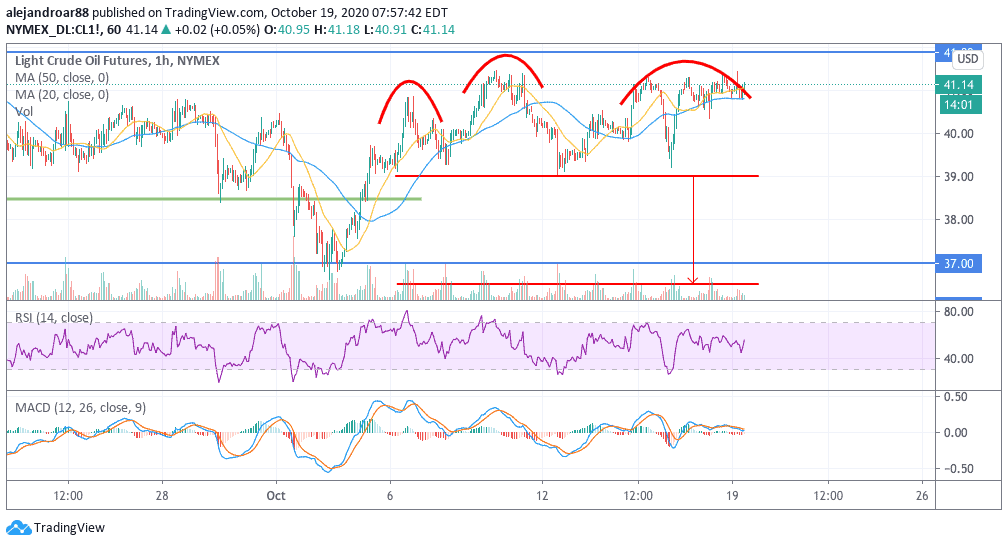

The hourly chart above shows how a potential head and shoulders formation has been shaping up since the beginning of October, with the price failing to move above $41 multiple times – resulting in the creation of both the head and the right shoulder of the pattern.

This pattern is still unconfirmed and could be invalidated if the price breaks above that $41 resistance this week, but, for now, it remains in play.

Moreover, another factor that reinforces this bearish outlook for oil is the bearish divergence shown in the chart by both the RSI and the MACD, with the price moving higher on weaker momentum.

This situation could lead to a reversal for oil in the short term, with the pattern being confirmed if the price action moves below the $39 neckline. If that were to happen, oil could drop by as much as 10% given the height of the pattern’s head – which is traditionally a plausible way to measure the extent of the downward move.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account