Amazon (NYSE: AMZN) would release its earnings for the first quarter of 2023 on Thursday after the markets close. Here’s what Wall Street expects from Amazon’s earnings.

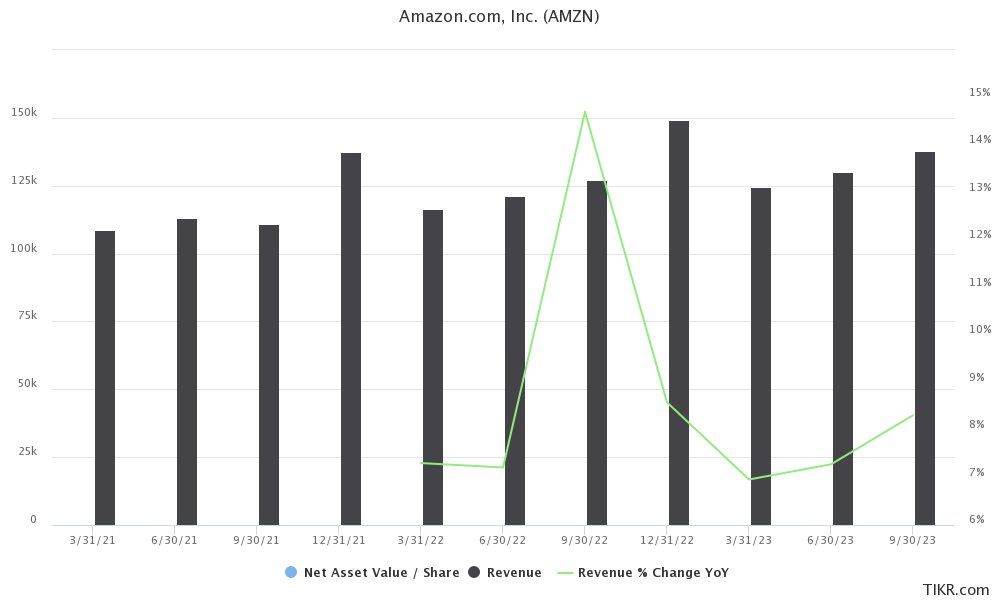

Analysts polled by TIKR expect Amazon to post revenues of $124.5 billion in the quarter – a YoY rise of 7%.

During their Q4 2022 earnings call, AMZN gave a revenue guidance of $121 billion-$126 billion which would imply a YoY rise of between 4%-8%.

Last year, Amazon’s revenues rose 9.4% as compared to 2021, which was the lowest-ever rate of growth since it went public. The revenue growth would seem even dismal considering it was partially aided by high US inflation.

AMZN is witnessing a growth slowdown

Analysts expect Amazon’s revenues to rise 8.4% this year which is even lower than the last year. However, its revenues are expected to rise by 12.7% in 2024.

Like fellow tech companies, Amazon is witnessing a severe growth slowdown and has announced 27,000 layoffs this year – which in absolute terms are the highest among FAANG peers.

In percentage terms though, Meta Platforms has announced the most layoffs as after it completes round two of job cuts, its workforce would be around 25% lower than what it was at the peak.

Commenting on the layoffs, Amazon’s CEO Andy Jassy said, “given the uncertain economy in which we reside, and the uncertainty that exists in the near future, we have chosen to be more streamlined in our costs and headcount.”

It has taken several other measures to lower costs and has also halted the construction at its HQ2 in Virginia.

Amazon’s Q1 2023 earnings estimates

Analysts expect Amazon to post an adjusted EPS of $0.22 in the first quarter – which is 157% higher than the corresponding quarter last year. While the company does not provide EPS guidance it forecast operating income between $0-$4 billion for the first quarter.

Notably, in the previous quarter, only AWS posted an operating profit while both the North America and International e-commerce operations posted an operating loss.

What to watch in Amazon’s Q1 2023 earnings release?

During Amazon’s Q1 2023 earnings, markets would watch the guidance for the second quarter including comments on AWS growth outlook.

During the Q4 2022 earnings call that was held in early February, AMZN said that so far in 2023, AWS revenue growth is in the mid-teens.

Also, analysts might look for some color on the company’s cost cuts.

Amazon might also comment on its AI initiatives. In its shareholder letter earlier this month, Amazon said, “We have been working on our own LLMs for a while now, believe it will transform and improve virtually every customer experience, and will continue to invest substantially in these models across all of our consumer, seller, brand, and creator experiences.”

Analysts are bullish ahead of Amazon’s Q1 2023 earnings

Meanwhile, Wall Street analysts look bullish on Amazon stock heading into earnings. Last week, JPMorgan reiterated AMZN as a best idea and said, “We’re modeling continued e-comm share gains in 2023 as AMZN & other retailers gain share in key under-penetrated categories such as grocery, CPG, apparel & accessories, & furniture/appliances/equipment.”

Bank of America also echoed similar views and said, “recession risk clouds the revenue outlook (especially for AWS), but with an investment cycle ending (see shareholder letter), Online retail share gains, and a large cloud opportunity ahead, we continue to like the stock on depressed valuation vs. history.”

Wolfe also reiterated AMZN as an outperform and said that it expects the company’s earnings to be in line with its guidance.

AMZN stock has underperformed tech peers

Amazon stock fell almost 50% last year and was the third worst-performing FAANG stock of the year. It was barely in the green in 2021 and underperformed the FAANG peers by a wide margin.

In 2021, Amazon looked set to become a $2 trillion company but last year, its market cap fell even below $1 trillion. It became the first company ever to lose $1 trillion in market cap. Apple too joined it on the dubious list after the stock crashed on the first trading day of 2023.

AMZN stock has meanwhile rebounded from the lows and the market cap has surpassed $1 trillion. It still however trades well below the 2021 highs.

The macro slowdown is hurting Amazon’s earnings

The macroeconomic slowdown is hurting Amazon. US retail sales have slowed down and sales of discretionary products have especially been tepid. Also, as more people have started shopping in stores, online sales growth has come down.

In its cloud segment, while companies are slowing down their spending, the competition is rising and AWS revenue growth fell to an all-time low in the fourth quarter of 2022.

While several brokerages listed Amazon stock as a top pick for 2023, the stock is yet to meaningfully justify the optimism.

Markets next look forward to Amazon’s Q1 2023 earnings next week to gain more insights into how the macro slowdown impacted the company in the first quarter.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account