Amazon (NYSE: AMZN) has been on a cost-cutting spree and has announced two rounds of mass layoffs this year. Wall Street analysts are meanwhile turning bullish on the stock amid the aggressive cost cuts.

In January, Amazon announced that it would lay off 18,000 employees which were higher than the 10,000 job cuts that it was previously planning. Last month, the company said that it would lay off another 9,000 employees.

In his blog post, Amazon’s CEO Andy Jassy said that the company took the decision after the annual planning exercise.

Amazon has announced 27,000 layoffs

He said, “given the uncertain economy in which we reside, and the uncertainty that exists in the near future, we have chosen to be more streamlined in our costs and headcount.”

Jassy added, “The overriding tenet of our annual planning this year was to be leaner while doing so in a way that enables us to still invest robustly in the key long-term customer experiences that we believe can meaningfully improve customers’ lives and Amazon as a whole.”

It has taken several other measures to lower costs and has also halted the construction at its HQ2 in Virginia.

Other tech companies have also taken measures to control costs and most have resorted to mass layoffs. Apple so far refrained from mass layoffs but even it has reportedly laid off some employees.

Amazon’s sales growth has slowed down

Amazon reported revenues of $149.2 billion in Q4 2022 which was 9% higher than the corresponding quarter last year.

In the full year, Amazon’s sales growth was only 9% which is the slowest pace of annual rise since it went public. Other FAANG stocks are also battling a growth slowdown. In the December quarter, Apple’s sales fell 5.5% which was the steepest pace of decline since 2016.

Netflix’s revenue growth also fell amid the economic slowdown. Meta Platforms’ revenues fell YoY last year, its first annual decline in revenue as a public company.

AWS was the only profitable segment in Q4 2022

Amazon posted a net income of only $0.3 billion in Q4 which transforms into an EPS of 3 cents. The company’s profits fell short of what markets were expecting. It posted an operating income of $2.7 billion in the quarter which was above the midpoint of its guidance.

That said, only AWS posted an operating profit of $5.2 billion in the quarter. While the North American segment lost $240 million, the international business reported an operating loss of $2.2 billion.

In the full year, the North American business reported an operating loss of $2.8 billion while the commensurate figure for international business was $7.7 billion. As has been the case for the last many quarters, AWS was the savior and generated an operating profit of $22.8 billion in the quarter.

Amazon has underperformed tech peers

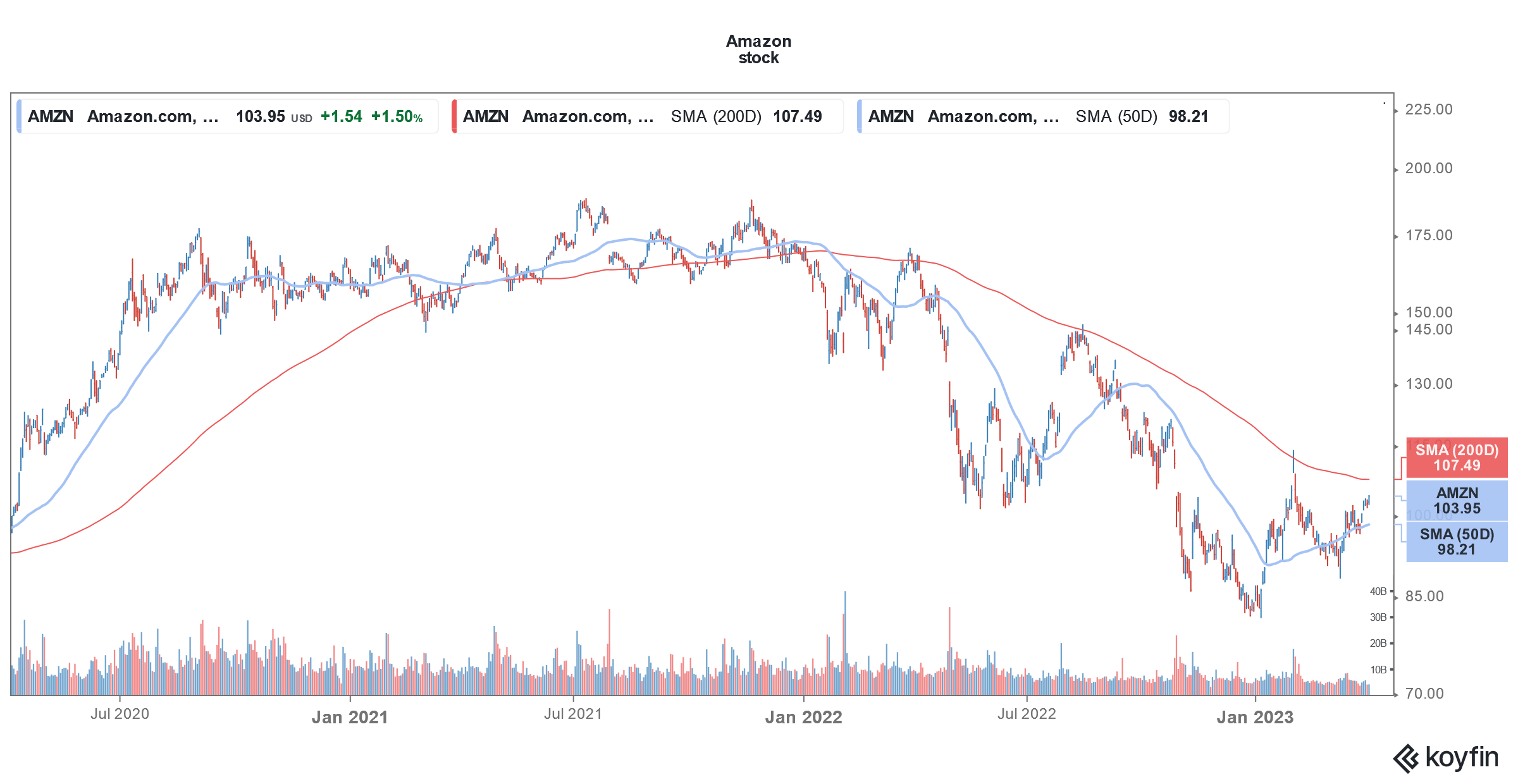

In 2021, Amazon looked set to become a $2 trillion company. However, the stock underperformed markets by a wide margin that year and was barely in the green even as the S&P 500 gained over 26%.

It shed almost 50% in 2022 as well and also lost its status as a $1 trillion company. It has the dubious distinction of becoming the first company to lose $1 trillion in market cap. Earlier this year, Apple too joined the list as the iPhone makers’ market cap briefly fell below $2 trillion.

While AMZN stock has recovered somewhat from the lows, it is still underperforming tech peers by a wide margin over the last year.

Baird reiterated AMZN stock as outperform

Last week, Baird reiterated AMZN stock as outperform and said in its note “While shares have underperformed other mega-caps over the past year, we believe improving margins in 2H23, some stability in AWS growth (after one more cut?), and/or improving e-commerce trends each could prove to be catalysts.”

Evercore ISI also reiterated the stock as outperform even as it slashed the target price from $160 to $155.

Amazon Q1 2023 guidance disappointed markets

Amazon forecasted sales growth between 4-8% in the first quarter. It sees revenues between $121 billion to $126 billion in the first quarter while analysts were expecting the metric at $125 billion.

Amazon said that its growth rates might not revive anytime soon. It also warned that so far in 2023, AWS revenue growth is in the mid-teens.

The company forecast operating income between $0-$4 billion for the first quarter. It posted an operating income of $3.7 billion in the first quarter of 2021.

Meanwhile, Amazon posted negative free cash flows of $11.6 billion in 2022 which were higher than the cash outflow of $9.1 billion in 2021.

What’s hurting AMZN stock?

The macroeconomic slowdown is hurting Amazon. US retail sales have slowed down and sales of discretionary products have especially been tepid. Also, as more people have started shopping in stores, online sales growth has come down.

In its cloud segment, while companies are slowing down their spending, the competition is rising and AWS revenue growth fell to an all-time low in the fourth quarter of 2022.

While several brokerages listed Amazon stock as a top pick for 2023, the stock is yet to meaningfully justify the optimism.

While the stock has gained around 23% for the year, it is outperforming the Nasdaq only slightly which would seem even paltry considering the massive underperformance in 2021 and 2022.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account