The price of spot gold is trimming its early losses during this morning’s commodity trading action as the annualized inflation rate in the United States rose above the market’s forecasts.

Before the data came out, the price of gold was down 0.65% at $1,876 per troy ounce but it quickly bounced to $1,885 per ounce after the US Bureau of Labor Statistics released its report on inflation covering the month of May, with the annualized consumer price index (CPI) advancing 5% – 30 basis points above economists’ forecasts for the month.

This has been the strongest spike in inflation rates since August 2008 while this is the second month in which analysts’ inflation estimates have been shattered as prices appear to be spinning out of control.

According to the report, core inflation, which excludes certain items like food and energy, advanced 3.8% or 30 basis points above the markets’ estimates, while the monthly headline CPI rose 0.8% – also 30 basis points above estimates.

Gold’s performance is almost flat for the year as the price of the precious metal has climbed from its March lows aided by well-founded concerns that inflation in the United States could be spinning out of control.

For centuries, gold has been viewed as a suitable hedge against the erosion in the US dollar’s purchasing power while cryptocurrencies, an asset class recently touted as a potential substitute for the precious metal, have been performing poorly in the past few weeks – a situation that has possibly accelerated the amount of inflows toward the most traditional alternative of the two.

Since May started, the top two exchange-traded funds (ETF) offering exposure to gold have attracted more than $1.6 billion in net inflows after months of outflows caused by a market-wide risk-on attitude prompted by the discovery of effective vaccines against the COVID-19 virus.

This turn in the tide for the precious metal can either be transitory if this latest rise in prices fades in the following months as the Federal Reserve expects or it could be just the beginning of a steep climb in the price of the yellow metal if the CPI starts to leap toward levels unseen in decades.

Meanwhile, the markets will probably weigh the possibility that the US central bank could start to seriously consider tapering its $120 billion asset purchase program as a plausible measure to slow down inflationary pressures. Such a scenario could result in higher volatility for equities as well.

What’s next for gold?

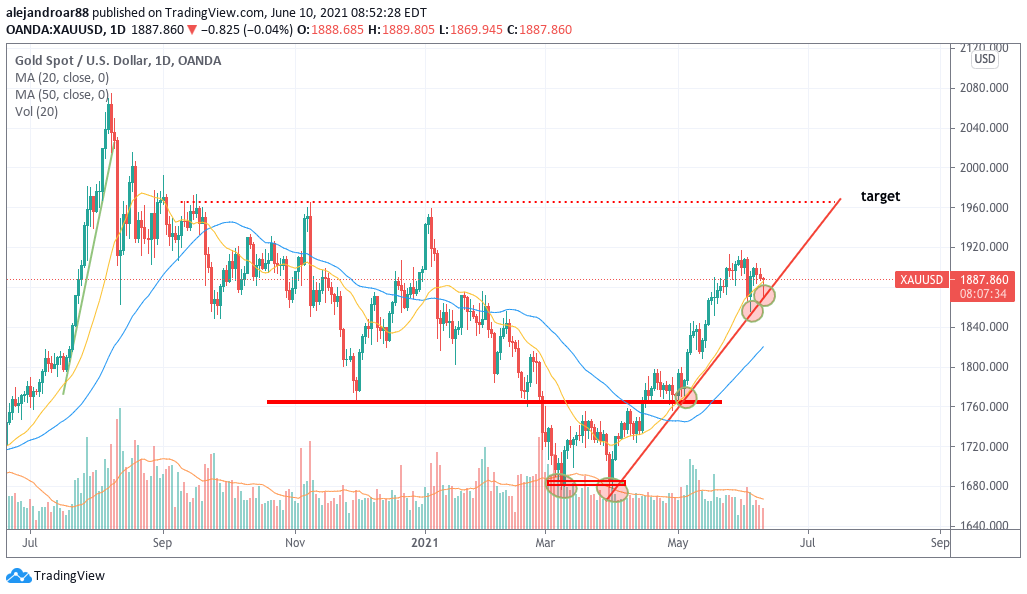

Our outlook for gold remains bullish on the back of this higher inflation narrative while the price of the precious metal is tagging a key trend line support for the fourth time. The candlestick formation seen today is showing a strong bounce off this support that could be signaling that the price of the yellow metal is ready for another leap toward a near-term target of $1,965 per troy ounce.

The backdrop remains favorable for gold as long as the Federal Reserve’s policy remains ultra-accommodative while any modifications to the central bank’s asset purchase program could either reverse the current uptrend or could end up driving more interest toward gold depending on the market’s perception about how effective such a measure would be to reduce inflationary pressures.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account