Gold prices are trading range-bound in the past few days amid a mix of positive and negative catalysts including a weaker dollar and vaccine optimism.

The spot price of gold is advancing 0.9% today in early commodity trading activity at $1,843 per ounce, as the city of London and Germany’s government introduce further restrictions amid a spike in virus cases in recent days.

Meanwhile, today’s uptick in the yellow metal is further supported by a weaker greenback, with the US dollar – as tracked by Bloomberg’s US dollar index – moving 0.1% lower during the European forex trading session.

This downtick in the North American currency seems to be prompted by a proposal from a bipartisan group of lawmakers, which consists of a relief bill of $908 billion for the country’s economy, with Congressional leaders aiming to pass the bill before the federal government’s funding lapses on Saturday.

However, the faith of the bill remains undecided as certain sticky points, including disagreements over local and state funding, have not yet been resolved.

The approval of the bill could put further pressure on the greenback, which would result in some short-term upside for gold prices – although other factors including the efficacy of the vaccine rollout in the United States are also likely to play a role in influencing the value of the yellow metal over the coming days.

It is important to remember that Citigroup (C) recently raised its price target for gold for 2021 to $2,500 per ounce – this being one of the few latest bullish calls on the yellow metal while others are actually downgrading. The American bank believes that “the conditions that drove gold to an all-time high this year are very much still in place”.

However, with a vaccine being rolled out in multiple developed countries, the prospect of a swift global economic recovery remains a mid-term threat to gold prices, making this target not as easy to achieve as it was before the treatment was available.

What’s next for the price of gold?

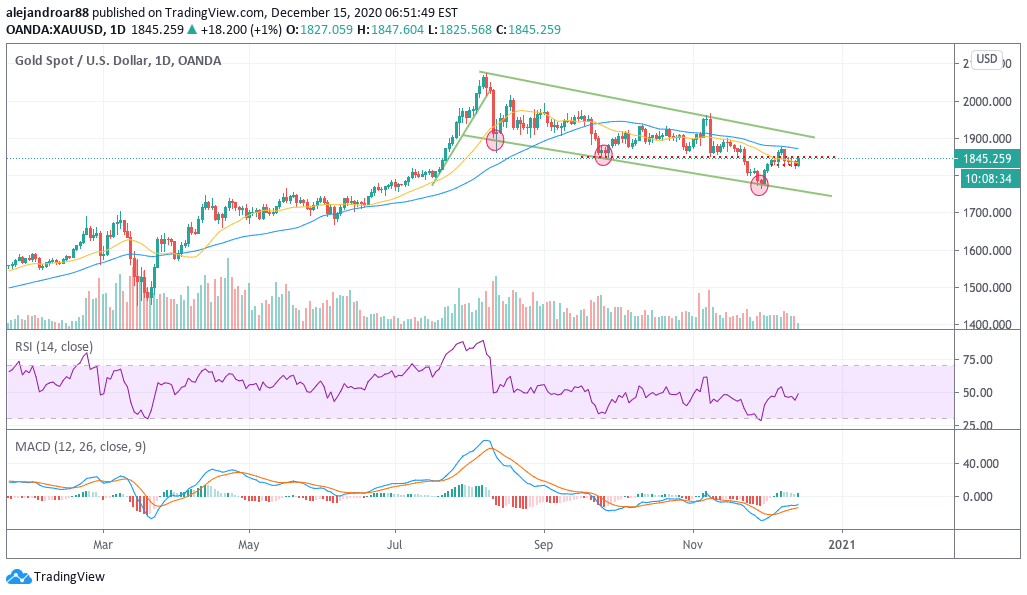

As of now, gold remains in a downtrend since the August pullback, although the possibility of the current formation being a bull flag pattern remains.

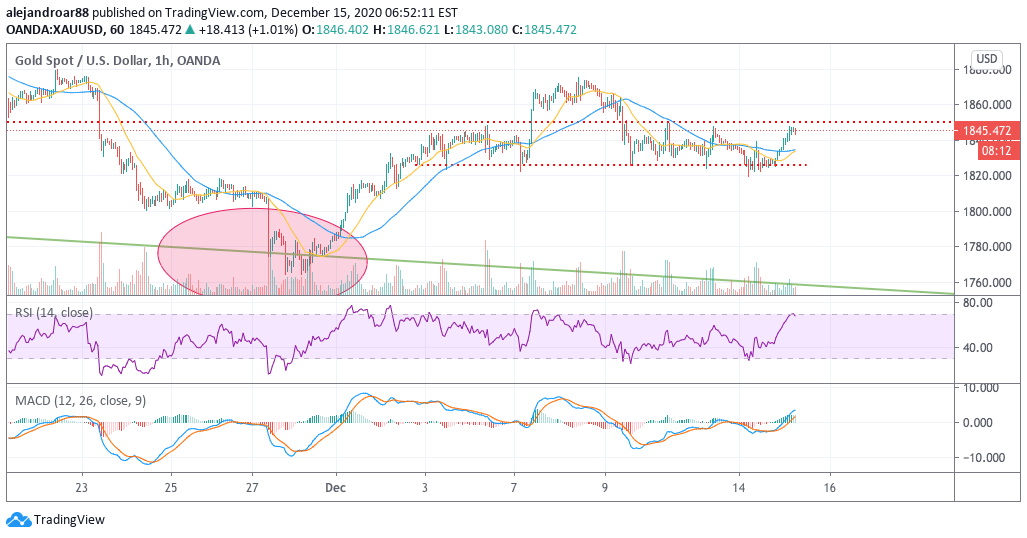

Meanwhile, the price of the precious metal has been trading range-bound since its early December rebound, with the price failing to climb its short-term averages lately while hovering between $1,850 and $1,825.

This consolidation is an interesting development in gold prices, as market players appear to be unresolved in regards to the faith of the commodity.

The next few days or weeks are probably going to be decisive in terms of where gold might be headed, as a break above or below the hourly price channel shown in the chart could be the starting point of a strong move.

As of now, the key support to watch is the $1,825 mark while the $1,850 level has now become the resistance to beat. If that bullish move were to happen, gold would have to break above its short-term moving averages in case bulls wants to take the wheels of the price action for longer.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account