The price of gold is advancing strongly for a second day in early commodity trading action as weakness in the US dollar and higher demand for US Treasury bonds appear to be tipping the balance in favor of the yellow metal.

Gold’s spot price is up 0.74% so far this morning at $1776.84 per ounce following yesterday’s 1.6% uptick in the precious metal.

Meanwhile, the US dollar index (DXY), a benchmark that tracks the value of the North American currency against a basket of foreign currencies, is down 0.1% so far in early forex trading action at 91.574.

The dollar’s weakness has contributed to the latest rebound in gold prices as the greenback is accumulating a 1.8% drop since its 2021 peak on 31 March.

Meanwhile, investors’ appetite for US Treasury bonds seems to have grown in the past couple of days as indicated by the performance of 10-year Treasury yields.

Yields have gone down 9.6 basis points since the week started, moving from 1.660% to 1.564% as of this morning despite the release of more data supporting a strong recovery in the US economy.

A widely-tracked report from the US Department of Commerce released Yesterday showed a 9.8% jump in retail sales during March as a result of the distribution of the federal government’s $1,400 stimulus checks.

The statistic far exceeded Wall Street’s estimates for the month, as economists were expecting a more discreet advance of 6.1% while it has been the second-largest monthly expansion since the pandemic started.

However, the market seems to have shrugged off the positive signal sent by this indicator as safe-haven assets, including gold and Treasury bonds, experienced higher demand following the release of the report.

Analysts are mentioning a strong inflow coming from Japan’s Ministry of Finance as a plausible explanation for this week’s drop in yields, as the Asian country reportedly spent $15 billion in foreign bonds during the week.

Meanwhile, experts have also emphasized that a temporary “COVID scare” could be directing some demand toward safe-haven assets as a fourth wave of a new strain of COVID in the country is expected despite the advance of vaccinations.

As of today, data from Worldometers shows that an average of 71,919 cases have been reported in the past seven days, representing a 29% jump compared to the average daily tally in mid-March.

What’s next for the price of gold?

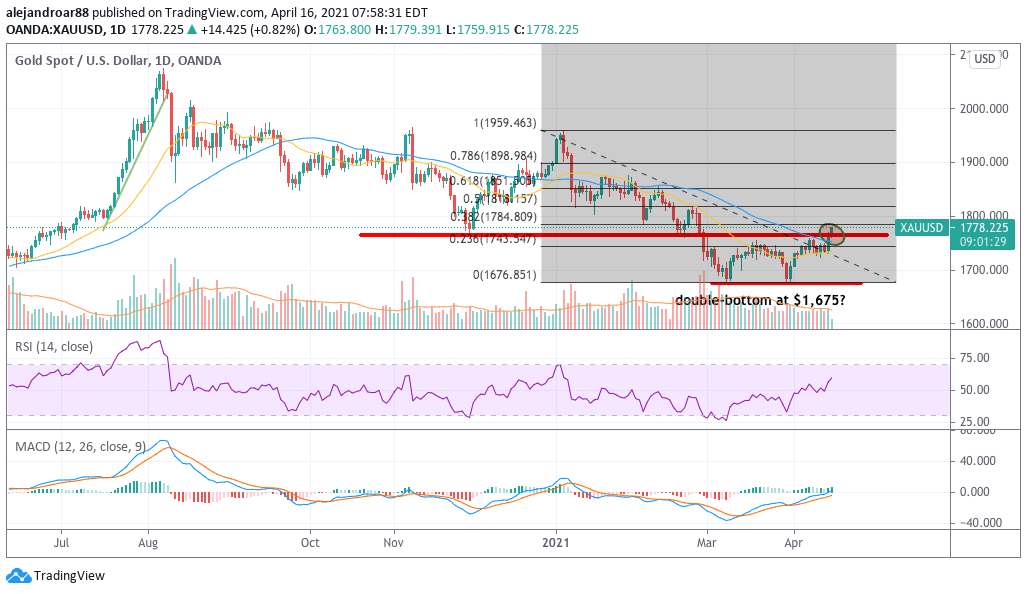

The chart above shows how the price of gold has just broken above a previous support area that had served as resistance for the yellow metal in the past few days although momentum remains quite weak.

At this point, although the break is a positive signal, a move above the 0.5 Fibonacci retracement level highlighted in the chart – standing at $1,820 – should provide stronger confirmation that gold prices might continue their uptrend in the weeks to come.

That said, the economic backdrop continues to favor lower demand for safe-haven assets as the US economy keeps recovering strongly from the virus downturn.

Moreover, data from ETF Database shows that almost $2 billion in capital flew out of the two biggest exchange-traded funds (ETF) offering exposure to gold in the past 30 days, which reinforces the notion that this could be a short-lived spike in gold prices rather than a potential trend reversal.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account