Analysts at JP Morgan’s point to oil, agriculture, and forex as long-term investments with conservative valuations, to counter gold and equity markets which hit all-time highs this month.

John Normand, head of cross-asset fundamental strategy for the bank, said that although developed-market debt is currently expensive – offering low or negative yields in most cases – emerging market bonds are currently trading at more attractive levels.

Norman highlighted said that “fairly valued ones are developed market and emerging market credit plus Asian equities”, referring to the asset classes that currently present the biggest opportunities for long-term investors.

Why is it important to diversify from equities?

Norman believes gold is expensive and said US equity markets are trading at high-risk premiums, which could lead to a mean-reversion. This would mean losses for investors.

Diversifying a portfolio by incorporating forex and commodities could cushion these losses, making this a tactical move that investors should take into consideration.

Meanwhile, he pointed to the inherent stability of bonds in comparison to equities, Norman said that stocks are currently “undergoing structural re-rating only partly related to the monetary policy environment”, which means that their value may shift once central banks tighten their policies a bit.

Oil is caught in a tight trading range, for now

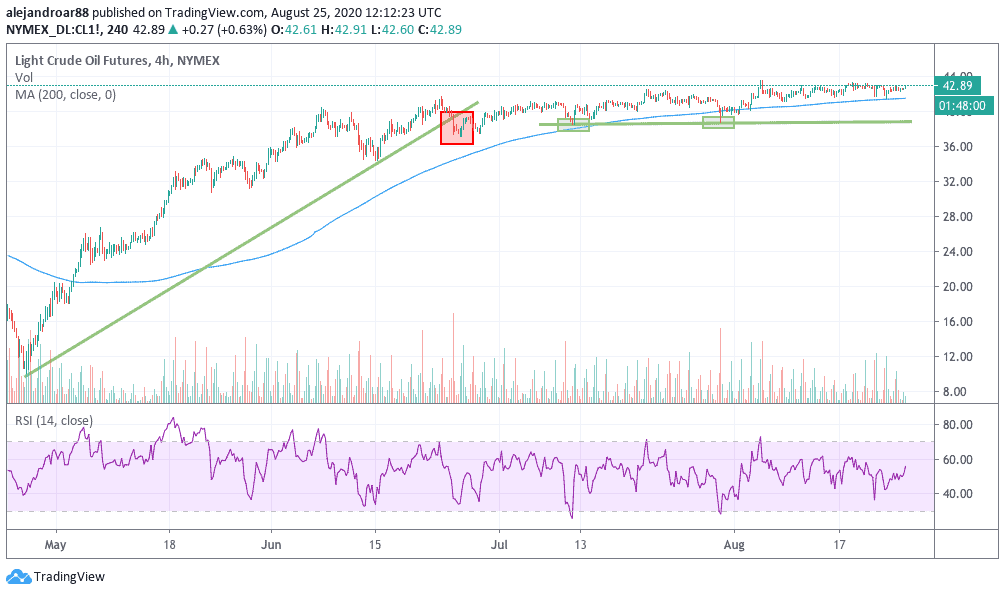

Oil could be among the commodities that investors may buy into their portfolios to diversify away from high-flying equities and precious metals like gold and silver. The commodity has been trading in a tight range, possibly awaiting a catalyst to take off to higher levels.

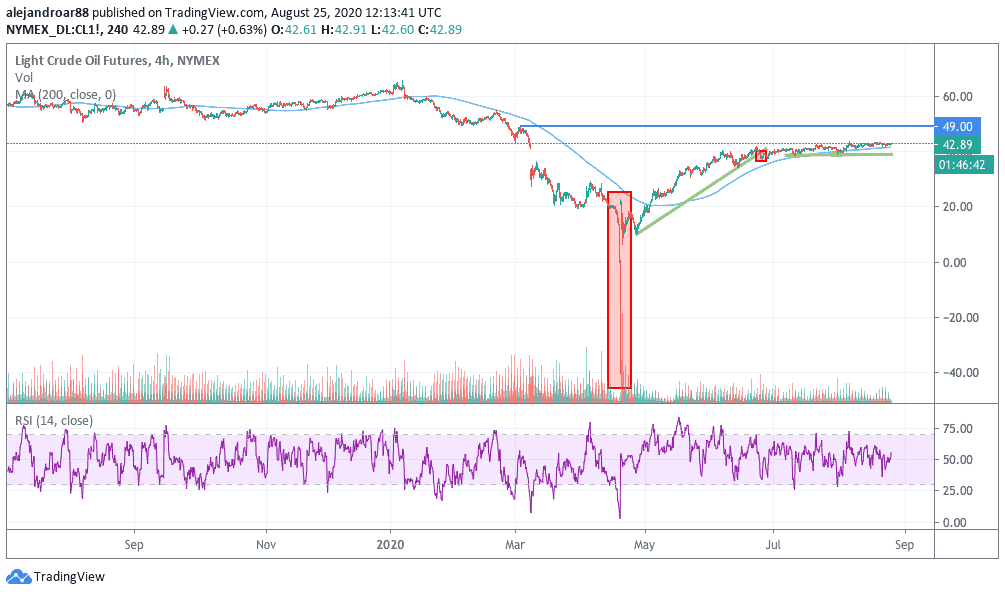

Oil futures have recovered after turning negative in late April, as an oil glut took the market by surprise, plunging the price of the commodity as a result.

However, oil prices broke below this uptrend in late June as a resurgence of the virus in the US put a halt to the rally, stalling prices in a level between $39 and $43 per barrel for the West Texas Intermediate (WTI) – the US crude benchmark.

Now that prospects of an upcoming vaccine before the end of the year are a possibility, investors may choose to buy into oil while its cheap, as good news on this front could trigger another push for crude prices, possibly towards to the $49 resistance highlighted in the chart (above).

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account