The FTSE 100 index is heading to its seventh consecutive day of gains despite the growing risk of a no-deal Brexit as negotiations remain stalled while Prime Minister Boris Johnson is heading to Brussels today to brush up the remaining differences between the union and the Kingdom.

The UK also started to roll out Pfizer’s COVID-19 vaccine just yesterday as the first step towards what could be the definite path to economic recovery once the virus situation is put behind.

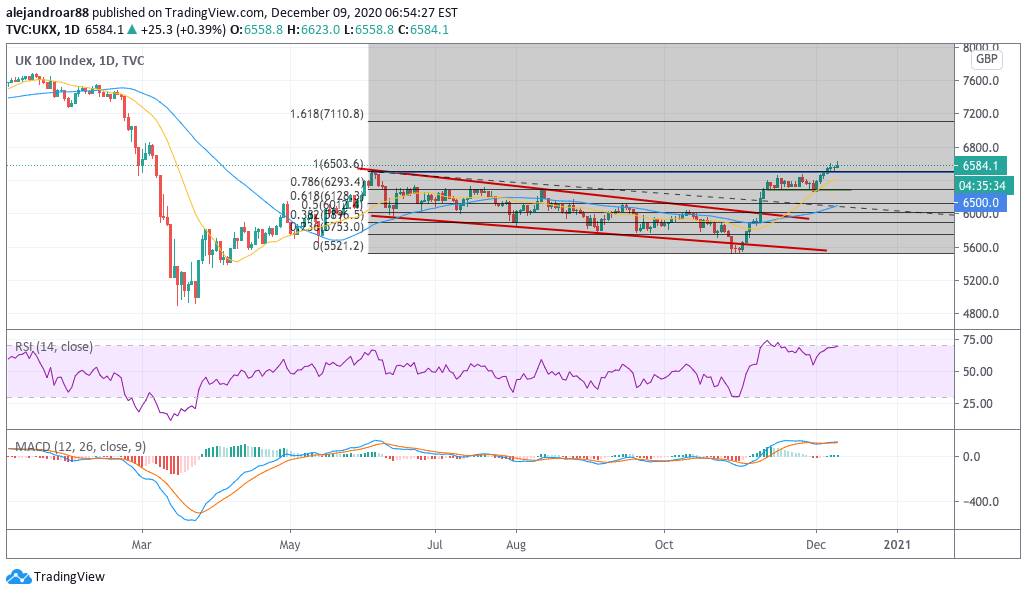

The FTSE 100 managed to break its 6,500 resistance on 4 December, reaching its highest level since the February-March pandemic sell-off. Since then, the index has hovered above that threshold while it is advancing 0.4% this morning in mid-day stock trading activity at 6,582.

Tailor Wimpey (TW) and IAG Group (IAG) shares are leading the winners’ board so far in today’s session, with the homebuilder advancing more than 4% at 163.85p while the British airline holding company is up 5% at 169.60 as both will be significantly benefitted from a successful vaccine rollout in the nation.

Meanwhile, a stronger pound could be capping the advance of the footsie this morning, as the British currency is advancing 0.69% against the US dollar and 0.63% against the euro during the European forex trading session, with the pound once again attempting to break its long-dated resistance of 1.35 against the greenback despite Brexit talks being on the brink of falling apart entirely.

This morning, Deutsche Bank’s Chief Executive Christian Sewing told CNBC that his firm was prepared “for each and every outcome” in regards to Brexit, a view that reflects how even a no-deal transition could already be priced into the valuation of the British stock index.

This statement possibly highlights why the benchmark is still down almost 13% this year despite a vaccine being rolled out in the country, as other indexes in Europe like the DAX have successfully shrugged off the losses caused by the pandemic and have even produced some minor gains at some point this year.

What’s next for the FTSE 100?

The FTSE 100 index has successfully climbed above its June highs in the past few days but the uptick has been fairly quiet, which means that bulls may still be holding their guns until the Brexit situation is cleared up.

Most firms have been preparing for a potential no-deal Brexit by establishing subsidiaries and offices across the European Union in an effort to cushion the impact of such a scenario, which means that the true impact of talks falling apart could not be as bad as some expect – at least not for UK’s stock market.

Meanwhile, the prospect of a full rollout of the vaccine during the first quarter of 2021 and the strong economic recovery that could follow are important catalysts that could provide a further push for the index over the next few weeks.

At this point, a bearish divergence in the RSI remains a threat to the short-term sustainability of this 7-day bull run. The healthiest response at this point for the bull to continue would be a strong uptick over the coming days, possibly once negotiations are settled – one way or the other.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account