Today, the US Labor Department would release the inflation data for January. The inflation reading has positively surprised markets for the last couple of months. Here’s what to expect from today’s CPI release.

Analysts expect that the CPI release would show inflation rising at an annualized pace of 6.2% in January. If analysts’ estimates are correct it would mean that inflation eased for the seventh month in a row.

Annualized CPI peaked at 9.1% in June and has since fallen every month and was 6.5% in December.

US inflation reading today: What to expect?

However, economists believe that on a monthly basis, US inflation rose 0.4% in January. Notably, the December CPI reading originally showed a 0.1% fall in inflation on a month-on-month basis. However, last week, the Labor Department revised the data due to the change in methodology. According to the new methodology, CPI actually rose 0.1% in December.

While the US inflation report has mostly pleased markets for the last few months, many see chances of a negative surprise this time around. Mark Zandi, chief economist at Moody’s Analytics said “We’ve gotten surprises on the soft side for the last three months. It wouldn’t be at all surprising if we get surprise on the hot side in January.”

Peter Boockvar, chief investment officer at Bleakley Advisory Group also echoed similar views. He said, “When you’ve had a string of lower-than-expected numbers, can that continue? I don’t know.”

Boockvar however added that the inflation reading “might not move the needle for Fed” as the US central bank looks set to raise interest rates by another 50 basis points.

Fed raised rates by 25 basis points in February

Earlier this month, the Fed raised rates by 25 basis points. In the December meeting, the Fed raised rates by 50-basis points. Prior to that, the US central bank had raised rates by 75-basis at four consecutive meetings. After the most recent rate hike, which is the first for the year, the Fed funds rate stands at 4.50-4.75%, which is the highest since October 2007.

The Fed has stepped down its interest rate hikes amid the gradual fall in inflation. Also, US economic activity has also shown signs of a slowdown.

Meanwhile, after the most recent meeting, the FOMC reiterated its resolve to fight inflation and said, “The Committee is strongly committed to returning inflation to its 2 percent objective.” It added, “in determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Mohamed El-Erian says the disinflation story is “complex”

Speaking with CNBC, Mohamad El-Erian said that the markets should closely watch the two-year treasury yield and said that he “would be worried” if that goes up. He added that markets now realize that the “disinflation story is more complex than we’ll like it to be.”

He added that now inflation in some goods is going up. El-Erian also emphasized that “service inflation is not going to happen in a long time.” He said that as the uncertainty over inflation has gone up, the uncertainty over Fed’s rate cuts has also risen.

El-Erian also warned that while the debt market has adjusted, the stock markets haven’t yet factored in the fact that inflation could stay higher for much longer. He pointed out that at his press conference, Fed chair Jerome Powell used the word “disinflation” 11 times and the “markets loved it.”

US stocks could react to inflation data

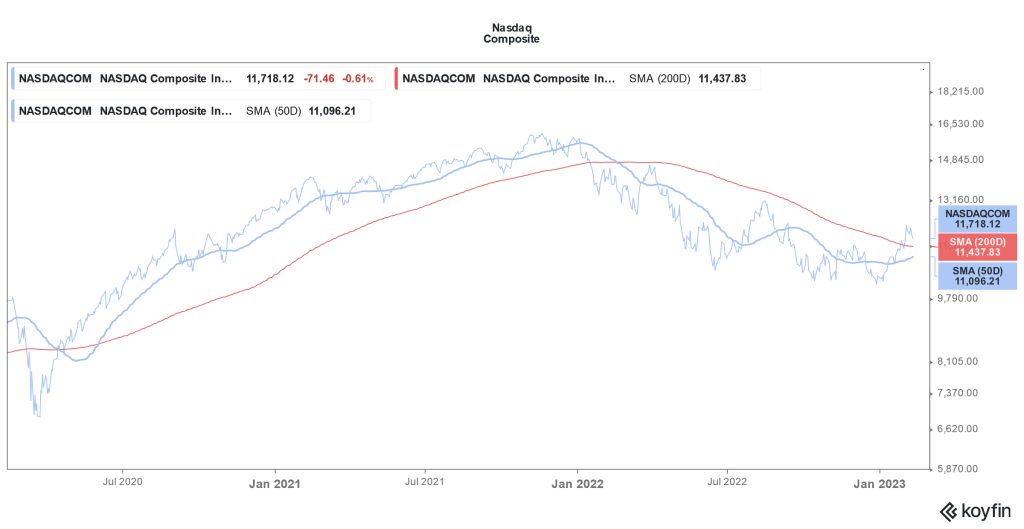

After a tumultuous 2022, US stocks have bounced back in 2023, partially because markets expected inflation to fall considerably. However, over the last few days, inflation fears have reignited.

Notably, the nonfarm payroll data showed that the US economy added 517,000 jobs in January which was over twice what the market was expecting. Speaking at an event in Washington last week, Powell said, that the jobs report was “certainly strong—stronger than anyone I know expected.”

He also said that a strong job market and wage growth make the job of lowering inflation tougher.

Powell meanwhile again used the word “disinflation” at the event. He said, “The disinflationary process, the process of getting inflation down, has begun and it’s begun in the goods sector, which is about a quarter of our economy.”

Recession fears

While US stocks have recovered in 2023, recession fears are still elevated. Banks like Wells Fargo, Bank of America, and JPMorgan see a mild recession as the base case scenario for this year.

Many analysts believe that the rally in US stocks will soon fizzle away. Morgan Stanley’s chief US equity strategist Mike Wilson is among those who expect US stocks to crash. He was right about his market calls in 2022 but so far, bulls have had the upper hand in 2023.

Bond guru Jeffery Gundlach said that while the probability of a US recession in 2023 has receded, it is still above 50%. He also said that the Fed would stop its rate hikes after one more hike. Gundlach meanwhile is circumspect on whether the Fed would start cutting rates this year.

Fed would also closely watch inflation data

On multiple occasions, Powell has said that the Fed reacts to economic data. If the inflation reading comes out above expectations, it might lead to an even more hawkish Fed. The market rally over the last month was built on the premise of a dovish Fed.

Ahead of the inflation data, Wells Fargo Securities’ Michael Schumacher said that he believes “The Fed is not your friend.”

He added, “You think about the history over the last 15 years. Whenever there was weakness, the Fed rides to the rescue. Not this time. The Fed cares about inflation, and that’s just about it.”

The Fed has indeed been inclined to lower inflation even at the cost of sacrificing growth and a possible recession.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account