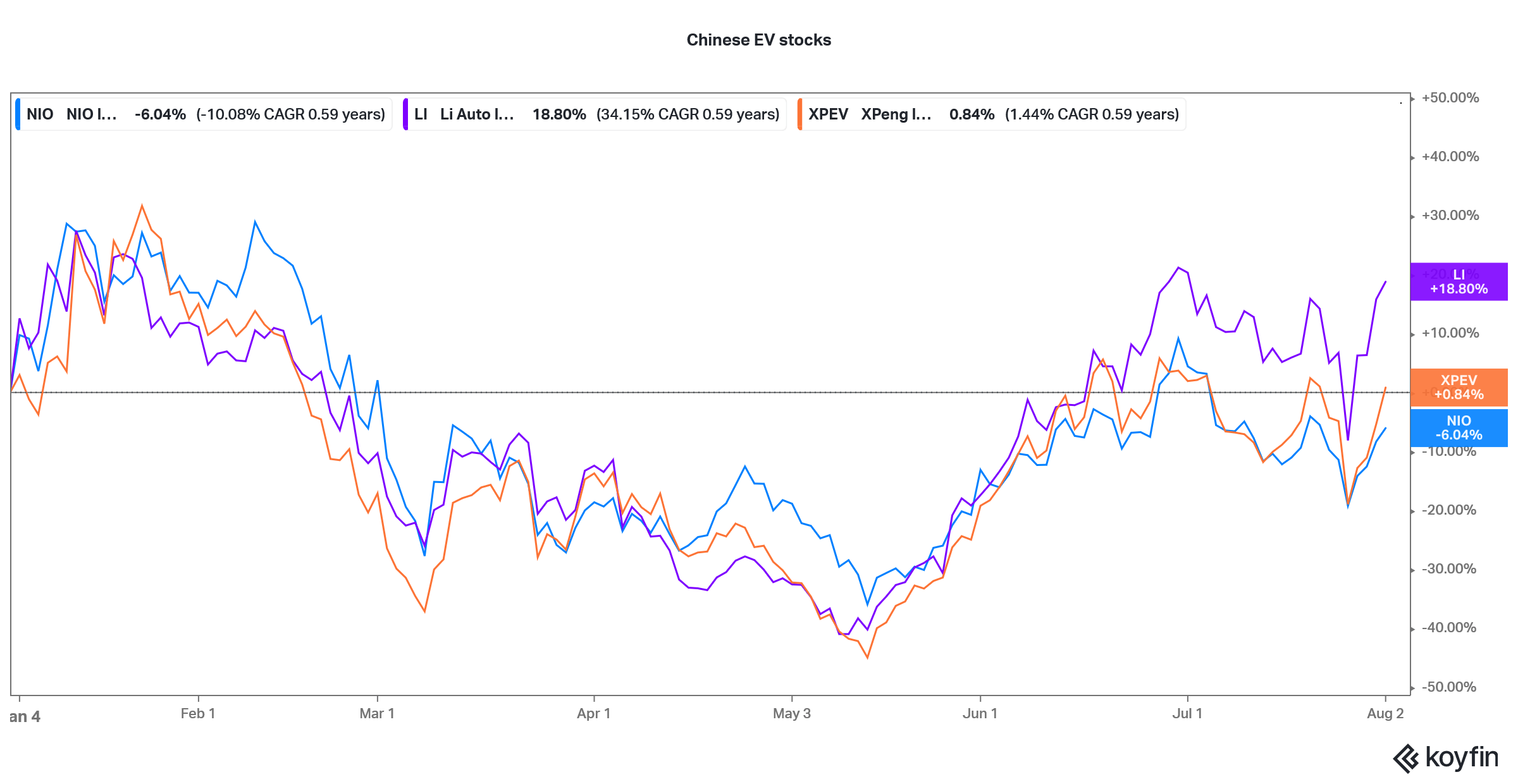

Chinese EV (electric vehicle) stocks including NIO, Xpeng Motors, and Li Auto were trading higher in early US price action today as markets gave a thumbs up to their July delivery report.

The price action is in stark contrast to the last month when Chinese EV stocks had fallen after reporting their June deliveries. While NIO, Li Auto, and Xpeng had all reported better than expected deliveries in June, the stocks still fell. Meanwhile, markets are reacting favorably to Chinese EV companies’ July deliveries. There is a broad-based rally in all the electric vehicle stocks and Tesla is also up sharply. Tesla releases its quarterly deliveries, unlike Chines peers that release their delivery reports on a monthly basis.

Key takeaways from Chinese EV companies’ July deliveries

NIO delivered 7,931 cars in July which was below the 8,083 that it did in June. The company has delivered 49,887 cars in the first seven months of the year which is higher than its 2020 deliveries. Li Auto delivered 8,589 cars in the month while Xpeng delivered 8,040 cars in the month. Both Li Auto and Xpeng delivered a record number of cars in July. It was the second straight month when Li Auto’s deliveries were higher than that of Xpeng Motors.

NIO July deliveries

NIO’s EV deliveries increased 125% in July. The company delivered 1,702 ES8s, 3,669 ES6s, and 2,560 EC6s in July. Looking at the rising demand for EVs in China, NIO is working to increase its production capacity. NIO does not produce its own cars but works with the state-owned Jianghuai Automobile Group popularly known as JAC. The company has announced that “Pursuant to the joint manufacturing arrangement, from May 2021 to May 2024, JAC will continue to manufacture the ES8, ES6, EC6, ET7 and potentially other NIO models in the pipeline.”

NIO is working to enhance EV capacity

It also said that “In addition, JAC will expand its annual production capacity to 240,000 units (calculated based on 4,000 work hours per year) in order to meet the growing demand for NIO vehicles.” The company’s gross margins have increased significantly over the last year. It now also has plenty of cash on its balance sheet to fund its growth.

Li Auto

Li Auto released its July deliveries yesterday. In the first seven months of 2021, the Chinese EV company has delivered 38,743 Li-One which takes its cumulative deliveries to 72,340. “Driven by outstanding product features and performance, the 2021 Li ONE set an all-time high in monthly deliveries once again. By the end of this year, we will launch a series of major OTA upgrades to elevate our product offering to new heights,” said Yanan Shen, co-founder and president of Li Auto.”

Currently, Li Auto only delivers the Li-One but plans to launch more vehicles in order to increase its customer base.

Xpeng Motors reports a record EV deliveries

Xpeng Motors’s total EV deliveries in the first seven months of 2021 increased 388% over the corresponding period in 2020 to 38,778 vehicles. The company’s deliveries are only marginally ahead of Li Auto during the period. In July, Xpeng Motors delivered 6,054 P7s and 1,986 G3s.

“P7 deliveries continued record-breaking momentum in July, reflecting the P7’s rising popularity among China’s tech-savvy consumers. In July 2021, at its first-year anniversary of customer deliveries, total P7 deliveries reach 40,612 since the launch. The P7’s Navigation Guided Pilot (NGP) highway solutions continuously increase appeal to a wider customer base, underpinning the Company’s commitment to technology innovation,” Xpeng said in its release.

Chinese EV companies have been under pressure

Chinese EV stocks have been under pressure over the last few weeks amid the sell-off in Chinese stocks. China has cracked down on several tech companies which dampened sentiments. While the country did not specifically target EV companies, markets got wary of Chinese stocks after the crackdown. Even Cathie Wood sold Chinese stocks amid the crackdown warning of a “valuation reset” for Chinese stocks.

Xpeng Hong Kong listing

Chinese companies have been looking at a Hong Kong listing in order to hedge themselves from souring US-China relations. Last month, Xpeng went for a Hong Kong listing and issued 85 million ordinary Class A shares priced at 165 Hong Kong dollars each. Other Chinese EV companies are also expected to follow suit.

XPeng raised $1.8 billion through the listing. The company has raised capital several times over the last year. After its $1.5 billion IPO in the US, it raised another $2.5 billion towards the end of the last year by way of share issuance. Apart from this, Guangdong Yuecai Investment Holdings Co., Ltd, the investment arm of the Guangdong provincial government has also invested money into XPeng this year.

Chinese EV companies could consider Hong Kong listing

“A dual listing in Hong Kong provides US-listed Chinese issuers with an option to mitigate geopolitical tensions between the US and China,” Brian Gu, XPeng’s vice-chairman, and president candidly admitted.

However, he added, “I would say our Hong Kong listing is a very strategic decision. In it, I think obviously, you know, hedging against geopolitical risks is only one of the considerations,” while speaking with CNBC.

According to Gu, “But in the long run though, we would like to have a listing venue that get us closer to home because we’re a consumer brand in China. Ultimately, we want our customers to be our shareholders, and having the dual primary listing status in HK (Hong Kong) will give us eligibility to be connected to Chinese capital markets.”

You can invest in Chinese EV stocks through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account