Shares of troubled departmental store J.C. Penney climbed 108% on Wednesday after announcing a rescue deal with landlords and lenders.

The Texas-based department chain was delisted by the NYSE in May and it currently trades on the “pink sheets.”

The coronavirus pandemic further aggravated J.C. Penney’s woes and the company had to file for bankruptcy in May. The Texas-based department chain also missed the payment due on 15 April for a bond set to mature in 2036.

Many retailers including Stage Stores, Neiman Marcus, and Lord & Taylor have filed for bankruptcy this year as the pandemic turned out to the final blow for retail companies that were anyways battling the onslaught from eCommerce companies like Amazon.

J.C. Penney rescue deal

On Wednesday, J.C. Penney reached a rescue deal with Simon Property Group and Brookfield Property Developers that would help it avert liquidation. As part of the deal, the companies would assume $500mn debt and pay $300mn cash to buy J.C. Penney valuing the company at around $1.75bn.

“We are in a position to do exactly what we set out to do at the very beginning of these cases and that is to preserve 70,000 jobs, a tenant for landlords, a vendor partner and a company that has been around for more than a century,” said Joshua Sussberg, a lawyer at Kirkland & Ellis. The company represented J.C. Penney at the court hearings.

He added, “Time, as we’ve mentioned over and over again, is not our friend.” “It is important — for this transaction to stay together and for all these stores to stay open and for the 70-plus-thousand employees to stay employed — for us to move with lightning speed.”

J.C. Penney’s Chief Executive Jill Soltau said that the deal is “the best path forward” for all stakeholders, and “The interest in our operations reflects our company’s strength and our loyal customer base.”

The transaction, however, is subject to approvals. Wells Fargo has also agreed to provide the company with $2bn in revolving credit after the deal is closed.

A win-win transaction

The deal is a win-win transaction for J.C. Penney and the mall operators according to Bloomberg Intelligence analyst Lindsay Dutch. “A joint purchase of bankrupt J.C. Penney would help Simon Property preserve occupancy at large anchor boxes that may be difficult to fill amid a pandemic-driven climb in vacancy,” said Lindsay in a research note.

The pandemic aggravated J.C. Penney’s woes

In recent years, J.C. Penney has been battling falling sales as more consumers have shifted to online shopping. The company’s revenues fell from $12.6bn in 2015 to $10.7bn in 2019. Its huge debt load made its survival even tougher.

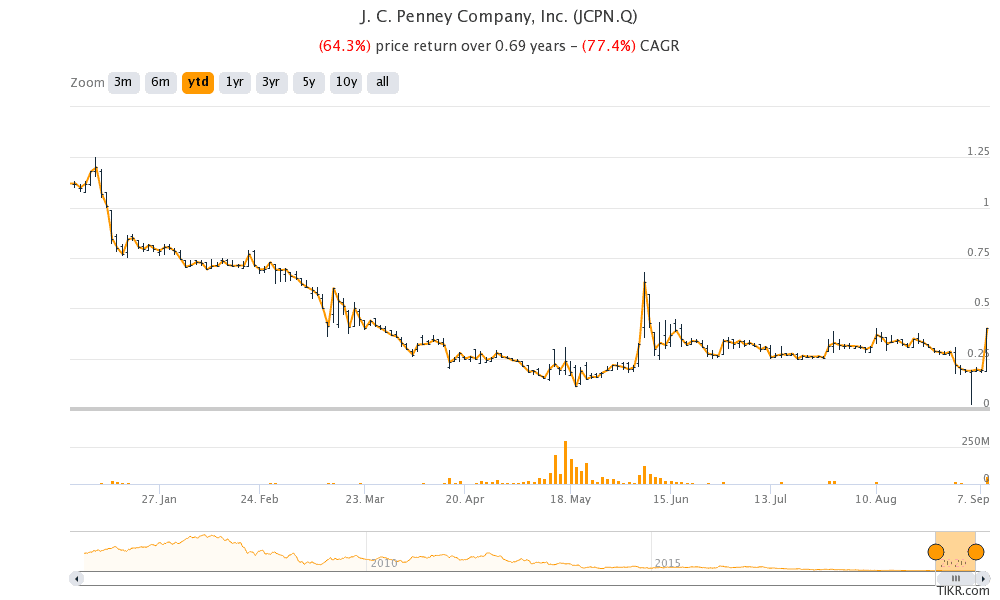

J.C. Penney shares are down over 64% so far in the year. However, not all retailers have been hit as severely by the pandemic especially those that have strong balance sheets and online presence.

Walmart and Home Depot have gained 16.5% and 23.3% respectively in 2020. However, Kohl’s Corporation shares are down 56% and it is among the top 15 losers in the S&P 500 this year.

Bet on Amazon for the long term.

Meanwhile, while the rescue deal would help J.C. Penney avert a shutdown of its 650 stores, the company would need to figure out a strategy to take on bigger retail giants like Walmart and also Amazon. Amazon shares are up 70% year to date and it is among the top 10 gainers in the S&P 500.

While J.C. Penney shares might rise further amid the rescue, in the long term, Amazon looks a better play as compared to some of the beleaguered retailers.

We’ve compiled a guide on how you can buy Amazon stock. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account