Berkshire Hathaway has released its first-quarter 13F which shows that chairman Warren Buffett continues to trim stakes in financials and pharma companies.

Berkshire Hathaway has not been able to identify compelling investment opportunities and was a net seller of stocks in the first quarter, just like it was in the calendar year 2020. However, the company did make some investments in the first quarter.

Warren Buffett stock buys in the first quarter

Berkshire Hathaway took a new stake in British insurance company Aon in the quarter. The company bought 4 million shares of the company in the quarter and the stake was valued at around $942 million. In the fourth quarter of 2020 also, the company added insurance broker Marsh & McLennan, and the stake was valued at just under $500 million.

While we don’t know whether it was Buffett or one of his deputies Ted Weschler and Todd Combs who made the investment, Buffett’s love for insurance companies is well known and the company has GEICO as one of its subsidiaries. Buffett sees GEICO as a key leg of the company’s growth and Berkshire Hathaway has been investing the insurance company’s massive float profitably over the years. However, over the last couple of years, Buffett has added to his cash pile.

Warren Buffett is spending heavily on buybacks

The company had $145.4 billion worth of cash and cash equivalents at the end of the first quarter which is not very far from the record highs that the company reported last year. Buffett repurchased $6.6 billion worth of its shares in the first quarter of 2021. In 2020, the company had repurchased $27.4 billion worth of its shares.

Meanwhile, coming back to the stocks that Berkshire Hathaway bought in the quarter, the company increased its stake in Kroger by 50%, and the stake is now valued at $1.8 billion. It also increased the stake in Marsh & McLennan by 24%. Buffett also increased the stake in Verizon by 8.3%. The stake is now valued at $9.2 billion and we can say with a reasonable degree of confidence that the investments are being made by Buffett himself as his lieutenants handle investments with lower ticket size. Berkshire Hathaway also marginally increased its stake in RH.

Stocks that Berkshire exited in the quarter

In the first quarter of 2021, Berkshire Hathaway fully exited Suncor Energy and Synchrony Financial. It also sold almost all of the remaining Wells Fargo shares in the quarter. Berkshire Hathaway was once the biggest shareholder in the bank with around a 10% stake. Buffett also stood behind the bank when it was rocked by scandals.

However, over the last couple of years, Buffett has been gradually exiting stakes in banking and financial services companies. It has fully exited JPMorgan Chase and Goldman Sachs over the last year. In the first quarter of 2021 also, the company trimmed stakes in U.S. Bancorp and Brazilian fintech company StoneCo.

Buffett loses love with pharma companies

In the first quarter of 2021, Buffett trimmed stakes in several pharma companies including Merck, Bristol Myers Squib, and AbbVie. The company had taken these positions last year only. It added more shares of Merck and Bristol Myers Squib in the fourth quarter of 2020 also even as it exited the stake in Pfizer.

Generally, Buffett is known to hold stocks for the long term but over the last few years, he has been selling some names within a quarter of buying them.

Apple stake

After gradually selling Apple shares over the last two years, Buffett did not make any changes to the holding in the first quarter of 2021. During the annual shareholder meeting earlier this month, Buffett admitted that he made a mistake in selling the stock. “We got a chance to buy it and I sold some stock last year…that was probably a mistake,” said Buffett.

According to Buffett “A car costs $35,000 and I’m sure with some people if you asked them whether they wanted to give up, had to give up, their Apple, they’d give up their car.” He termed Apple as “indispensable” and a “huge huge bargain.”

Warren Buffett on S&P 500 ETF

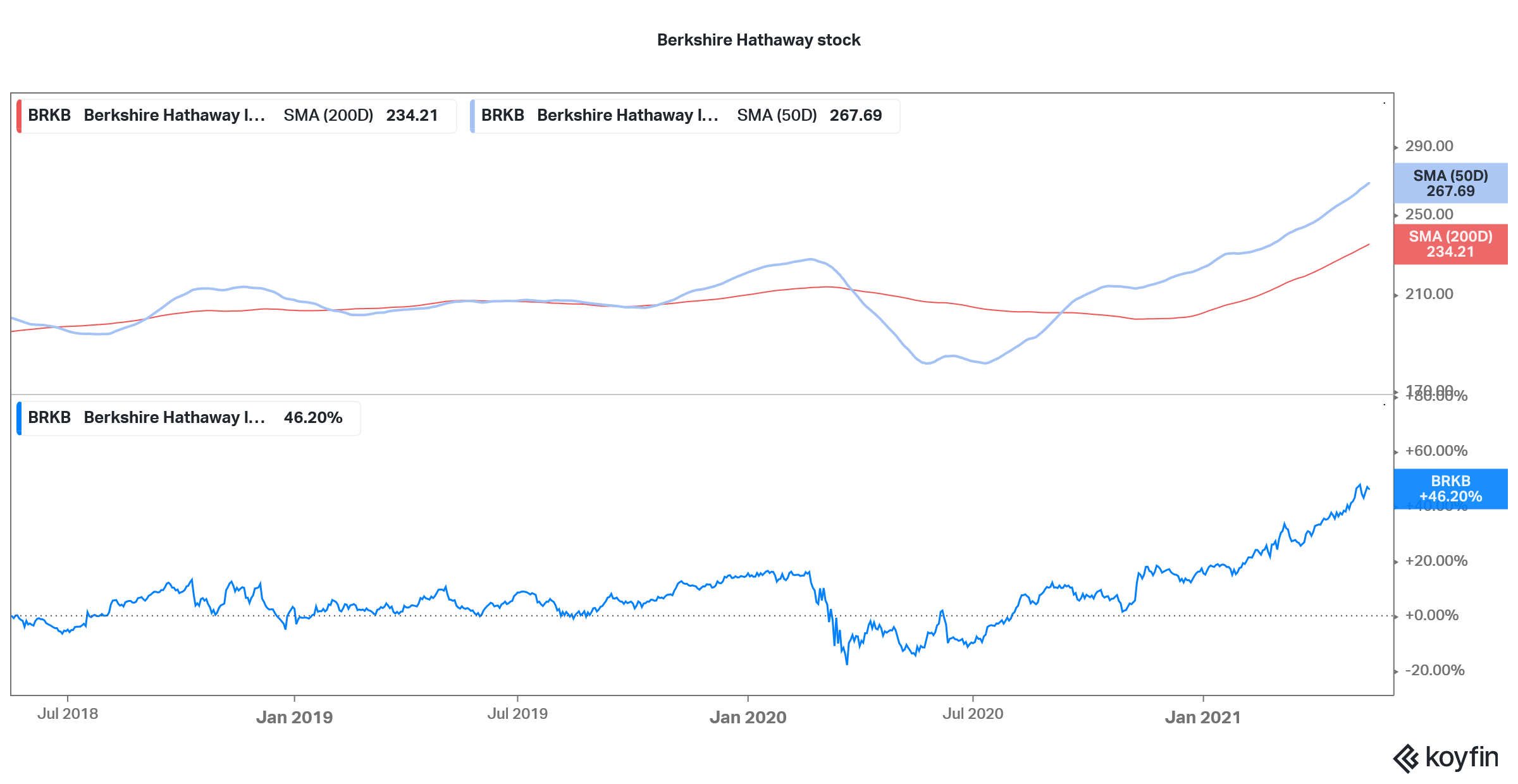

Berkshire Hathaway stock underperformed S&P 500 by a big margin in 2019 and 2021. However, it is outperforming in 2021 as value stocks are back in favor after a decade of underperformance. According to Buffett, retail investors who lack the time and skills to invest directly in stocks should opt for an S&P 500 index fund or an ETF.

You can buy Berkshire Hathaway stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

As an alternative, you can look at ETFs like the SPDR S&P 500 ETF trust that invests in S&P 500 companies.

Through an S&P 50 ETF, you can diversify your risks across many companies instead of just investing in a few stocks. By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account