The price of Brent crude futures is sliding for a fourth day today ahead of an important OPEC meeting, with analysts expecting that major oil producers could hike their supply quotas as output from the US remains capped by the impact of the winter storm.

The oil cartel and its allies – commonly referred to as OPEC+ – are scheduled to convene virtually this Thursday to discuss the situation of the oil market and their response to it with oil prices trading at pre-pandemic levels already – a situation that could support an expansion in the cartel’s output levels.

The latest price action in Brent crude futures seems to reflect these expectations, as the global benchmark has slid for four days in a row now, with the price moving from a post-pandemic peak of $67.1 per barrel to $63.6 today while losing 1.6% in early commodity trading action today.

Meanwhile, futures of the West Texas Intermediate (WTI) – the US benchmark – are retreating 0.15% at $60.55 after facing a similar drop in the past four days.

“Russia wants to move back towards normal production as quickly as possible while Saudi Arabia wants to enjoy high prices a little while longer and rather keep the market on the tight side than the loose side”, commented Bjarne Schieldrop, chief commodity analyst for Sweden-based financial services firm SEB.

He added that both countries might end up getting what they want, which means that Russia will be permitted to hike its production while Saudi Arabia could continue to make voluntary cuts to keep prices on the high end.

Even though vaccines continued to be rolled out in most of the developed world, Saudi Arabia appears to remain cautious in regards to the outlook for oil demand until these treatments are administered to a larger portion of the world’s population.

Meanwhile, Louise Dickson, an analyst for Rystad Energy, said to CNBC: “Our expectation is that they are going to rise in line with their previous policy deal which was announced in December of 2020. And that is to not increase production more than 500,000 barrels per day”.

What’s next for Brent crude futures?

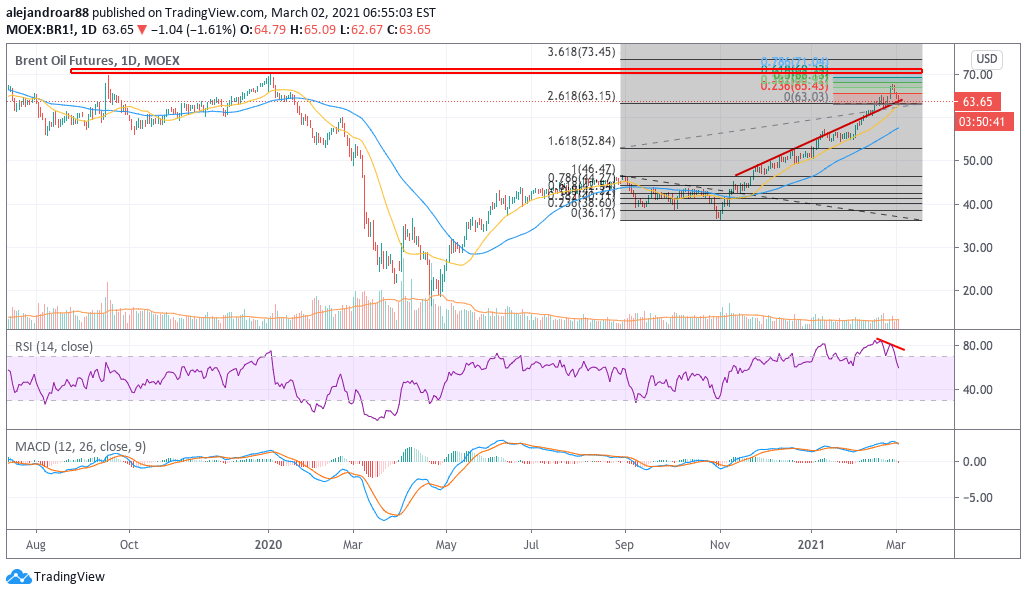

While this latest downtick in Brent crude futures is not yet triggering a warning signal, if OPEC members were to be more permissive than expected in regards to the increase of their supply quotas, chances are that the price per barrel could slip below the 2.618 extension shown in the chart – possibly heading for the $60 level in short notice.

Meanwhile, it is important to highlight that this decline comes after the RSI posted a bearish divergence – a situation that indicates that the positive momentum for Brent crude futures was already decelerating.

Additionally, traders will be taking notice of how the situation for crude unfolds in the United States, possibly eyeing the next EIA weekly report, which will be released tomorrow, with the market expecting to see a drop in US crude inventories of around 1.85 million barrels.

As stated in a recent article, a pullback in oil prices such as this could provide an opportunity for those wanting to take a long position in the commodity, as the market remains optimistic about the short-term outlook for crude as reflected by the latest price target hikes given to the Brent – with Goldman Sachs seeing the benchmark hitting the $75 threshold during the third quarter of the year.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account