Oil futures are advancing today in early commodity trading activity ahead of the release of data from the US Energy Information Administration (EIA), with the market expecting a 4.8 million decline in crude inventories according to data from S&P Global Platts.

During yesterday’s session, future contracts of the West Texas Intermediate (WTI) declined 0.5% at $61.7 per barrel, while the price of Brent crude futures stood unchanged during the session even as data from the American Petroleum Institute indicated a 1 million build-up in crude inventories.

Meanwhile, WTI futures are trading 0.75% higher today at $62.1 while Brent futures are up 2.1% at $65.9, as market players await confirmation from the EIA in regards to this alleged uptick to fully gauge the impact that the winter storm has had in the supply chain.

Although disruptions in drilling operations can lead to a shrinkage in weekly output, the event has also affected many refineries located within the affected area, which could effectively reduce the demand for crude, making it difficult to estimate the extent to which the two variables can offset each other.

“The key question is how quickly does U.S. oil supply recover. It looks like supply will recover faster than refineries, and supply is going to outpace demand in the next few weeks. That will give negative weight to the market” said Vivek Dhar, an analyst for Commonwealth Bank.

That said, Goldman Sachs just upped its forecasts for oil futures only a couple of days ago, with the investment bank now forecasting that WTI futures will hit $72 during the third quarter of this year while Brent crude futures should reach the $75 threshold – the highest levels for the two benchmarks in the last 24 months if those targets were to be hit.

Alongside Goldman, Morgan Stanley also hiked its price target for Brent oil futures to $70 by the third quarter of this year, citing “signs of a much improved market” while Goldman emphasized lower inventories and speculative inflows as the primary drivers for oil’s forecasted surge.

These bullish price target revisions seem to have contributed to the 22 February uptick, along with the winter storm disruption, with WTI futures advancing 4.1% on the day that Goldman hiked its target while Brent futures advanced 2.8% as well.

What’s next for oil futures?

Among the two benchmarks, Brent futures seem to be the most decisive in continuing the current bull run as European and Asian countries could be heading out of the virus crisis much faster than the United States given the speed at which vaccines can be rolled out within the relatively smaller population of the developed countries within these regions.

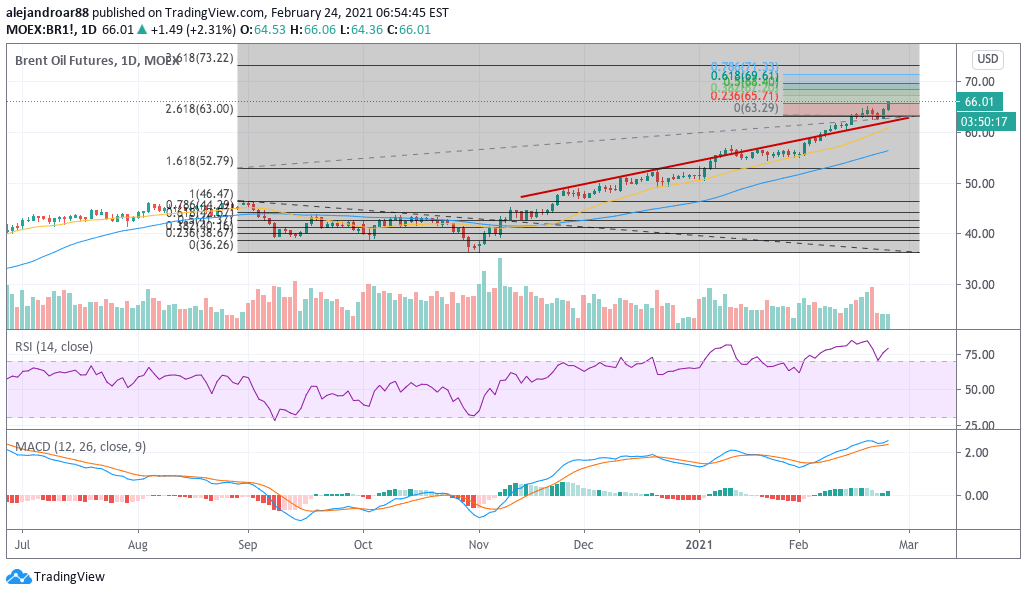

In this regard, Brent futures have outpaced our previous forecast and are now blasting above the 2.618 Fibonacci extension – signaling the potential start of a new stage of the rally.

Although a pullback can be expected at this point, the prospect of a recovering global economy should continue to serve as an important supporting factor for the continuation of the uptrend, with a first target set at $71 – in line with Goldman and Morgan Stanley’s estimates for Brent crude.

If that were to happen, any pullback at this point should provide an opportunity to enter the rally at a more appealing price, although, at the current level, a move towards the $71 mark would still produce a 7.5% upside for traders if the target is hit.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account