The price of Bitcoin is surging past the $50,000 mark for a second day this morning in early cryptocurrency trading as the Tesla-led bull run appears to have created a sustained positive momentum for the crypto asset.

After steadily moving higher during the next few days that have followed Tesla’s announcement of a $1.5 billion investment in BTC, the price has finally managed to break the $50,000 threshold, hitting a fresh all-time high today at $51,333 as it advances 4.4%.

In total, Bitcoin has gained 10% since the electric vehicle company headed by Elon Musk disclosed its investment through its annual report, instilling optimism among crypto investors about another wave of institutional buyers that might adopt the cryptocurrency as a plausible hedge for its cash reserves.

However, possibly contradicting this view, Microsoft’s President Brad Smith quickly dismissed rumors that the tech giant was contemplating a Bitcoin investment, as he said during an interview with CNN that there have been no discussions within the Board of Directors in regards to such a move.

Such a statement follows recent criticism from UBS’s Chief Investment Officer, Mark Haefele, who cautioned investors about adopting cryptocurrencies – including Bitcoin – as a cash equivalent, as he believes that the fact that a single individual or company, referring to Tesla (TSLA), can have such an impact on the value of the asset raises concerns about its liquidity and volatility.

He added: “Far from boosting the credibility of crypto, we think this undercuts it.”

On the other hand, a highly reputed wealth management firm from Wall Street, Wedbush Securities, believes the opposite, as the firm stated recently in a note to clients that Tesla’s investment could trigger a rise in BTC’s adoption among other big corporations.

In fact, Wedbush qualified Tesla’s investment as a “paradigm-changing move for the use of Bitcoin from a transaction perspective” while also seeing the move as a potential “game-changer” for Bitcoin (BTC) – similar to what happened to the coin back in October last year when PayPal launched a service to buy and sell cryptocurrencies through its massive digital payments platform.

These contradicting opinions seem to be the norm these days, as Bitcoin’s rally keeps attracting media attention while leaving financial institutions with the complex task of assessing a novel type of financial asset whose functioning and fundamentals are entirely different from traditional securities.

What’s next for Bitcoin (BTC)

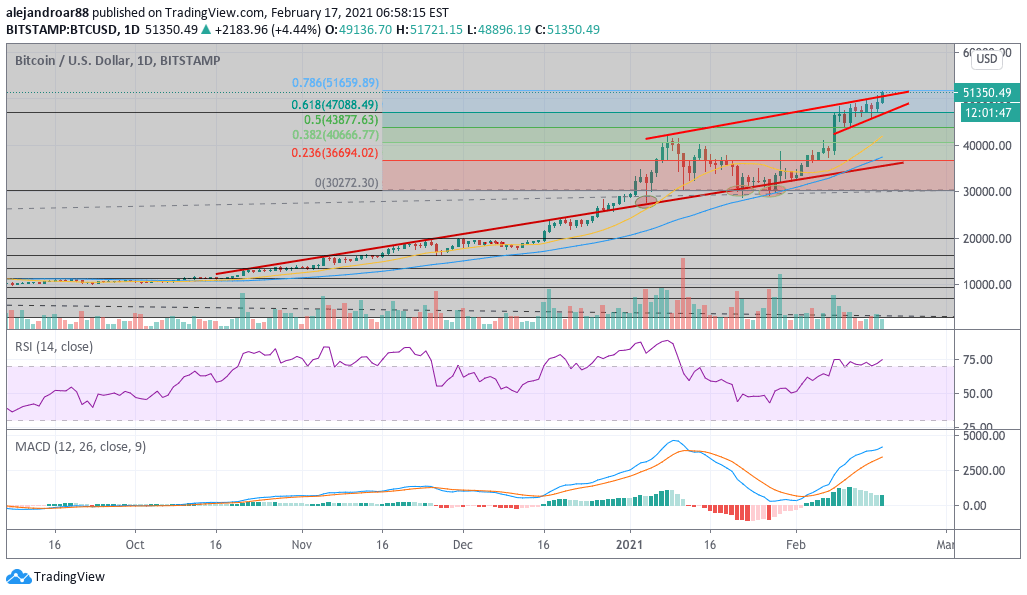

Today’s price action in Bitcoin is pushing the value of the coin above a potential trend line resistance, while also testing the 0.786 Fibonacci target we have been sharing in the past few weeks for BTC.

At the moment, the pattern formed by a series of higher lows and today’s breakout could indicate that Bitcoin is ready to enter a fresh new bull run – now targeting the 3.618 Fibonacci extension derived from the December 2017’s retracement.

Tesla’s adoption of Bitcoin is right now the most important positive catalyst for the value of the cryptocurrency, while news of other institutional players possibly diversifying their cash holdings by buying crypto could add further fuel to this already overheated rally.

One point of concern is a potential bearish divergence showing up in the RSI, although it is still too early to call it that since there have been no significant downside momentum following the Tesla uptick.

A confirmation candle should be expected at this point before jumping to conclusions, especially since multiple resistances are in confluence at this particular level.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account