Bitcoin bulls seem to be throwing everything they have to hold the coin’s $13,000 level while gold has retreated again below the $1,900 resistance as market volatility made a strong comeback this week.

The price of Bitcoin (BTC) is down 1.45% this morning at $13,272 during early cryptocurrency trading activity with bulls managing to lift the value of the coin from its intraday lows in the past two days as the $13,000 level remains an important psychological threshold that could serve as support for further jumps.

Today’s early losses in US stock futures amid a negative reaction from market players to yesterday’s big tech earnings could challenge this bullish activity as volatility persists – which poses the risk of another sell-off similar to the one seen earlier in the week.

Meanwhile, gold prices are advancing 0.35% on the back of a weak dollar, with the yellow metal trading at $1,874 per ounce after losing almost 2.4% in the past two sessions.

Both gold and Bitcoin suffered similarly during the market’s strong pullback seen this week, which highlights the strength of a risk-off move that doesn’t seem to be over.

However, a resurgence of the virus in both the US and Europe and the resulting need for more fiscal and monetary stimulus could help lift both assets over the coming weeks, with the European Central Bank (ECB) saying that it is already considering the implementation of additional monetary easing measures in December.

A similar decision could be taken by the Federal Reserve if volatility persists, as the central bank is all-hands-on-deck when it comes to keeping the markets afloat to prevent systemic chaos.

Both scenarios are likely to benefit both gold and Bitcoin as investors keep favoring safe havens amid a strong and continuous debasement of fiat currencies resulting from central bank measures.

What’s next for Bitcoin and gold?

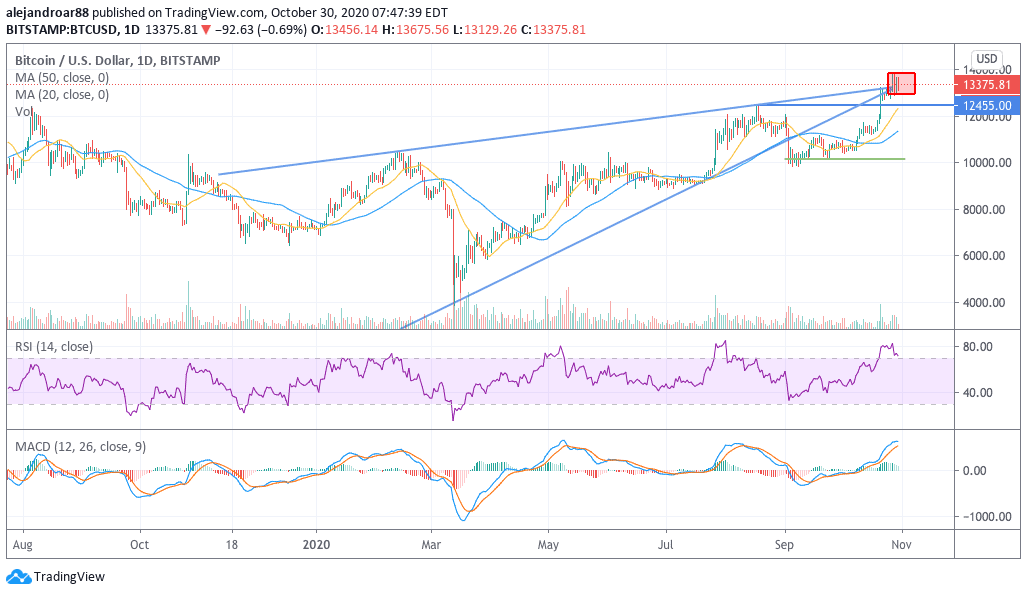

Bitcoin’s daily chart shows how the cryptocurrency has stepped into consolidation mode right after peaking at almost $13,900 per coin, with the price action forming a traditionally bearish rising wedge pattern that was pointing to a potential reversal.

Although this reversal did not occur once the price reached the tip of the triangle, the sideways consolidation seen by Bitcoin now could still result in a downward move, as the daily RSI has already moved to overbought levels while the MACD is posting one of its highest readings since the year started.

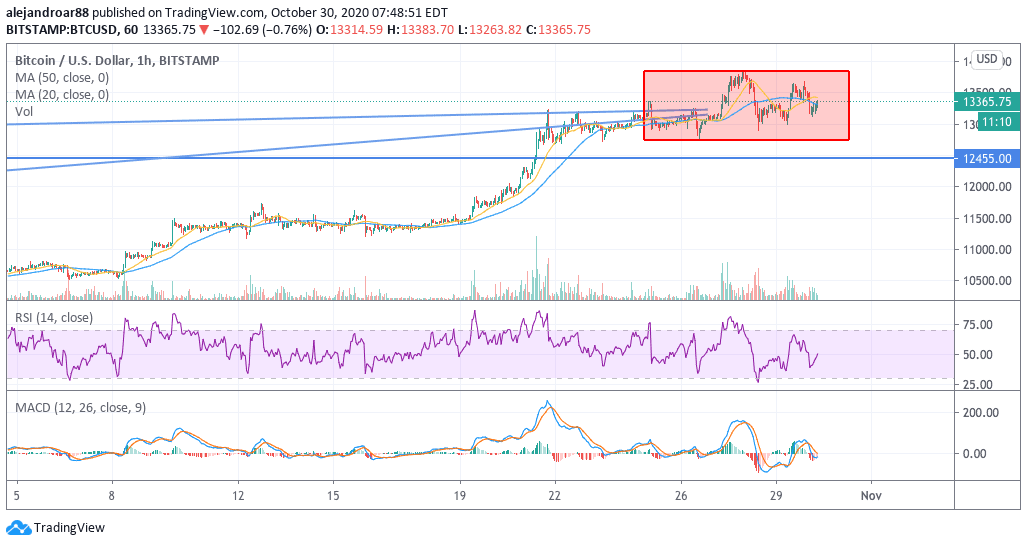

That said, the hourly chart shows that the price has found a strong floor at the $12,900 – $13,000 level, which means that Bitcoin bulls could keep pushing the price higher now that a potential double bottom has been made.

In this context, it is highly likely that Bitcoin will take a breather over the next few days, followed by another bull run – possibly aiming towards the $14,000 level this time – if bulls manage to keep the price above $12,500 once the profit-taking takes place.

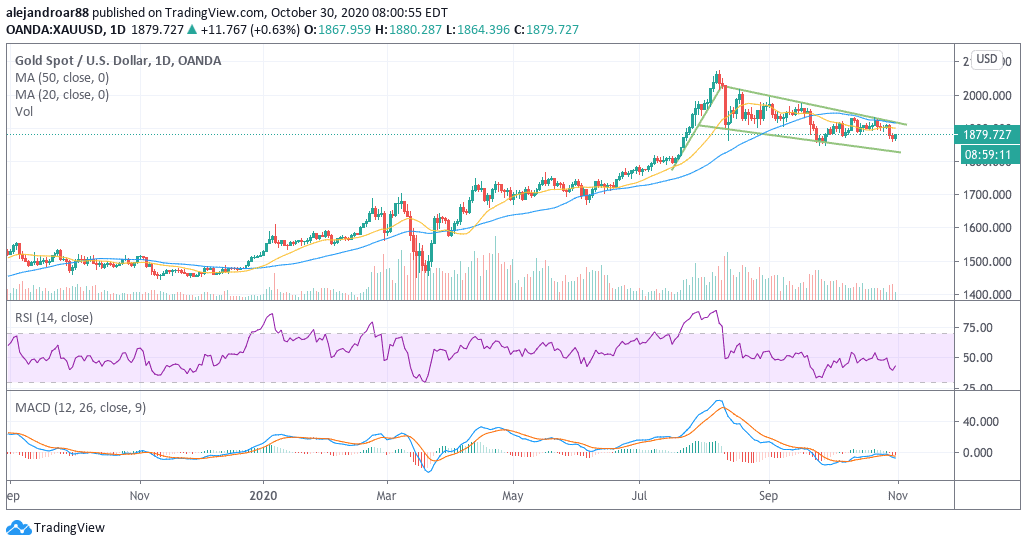

As for gold, the price action keeps confirming a potential bull flag pattern, with the yellow metal trading in a very narrow and slightly downward price channel that followed the strong push seen in July.

As long as the price keeps moving within those trend lines, there’s not much to do with gold at the moment.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account