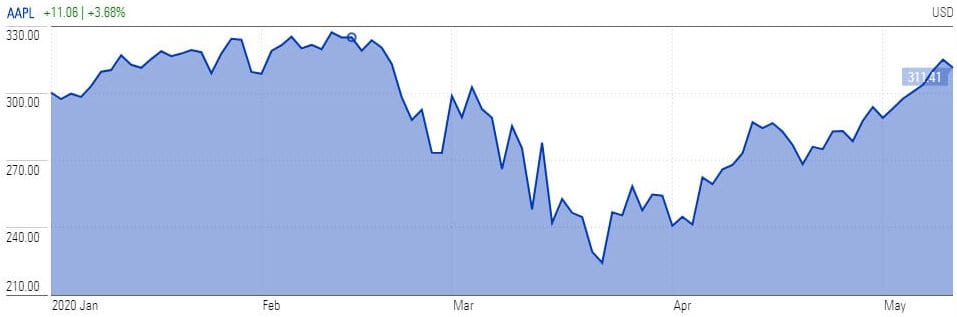

Apple (NYSE: AAPL) stock price has rallied more than 15% from its March low and shares passed the $300 mark early this month. However, Wedbush analyst Daniel Ives, who stands among the biggest Apple bulls, says the stock has almost 10% more upside potential, suggesting investors buy the stock taking advantage of the near-term uncertainty.

While the chances are high for extending the 5G supported iPhone 12 fall launch to November or December due to the change in consumer priorities amid coronavirus outbreak, Wedbush analyst still believes iPhone 12 is among the biggest catalyst for growth, with momentum accelerating up into early 2021.

The world’s largest technology company is likely to sell 165 million to 185 million iPhone units this year, according to Wedbush.

Meanwhile, Keybanc data shows that iPhone sales fell 77% year over year in April due to store closure across the world.

During the March quarter earnings call, chief executive officer Tim Cook (pictured) said that wearables and iPhone’s revenue will decline significantly during the June quarter from previous periods while services revenue is likely to grow quarter over quarter.

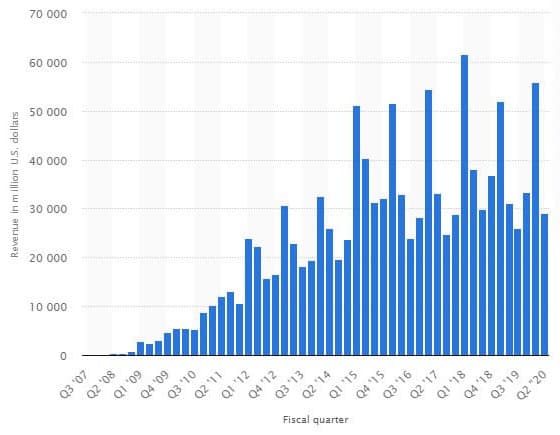

The robust growth in revenue from services and subscription-based units that include Apple TV+, Apple Music, and more has also impressed Wedbush’s Ives. Theses unit’s revenue soared to a record $13.35bn in the three months to the end of March.

Ives says Apple’s subscription-based unit’s annual revenue would hit $60bn in 2021, predicting that subscription-based unit will worth around $500bn in the long-term.

Wedbush analyst has raised Apple stock trading price target to $350 with Outperform rating. JPMorgan has also added Apple stock to its “top pick” list, saying America’s largest tech giant will outperform the broader market over the coming months.

If you plan to invest in stocks via day trading or options trading, you can review our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account