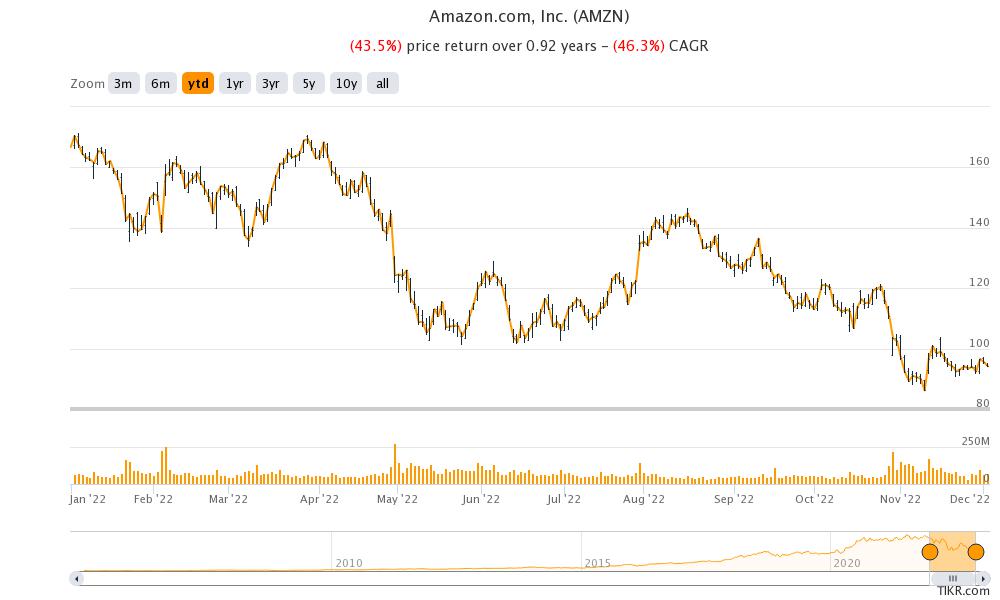

Amazon stock (NYSE: AMZN) fell 3.3% yesterday and is now approaching its 52-week lows. What’s driving the crash in Amazon stock?

To be sure, there has been a wider market sell-off. Tech stocks have been especially under pressure given their relatively high valuations. Also, Amazon is among the former “stay-at-home” winners. These stocks saw their sales boom during the lockdowns. However, as the economies reopened, they are witnessing a slump in sales.

Amazon reported lower-than-expected growth in the third quarter

Talking of Amazon, its revenue growth slumped to single digits in the first and second quarters of 2022. It was the first time in over two decades that the company’s sales growth was in single digits. Its sales did rebound in the third quarter of 2022 and rose 15% YoY to $127.10 billion. However, the metric still fell short of the $127.46 billion that analysts were expecting.

Looking at the business segments, Amazon’s North America sales increased 20% YoY to $27.7 billion. Amazon’s international e-commerce sales however fell 5% to $27.7 billion. In constant currency terms, the segment’s revenues increased by 12%.

AWS posted revenues of $20.5 billion which was 27% higher than the corresponding quarter last year. AWS sales fell short of the $21.1 billion that analysts were expecting.

AWS growth has stalled too

Notably, for AWS, it was the slowest pace of growth since 2014 when the company started separately reporting the segment’s revenues. AWS posted an operating profit of $5.4 billion versus an operating profit of $4.9 billion in Q3 2021. It however fell short of estimates.

Amazon posted an operating income of $2.5 billion in the third quarter of 2022, which was nearly half of what it did in the corresponding quarter last year. As has been the case for the last couple of quarters, the income came from AWS and both the North America and International e-commerce operations posted an operating loss in the quarter.

In Q3 2022, Amazon’s North America operations posted an operating loss of $0.4 billion as compared to an operating profit of $0.9 billion in Q3 2021. The International segment posted an operating loss of $2.5 billion. In the third quarter of 2021, the segment posted an operating loss of $0.9 billion.

The macroeconomic slowdown is hurting Amazon

The macroeconomic slowdown is hurting Amazon. US retail sales have slowed down and sales of discretionary products has especially been tepid. Also, as more people have started shopping in stores, online sales growth has come down.

The company expects sales between $140-$148 billion in the fourth quarter of 2022, which implies a YoY growth between 2-8%. The guidance fell short of what analysts were expecting.

Brian Olsavsky, Amazon’s CFO said during the earnings call, “As the third quarter progressed, we saw moderating sales growth across many of our businesses, as well as increased foreign-currency headwinds … and we expect these impacts to persist throughout the fourth quarter.”

Amazon is also circumspect about holiday spending. Olsavsky said, “we’re realistic that there’s various factors weighing on people’s wallets, and we’re not quite sure how strong holiday spending will be versus last year. And we’re ready for a variety of outcomes.”

Companies are reconsidering their cloud spending

Amid the challenging and uncertain market, several companies are reconsidering their cloud investments. Reports suggest that some AWS customers are also looking at cutting their cloud spending.

While the company did not provide revenue guidance for AWS, Olsavsky implied that the growth rate is coming down. He said that AWS’s revenue growth in the back end of the third quarter was in the mid-20s, which is below the 27% growth that the business generated in the full quarter.

Amazon posted negative free cash flows in 2021

Amazon posted negative free cash flows in the third quarter. The company posted negative free cash flows in 2021 also and looks on track for another year of negative free cash flows in 2022. In response to an analyst question on the cash flows, Olsavsky attributed it to multiple factors.

Firstly, he said that the company’s earnings have fallen. Secondly, he added that Amazon’s inventory has increased which is a drain on cash flows.

Amazon has always been a cash flow powerhouse even as its accounting earnings were not that high. Now, with the company faltering in free cash flow generation, markets are getting apprehensive about the stock.

Analysts maintain their buy rating on AMZN stock

While Amazon stock has underperformed in both 2021 and 2022, Wall Street analysts continue to maintain their buy rating on the stock. Gene Munster of Loup Ventures believes that Amazon has a strong moat in logistics which is tough to emulate.

Yesterday, Jefferies also reiterated Amazon stock as a buy. In a client note, it said, “Our proprietary U.S. survey shows 42% of consumers plan to spend more online this year, which is four times greater than the 11% who plan to spend less. We believe our e-commerce coverage (AMZN, ETSY, EBAY) should benefit from durable ecommerce trends in the U.S., but expect int’l to be a drag on Q4 results.”

Most analysts see Amazon’s recent underperformance as transitory and see it rebounding. JPMorgan has added AMZN stock to its 2023 top ideas list. The brokerage had listed it as a top pick for 2022 as well.

Why is Wall Street bullish on Amazon stock?

There are multiple reasons Wall Street is bullish on Amazon stock. Firstly, the company would face easier comps next year. Secondly, it has taken several steps to cut down costs and has also lowered its corporate workforce. Additionally, it is exiting or trimming losses in its loss-making businesses.

Amazon is also realigning its investments in line with the current macro environment. During Q3 2022 earnings call, Amazon CEO Andy Jassy said, “There is obviously a lot happening in the macroeconomic environment, and we’ll balance our investments to be more streamlined without compromising our key long-term, strategic bets.”

Meanwhile, in the short term, markets continue to remain apprehensive about Amazon stock as is visible in its price action.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account