The price of gold is advancing for a third day today in early commodity trading action as the combination of a weaker dollar, choppy equity markets, lower US Treasury yields, and inflation worries are driving higher demand toward the precious metal.

Gold has been staging a comeback since bottoming at $1,714 two times, the latest occurring in late March, delivering a 6.1% gain since then.

During that same period, Bloomberg’s US Dollar Index has retreated 2.6% after peaking at 93.297, while the benchmark is unmoved this morning at 90.832 in early forex trading activity.

Moreover, 10-Year US Treasury bond yields have retreated from a peak of 1.745% seen back then to 1.576% this morning as investors seem to be more attracted to bonds given the latest choppy performance of stock market indexes.

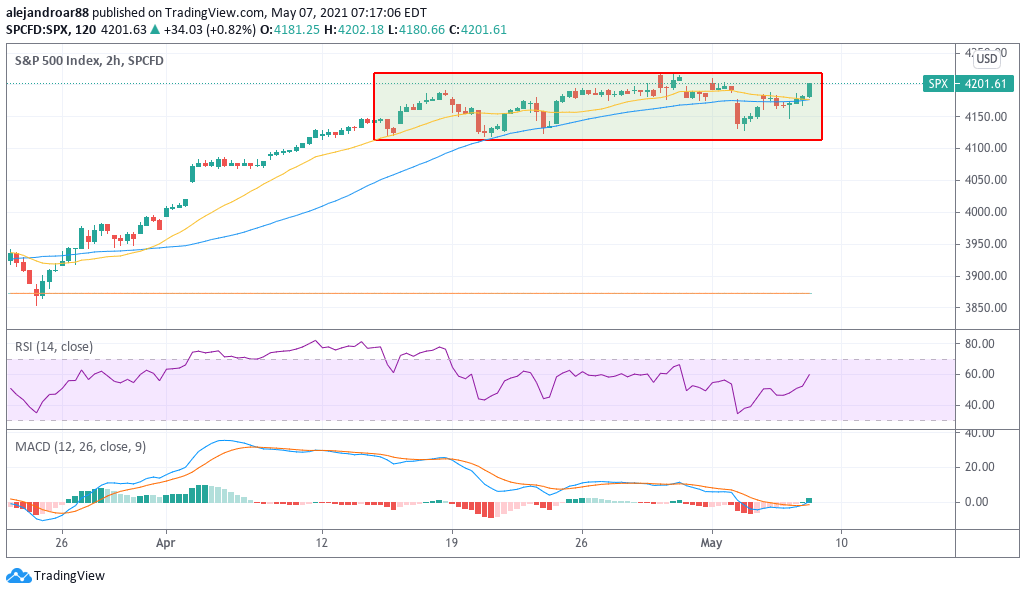

The 2-hour chart above shows how the S&P 500 has been trading relatively range-bound since mid-April, failing to climb above the 4,200 level at least three times now to then retreat to the low 4,100s.

This weakness in the price action has possibly caused concerns among investors about a potential short-term top in the stock index that could be followed by a sharp correction.

Meanwhile, this near-term uptick in gold prices appears to be attracting some interest from investors who use exchange-traded funds (ETF) as a vehicle to get exposure to the precious metal, as reflected by net positive inflows of around $168 million received by the two largest funds tracking gold – the iShares Gold Trust (IAU) and the SPDR Gold Trust (GLD) – after months of sustained outflows.

Moreover, concerns about higher inflation in the United States in the near future are possibly another positive catalyst for gold lately. In this regard, the University of Michigan (UoM) reported in late April its popular Inflation Expectations survey, in which consumers stated that inflation could rise to 3.4% over the next twelve months – up from 2.5% they expected in late December.

This narrative could be prompting investors to take refuge on gold and other assets that are seen as plausible stores of value – including cryptocurrencies – to prevent an erosion in the purchasing power of their dollar savings and holdings.

Only yesterday, the governor of the Bank of England (BoE), Andrew Bailey, warned that consumer price indexes in the United Kingdom could advance above the central bank’s target of 2% temporarily as a result of higher commodity prices.

That said, the central banker emphasized that the institution believes that “the policy setting is appropriate” while he also attributed this short-term uptick in prices to the “base effect”.

“Inflation is going to be a bit bumpy this year in that sense as these base effects come in and out. At the moment, we are not seeing evidence that alarms us in terms of will this become embedded in higher inflation”, the governor added during an interview with CNBC.

Governor’s Bailey warning in another corner of the world shows how the ultra-accommodative monetary policies adopted by central banks across the globe to contain the fallout caused by the pandemic are producing similar results.

In a similar fashion, the Open Market Committee of the Federal Reserve also acknowledged last week that PCE inflation is likely to move above 2% in the United States, primarily due to this alleged “base effect” but also as a result of a rebounding economy. However, the Fed stated that “these one-time increases in prices are likely to have only transitory effects on inflation”.

What’s next for gold?

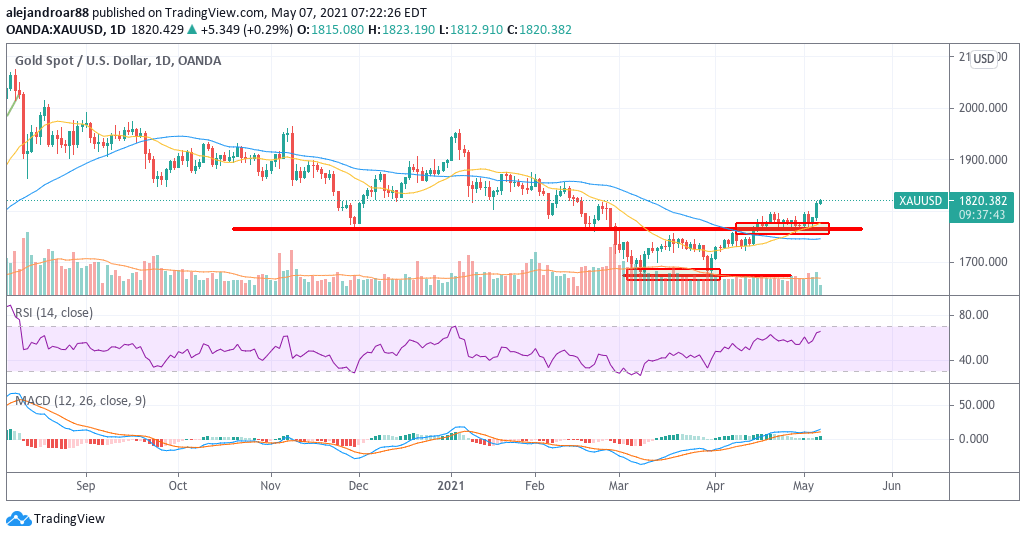

The daily chart above shows that gold is staging a strong comeback as it continues to bounce from its late March lows to the highest level seen since late February.

Reinforcing this view, the RSI is climbing near overbought levels, a situation that could be signaling a significantly positive momentum for the precious metal while the MACD is posting its highest reading since early January 2021.

Perhaps the most interesting setup for gold is the strong support the price of the precious metal has found at the $1,760 level as it hovered above that particular mark for days before yesterday’s strong uptick.

That particular support area could serve as a leg for another short-term spike in the price although confirmation of what could be a new bullish cycle for gold would be obtained if the price surges past the 0.618 Fibonacci scale shown in the chart. If that happens, a first plausible target for gold could be set at $1,959.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account