The clean energy sector has been dramatically favored by the pandemic, as a shift towards renewable sources of energy and technologies including hydrogen fuel cells, wind, and solar solutions have gained traction as feasible ways to deal with the issue of climate change.

During 2020, the largest clean energy exchange-traded funds (ETF) have seen tremendous growth in both gains and assets under management, as investors seem to have identified that the pandemic has accelerated the adoption of clean energy sources by both corporations and governments, positioning multiple companies as potential big winners of this trend in the near future.

The following article provides more details about these ETFs, along with a closer look at their current technical setup to come up with a potential short-term target based on their latest price action.

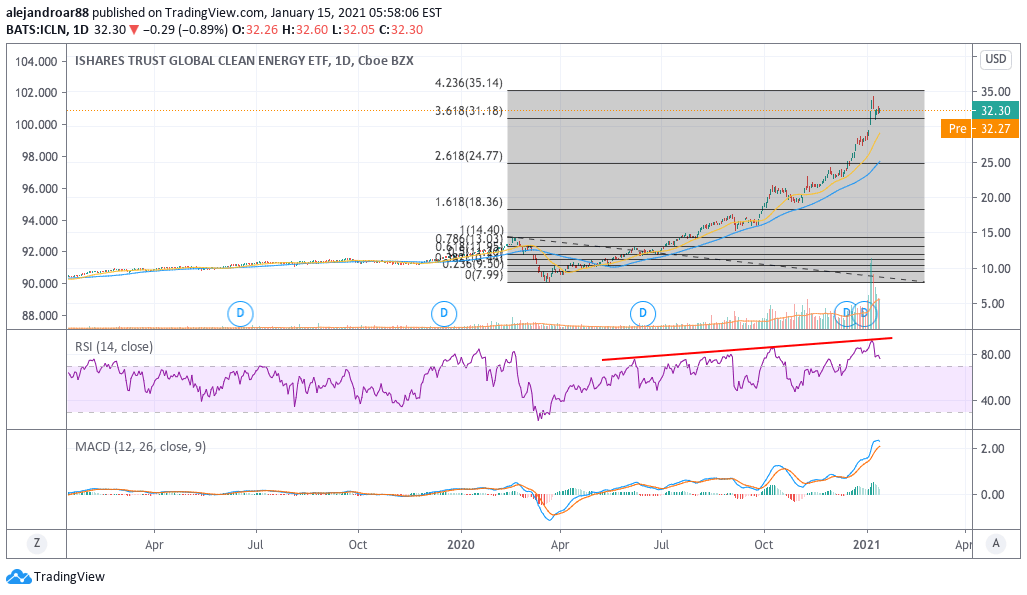

iShares Global Clean Energy ETF (ICLN)

Total Assets under management: $6.6 billion

2020 Performance: 141.8%

The iShares Global Clean Energy ETF more than doubled during 2020, as the ETF’s top constituents including Plug Power Inc (PLUG) and Enphase Energy (ENPH) saw triple-digit gains during the year after being categorized as some of the most promising companies in a world where renewables become the primary source of energy.

The chart above shows how the price action has broken through nearly all of its Fibonacci targets, now approaching the top 4.236 extension derived from the February-March retracement.

Reinforcing this bull run, the RSI and the MACD are both posting higher highs amid the surge, which indicates that the momentum remains strong for ICLN while the price remains 10% and 30% above its 20-day and 50-day moving averages.

That said, based on the current setup, it would be plausible to expect a strong pullback from here before the price moves any higher, especially as both PLUG and ENPH – the top contributors to ICLN’s positive performance last year – could see their upside capped during 2021 if market players feel the rally has gone too far.

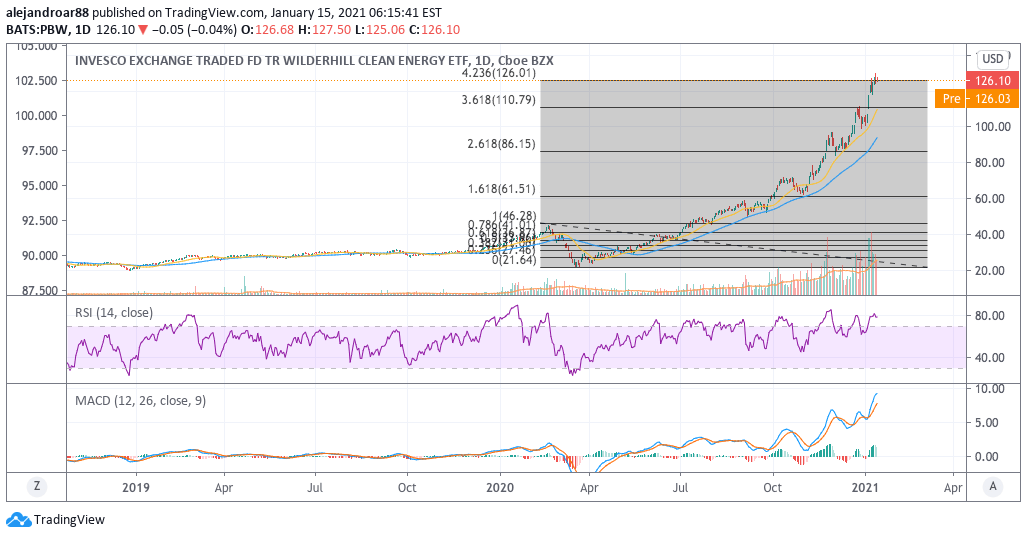

Invesco WilderHill Clean Energy ETF (PBW)

Total Assets under management: $3.03 billion

2020 Performance: 204.8%

The top constituent of this Invesco ETF – ReneSola Ltd – is among the group of triple-digit earners during 2020, with the stock surging roughly 707% last year while other smaller holdings like Plug Power (PLUG) and China-based Daqo New Energy Corp (DQ) have also contributed their fair share to the fund’s gains during such period.

Invesco seems to have diversified its roster of top constituents lately, by rotating the fund’s exposure out of the most stretched green energy players to incorporate new holdings that have much more upside potential ahead.

This situation, although it can knee-cap the short-term performance of the fund, can also end up cushioning the impact of a strong decline in 2020’s clean energy top performers.

Meanwhile, from a technical perspective, the latest price action seen by PBW has stretched above the 4.236 Fibonacci extension derived from the February-March sell-off, which could lead to a short-term pullback.

If that were to happen, investors could use the opportunity to enter the fund at a more advantageous price point based on the fact that certain components of the ETF are still favorably positioned to gain from the positive momentum seen by the sector as a whole.

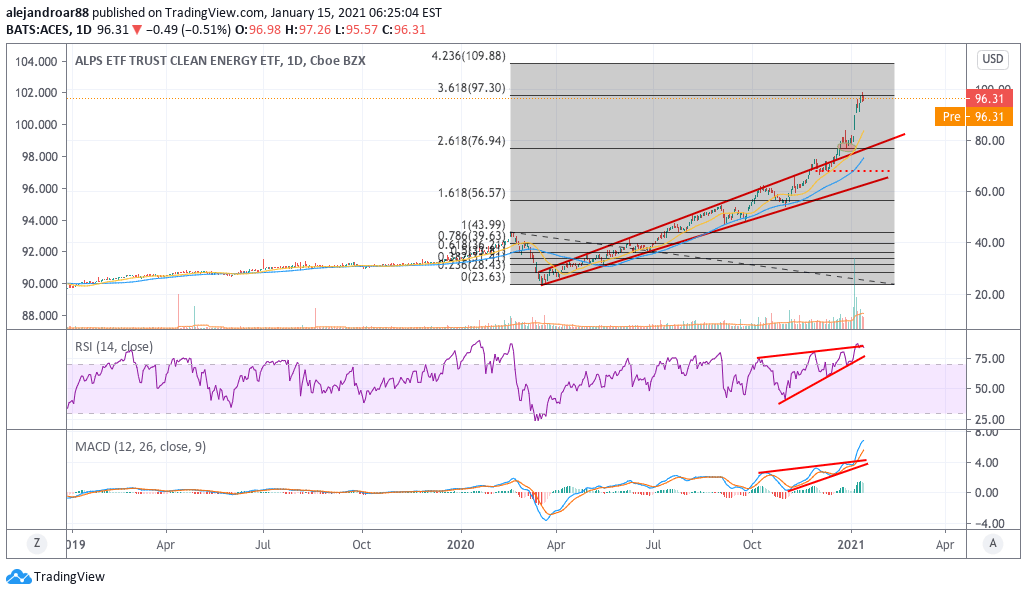

ALPS Clean Energy ETF (ACES)

Total Assets under management: $1.08 billion

2020 Performance: 140.3%

Although smaller than the other two funds mentioned in this article, ALPS Clean Energy ETF (ACES) offers a diversified portfolio of green energy stocks including Sunrun (RUN), Tesla (TSLA), and Cree (CREE).

The fact that ACES includes not just providers of renewables sources of energy, but also companies that develop technologies that serve this particular sector, is an interesting characteristic of this fund’s composition. That said, its 9.6% exposure to Plug Power (PLUG) makes its short-term performance a bit too sensitive to the volatility of this individual stock.

For now, the price action remains heavily extended from the ETF’s short-term moving averages, while the parabolic trend shown in the chart has also been broken in the past few days.

On the other hand, the momentum of the fund doesn’t seem to be fading, which gives room to think that the price could move to the 4.236 extension on short notice, representing a 14% potential upside for traders based on yesterday’s closing price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account