Chinese electric vehicle maker NIO would release its first quarter earnings on 29 April. What’re the markets expecting from the company in the quarter?

The first quarter earnings season is in a full swing. Tesla would release its first quarter earnings today and analysts expect the Elon Musk-run company to post a profit in the quarter. It has posted a net profit in every quarter since the third quarter of 2019. However, unlike Tesla, which has turned sustainably profitable as well as free cash flow positive, all other electric vehicle makers including NIO are in the red.

NIO first quarter earnings estimates

Analysts polled by TIKR expect NIO to post revenues of $1.04 billion in the first quarter—a year-over-year rise of almost 440%. The company’s revenues had increased 154% and 162% respectively in the fourth and third quarter of 2020. Its revenues are expected to climb 125% in the second quarter of 2021.

Meanwhile, the sharp rise in NIO’s first quarter revenues should be seen in the light of the lower base effect. Its deliveries had fallen in the first quarter of 2020 as the COVID-19 pandemic took a toll on its production as well as sales in China. The company’s revenues had fallen 18.7% year-over-year in the first quarter of 2020.

NIO reported higher deliveries

Most of NIO’s revenues come from the sale of its electric vehicles. The company delivered 20,060 electric cars in the first quarter which were ahead of its revised guidance of 19,500. Previously, it had said that it expects to deliver between 20,000-20,500 electric cars in the first quarter. However, while announcing the production halt it said that it expects to deliver 19,500 cars in the quarter.

NIO had to shut its plants for five days in March due to the chip shortage that took a toll on its production. Other automakers including Ford, General Motors, and Volvo also had to shut plants due to chip shortage that has impacted several industries especially the automotive industry.

Tesla

Unlike mainstream automakers that carry inventories of at least a few weeks, electric vehicle companies like Tesla and NIO are supply-constrained and can sell only as many cars as they can produce. Meanwhile, all electric vehicle companies are investing in ramping up their capacity. Tesla is coming up with two new plants in Texas and Berlin that would complement its production capacity. The company currently produces cars at the Freemont and China Gigafactories.

NIO expected to post a loss

Meanwhile, while NIO’s revenues are expected to rise sharply in the quarter, it is expected to post a net loss of $153 million in the quarter. While the company has managed to expand its gross profit margins to a healthy double-digit, it is still far away from profitability. Analysts don’t expect it to turn profitable at least for the next two years. But then, even Tesla took over a decade to turn sustainably profitable, and even now the company’s net profit margins are in the low single digits.

What to watch in NIO’s first quarter earnings call?

During NIO’s first quarter 2021 earnings call, markets would watch details on its second quarter delivery guidance. Also, it would be interesting to watch the management’s commentary on the chip shortage and how it plans to tackle the bottleneck. Rival Chinese electric vehicle maker XPeng is reportedly planning to make its own chips as the global chip shortage is expected to persist for the next several quarters.

Also, NIO might offer more details about its battery packs and the upcoming sedan ET7. The management might also offer insights into the intensifying competition in the electric vehicle industry. Luxury automaker Mercedes has also thrown its hat into the ring with its EQS while Lucid Motors is set to start delivering its Lucid Air later this year.

Also, the company might provide a roadmap for its capital-raising plans. NIO has raised capital by selling shares thrice over the last year.

Analyst rating

Earlier this year, Mizuho analyst Vijay Rakesh set a target price of $60 for NIO. “Nio has a key differentiation from peers: a premium EV offering with a lower cost of ownership through its novel Battery-as-a-Service (‘BaaS’) battery swap module,” said Rakesh. Last week, the brokerage also raised Tesla’s target price and expect it to beat first quarter estimates.

Notably, NIO offers a battery replacement service that helps it lower the car’s initial price. Buyers can buy the company’s cars without the battery which helps to lower the initial buying price. The battery is among the most critical cost elements of an electric car. Furthermore, while NIO cars don’t otherwise qualify for China’s electric car subsidy based on the car price, they are still eligible for it due to the battery swapping technology.

“While Nio is focused on the premium EV segment, a China subsidy and an innovative BaaS program make Nio’s cars eminently affordable compared to competing brands, such as Tesla,” said Rakesh.

NIO target price

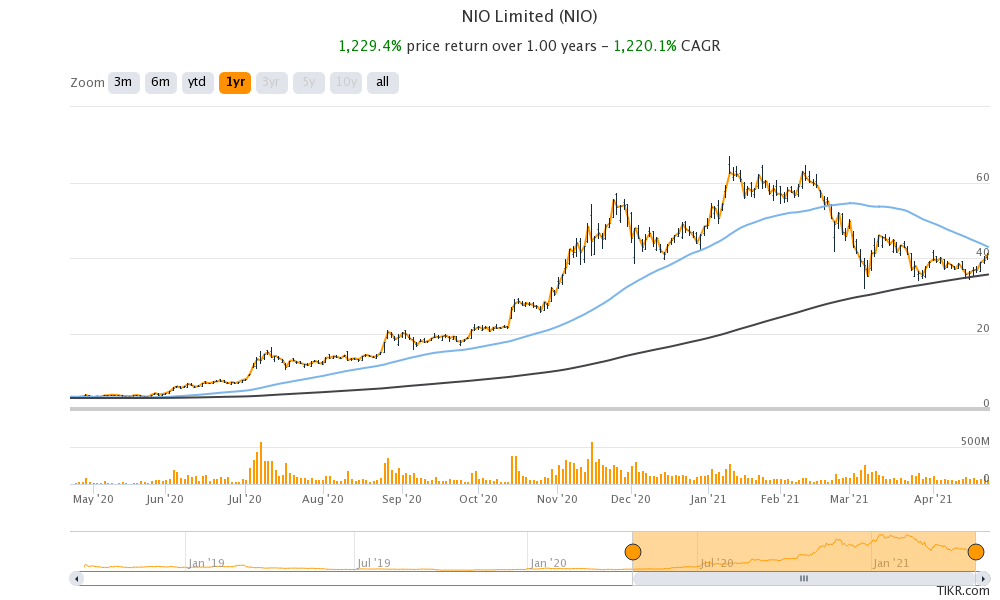

According to the estimates compiled by CNN Business, NIO’s median price target is $61.50 which is a premium of almost 50% over current prices. As NIO stock rallied last year, it consistently traded above the target price. However, after the sharp fall in its stock, it is now trading considerably below its target price.

NIO is down 39% from its 52-week highs while Li Auto and XPeng have respectively fallen 57% and 55% from their peaks. Tesla is down 19% from its 52-week highs.

Of the 20 analysts covering NIO stock, 13 rate it as a buy while six rate it as a sell. The remaining one analyst has a hold rating on the stock.

NIO also has the blessings of the Chinese government as was visible in its bailout by the Hebei Municipal government in 2020. The country has a special category for subsidy for companies that have battery swapping technology where only NIO qualifies.

You can invest in electric vehicle stocks like NIO through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account