The fourth quarter earnings season in full swing. General Motors, the largest automaker in the US, would release its earnings on Wednesday. Here’s what analysts are projecting for the company’s Q4 earnings.

Analysts expect General Motors’ fourth quarter revenues to rise 17.9% year over year to $36.3 billion. Its revenues are expected to rise on a yearly basis in the first and second quarter of 2021 also.

General Motors earnings estimates

General Motors’ (GM) Q4 2020 EPS is expected to jump sharply to $1.61 in the fourth quarter of 2020. In comparison, it posted an adjusted EPS of only 5 cents in the corresponding quarter in 2019. That said, in Q4 2019, the company’s EPS had tumbled 96%.

Ford’s Q4 earnings

Ford, which released its fourth quarter earnings last week, missed its revenue estimates. However, the company posted a surprise profit in the quarter while analysts were expecting it to post a loss. Ford stock had jumped after its fourth quarter earnings release. Along with the earnings beat it gave better than expected guidance for 2021 and also doubled down on its electric vehicle plans

General Motors electric vehicle plans

GM also announced last month that it plans to sell only zero-emission vehicles by 2035. “General Motors is joining governments and companies around the globe working to establish a safer, greener and better world,” said General Motors’ CEO Mary Barra in a statement. She added, “We encourage others to follow suit and make a significant impact on our industry and on the economy as a whole.”

Hydrogen and electric vehicles

Along with battery electric vehicles, vehicles that run on hydrogen fuel cells also count as zero-emission vehicles. While Tesla’s CEO Elon Musk has mocked hydrogen fuel cell technology in the past, fuel cell stocks have rallied sharply over the last year.

Toyota Motors, Honda Motors, and Nikola are among the carmakers that are betting on both battery-electric and hydrogen fuel cell cars.

Legacy automakers are trading at low valuations

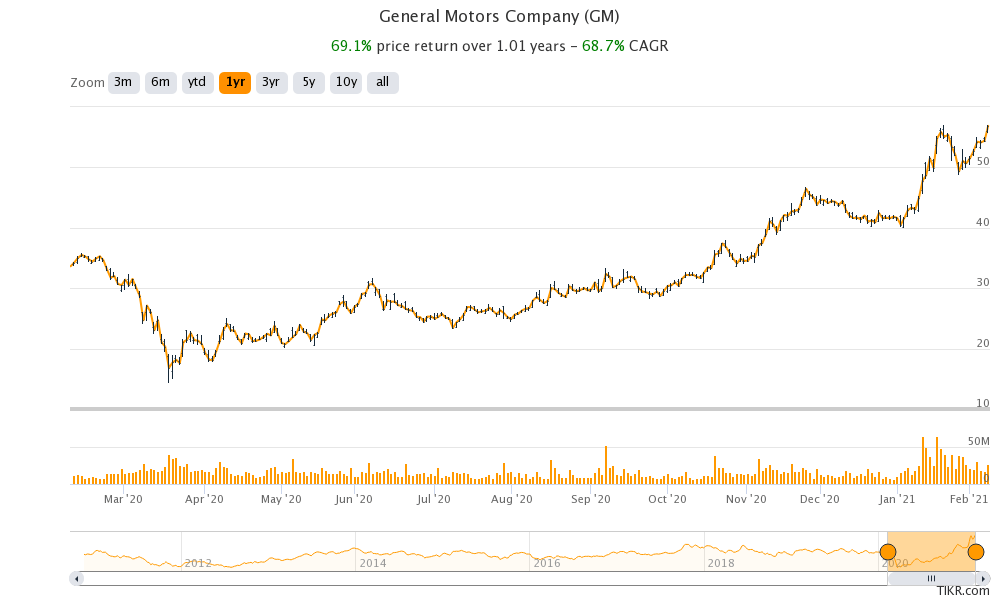

While General Motors’ stock has surged over the last year, its valuation multiples are nowhere near the valuations that pure-play electric vehicle stocks are commanding. General Motors is trading at an NTM (next-12 months) PE multiple of 9x which is a fraction of what Tesla trades at. Barring Tesla, which is now sustainably profitable, other electric vehicle companies have been posting losses.

Should General Motors separate its electric vehicle business?

Morgan Stanley auto analyst Adam Jonas has called upon legacy automakers to consider a separate listing of their electric vehicle business as it can help unlock value. “We believe management actions to address issues of proximity/separation of their ICE and EV businesses over the next few years will be a potentially far greater driver of their stock prices than items such as US [unit sales announcements] and [earnings forecast] revisions,” said Jonas commenting on General Motors.

Dan Ives of Wedbush Securities holds a different view. “As Detroit shows more success in EVs, investors will break down the business with a sum-of-the-parts valuation,” said Ives. He added,+` “If you assign an EV-like multiple to even a quarter of their business, their stocks go significantly higher than where they are today.

General Motors stock prediction

According to the estimates compiled by TipRanks, General Motors has an average one-year price target of $58.08 which is only a 2% premium over its current stock price. The stock’s highest price target is $43 while $80 is its street high price target. Of the 13 analysts covering the stock, only one has rated it as a hold while the remaining 12 rates it as a buy or higher.

General Motors and Ford could see a valuation rerating this year as they scale up their electric vehicle sales. We’ll get more updates on General Motors’ vehicle electrification plans during the company’s fourth quarter earnings call.

How to invest in General Motors

You can trade in General Motors stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the green energy ecosystem could be to invest in ETFs that invest in clean energy companies like Tesla and NIO.

Through a clean energy ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account