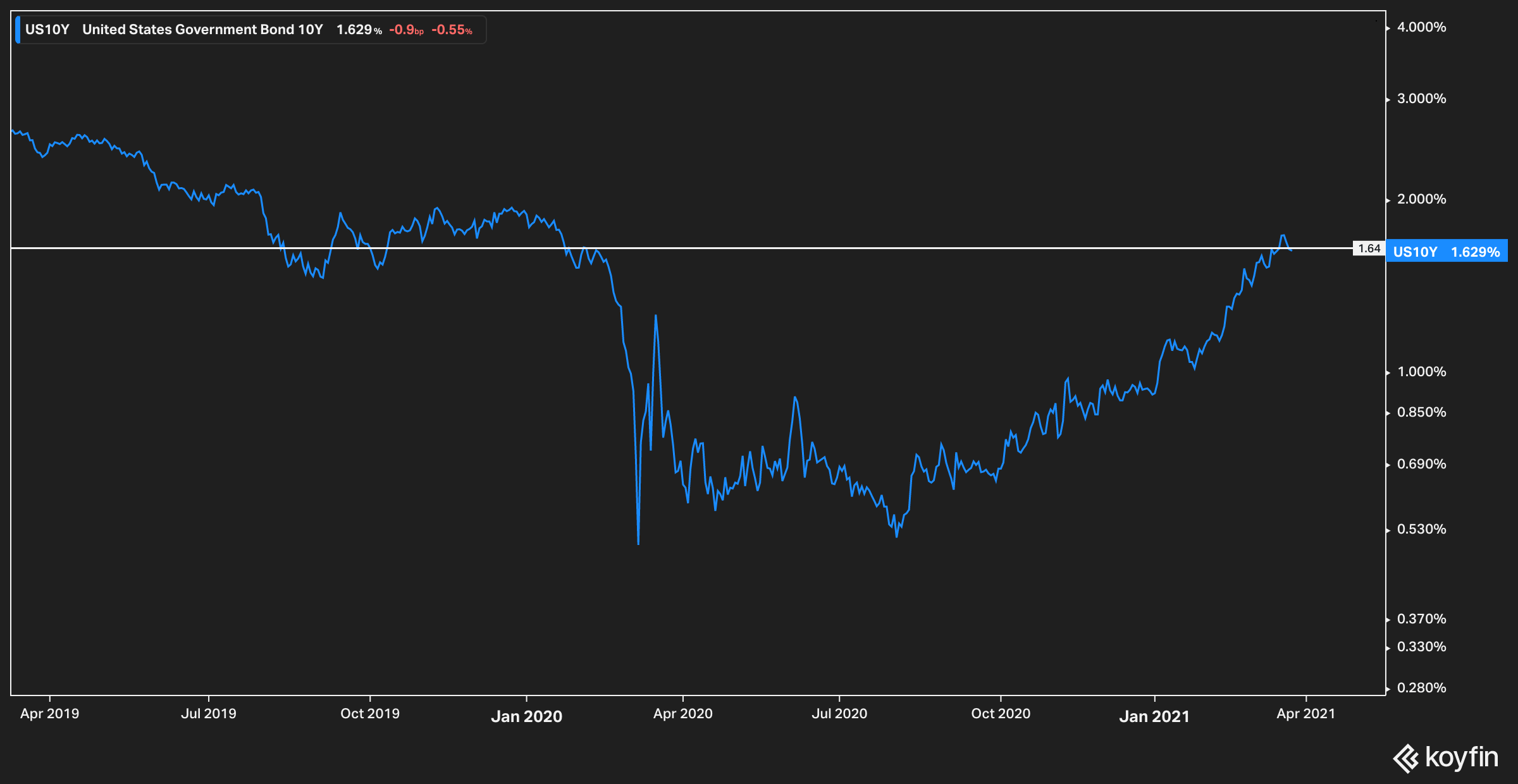

US Treasury yields remain on neutral territory this morning after dipping for two days in a row, with the benchmark 10-year rate sliding almost 10 basis points to 1.627% after reaching a post-pandemic high of 1.726% on Friday.

Comments from the Chairman of the Federal Reserve, Jerome Powell, and US Treasury Secretary, Janet Yellen, during a hearing with the House’s Financial Services Committee seem to have influenced the performance of Treasury bonds, as Powell reassured market participants that the Fed has not even started to consider tapering its asset-purchase program at the moment.

Meanwhile, when questioned about potentially lofty valuations in the financial markets, Yellen conceded that some areas of the market look rather elevated. However, Chairman Powell emphasized the strength of financial institutions as a pillar of the system’s overall stability.

In this regard, Powell stated: “You can say that some asset prices are a bit high, but the bank system is highly capitalized”.

US stock futures seem to be reacting positively to the retreat in bond yields this morning, with futures of the tech-heavy Nasdaq 100 index advancing 0.8% at $13,108 followed by E-mini futures of the S&P 500 and Dow Jones which are moving 0.4% higher at 3,915 and 32,425 respectively.

Powell’s assurance in regards to the continuation of the Fed’s asset-purchase program as is – which involves buying roughly $120 billion in Treasury bonds and mortgage-backed securities every day – might have eased investor’s concerns about a potential early hike in the central bank’s benchmark interest rate.

About this possibility, the head of the US central bank said: “In terms of moving forward, we’ve said that we would start to taper our asset purchases when we’ve seen substantial further progress toward our goals”. These goals include reaching higher levels of employment while hitting the Fed’s inflation target of 2%.

However, worries seem to persist about the seemingly unstoppable uptrend in US Treasury yields lately, as the country continues to emerge from the coronavirus crisis, which favors a risk-on attitude from investors who could keep disposing their bond holdings to pursue more attractive and riskier assets like equities.

This scenario is reflected by yesterday’s late drop in US stock indexes, with the Dow Jones Industrial Average finishing the day with a 1% loss after dropping sharply in the last two hours of the stock trading session.

What’s next for US Treasury yields?

A report from Reuters this morning indicated that the demand for the US government’s latest auction of 2-year Treasury notes was quite strong, as the Treasury Department successfully allocated $60 billion at the same yield at which these issues traded prior to the auction.

Meanwhile, two other important auctions of 5-year and 7-year bonds are scheduled to take place on Wednesday and Thursday respectively and market participants will be closely watching how the demand for those longer-dated issues behaves to possibly gauge the market’s sentiment for these fixed-income securities.

Weak demand during these two auctions could result in a jump in Treasury yields as the selling spree could resume. However, the positive tone of today’s auction could mean that institutional investors have felt reassured by Powell’s comments about the continuation of the Fed’s tapering – a major force that has kept asset prices from falling down a cliff since the pandemic started.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account