US stocks are sharply lower this morning after credit rating agency Fitch lowered US sovereign debt rating. Economists aren’t too perturbed by the downgrade though.

Fitch lowered the long-term US sovereign debt rating from AAA to AA+. The rating agency had placed the rating on a “negative watch” in May amid the drama over the debt ceiling in the country.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” said Fitch in its note. Notably, the standoffs over the debt ceiling have been a recurrent phenomenon in the US.

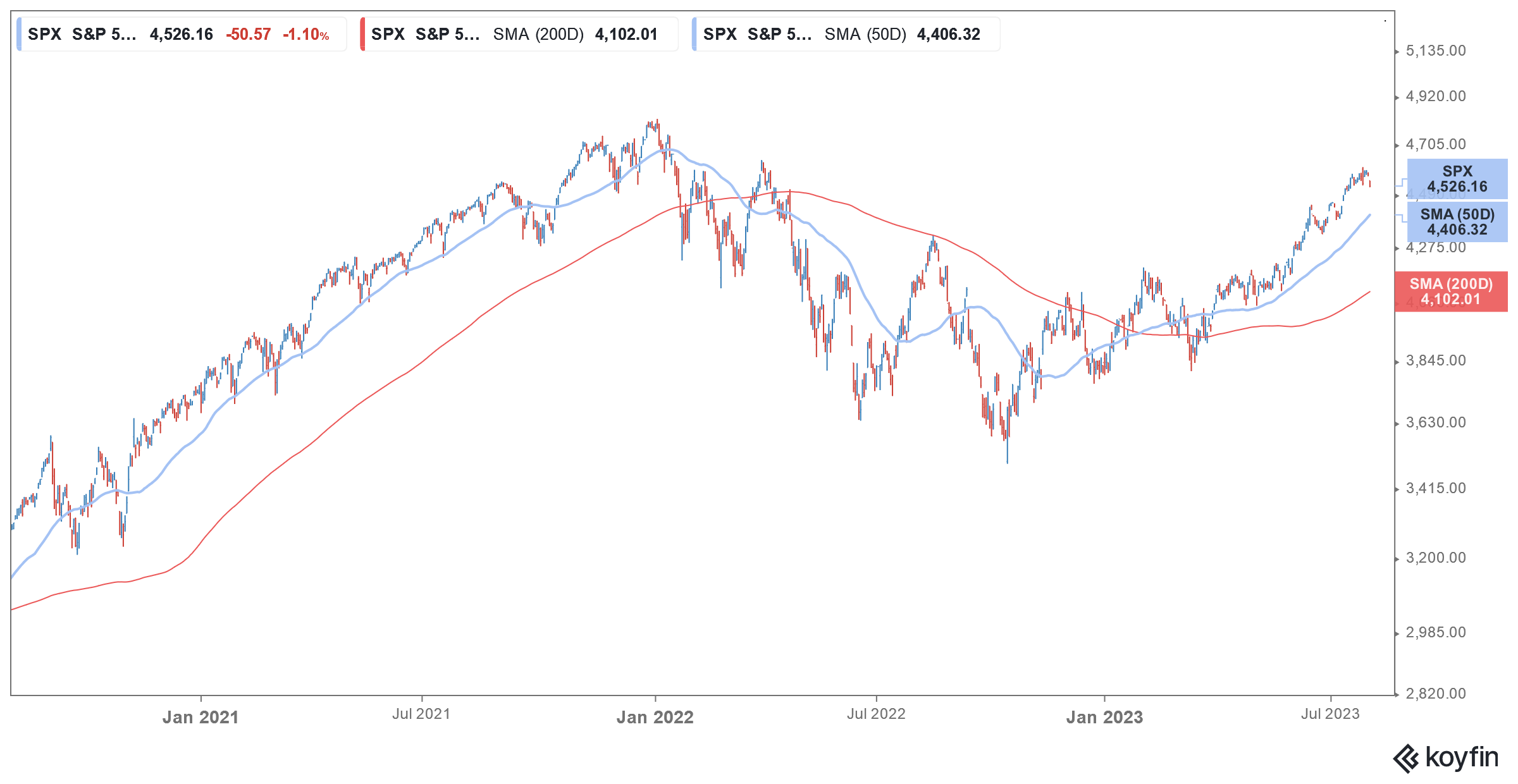

US stocks fall after Fitch downgrades US sovereign rating

Also, the US fiscal deficit as a percentage of GDP has surged and Fitch expects the metric at 6.3% in 2023 – as compared to 3.7% in 2022. Also, the US sovereign debt surpassed GDP after the government opened the purse strings during the COVID-19 pandemic.

In its report, Fitch said, “In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025.”

As expected, the White House has disagreed with Fitch and press secretary Karine Jean-Pierre said, “It defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.”

US stocks are meanwhile sharply lower today amid the risk-off sentiment following the downgrade. Global stocks were also invariably lower today as markets digested the news of the downgrade.

Economists react to Fitch’s downgrade

Former U.S. Treasury Secretary Larry Summers who has been predicting a US recession termed Fitch’s rating downgrade as “bizarre and inept” while Allianz Chief Economic Advisor Mohamed El-Erian said that he is “perplexed” by both the reasoning behind the downgrade as well as its timing.

Goldman Sachs Chief Political Economist Alec Phillip said that the rating downgrade “should have little direct impact on financial markets as it is unlikely there are major holders of Treasury securities who would be forced to sell based on the ratings change.”

“Fitch’s projections are similar to our own — they imply a federal deficit of around 6% of GDP over the next few years — and Fitch cites CBO (collateralized bond obligation) projections in its medium-term outlook, so the downgrade does not reflect new information or a major difference of opinion about the fiscal outlook,” added Philip in his note.

Wells Fargo says US stocks would bounce back

Wells Fargo Securities Head of Equity Strategy, Chris Harvey said the Fitch downgrade “should not have a similar impact to S&P’s 2011 downgrade (SPX 1-day: -6.7%), given the starkly different macro environments and other reasons.”

Notably, in 2011 S&P Global had also lowered US sovereign credit by a notch which led to a widespread sell-off in global stocks.

However, Wells Fargo believes that any correction in stocks this time would be “relatively short and shallow.”

Mark Mobius believes investors might rethink their strategies

Mark Mobius said, “I think from a longer term perspective people are going to begin to think that they’ve got to diversify their holdings, first away from the U.S. and also into equities because that’s a way to protect them from any deterioration of the currency — the U.S. dollar or for that matter any other currency.”

Notably, many countries especially China which is the single biggest holder of US Treasuries, have anyways been diversifying their holdings.

Bank of America reverses its recession call

Meanwhile, the sentiment towards the US economy is improving and not many see a recession as imminent in 2023. Joining the ranks is Bank of America whose economists said “Recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the US economy.”

Notably, the Fed has so far maintained that its rate hikes might cause a recession even if it is not something that it is deliberately pushing for. After last month’s rate hike which catapulted US interest rates to the highest since 2001, Fed chair Jerome Powell said that its economists no longer forecast a recession.

BofA economists, led by Michael Gapen, wrote in a note to clients that “Growth in economic activity over the past three quarters has averaged 2.3%, the unemployment rate has remained near all-time lows, and wage and price pressures are moving in the right direction, albeit gradually.”

Citi raised its target for US stocks

Citi recently raised its yearend S&P 500 target to 4,600 as the brokerage sees a higher chance of a soft landing. US stocks have rebounded in 2023 and have recouped most of their 2022 losses. Tech stocks were especially strong in the first half of 2023 with the Nasdaq having its best start to the year in four decades.

Stocks globally have looked strong this year amid hopes that not only is the global economic growth better than expected but inflation has also fallen much faster than what many envisioned.

However, despite the US annualized CPI falling from 9.1% last June to 3% in June 2023, the Fed does not believe that it has one the battle and continues to raise rates – albeit at a much slower pace than the last year.

As for the Fitch downgrade, it has negatively impacted market sentiments today and US stocks are down sharply. However, as the week progresses markets would turn their attention to earnings as heavyweights like Apple and Amazon release their earnings

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account