This week, several retail giants including Walmart and Home Depot would release their earnings. The earnings are coming at a time when recession fears are heightened while the consumer confidence index is at a multi-month low.

Target, TJX Companies, Bath & Body Works, and Ross Stores would also release their quarterly earnings this week and we’ll get the retail sales data for April. The metric fell 1% in March but is expected to have risen by 0.8% in April.

US consumer confidence index fell in May

US consumer confidence index fell to 57.7 in May – as compared to 63.5 in April. The data point came in sharply below estimates as recession and debt ceiling fears took a toll on consumer sentiments.

Survey director Joanne Hsu said, “While current incoming macroeconomic data show no sign of recession, consumers’ worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff.”

Hsu added, “But with the job market remaining strong and incomes rising, albeit faced with inflation, consumers have maintained their spending habits.”

What to expect from retail earnings this week?

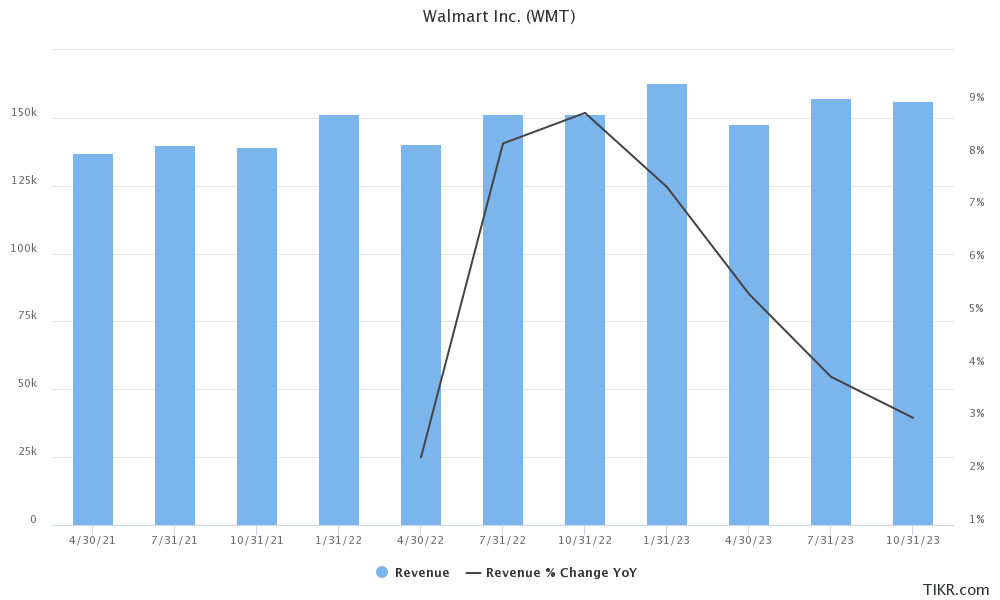

talking of retail earnings, analysts expect Walmart’s same-store sales to rise by 5.4% in the quarter. Jefferies analyst Corey Tarlowe said in a note “As we head into earnings, we believe WMT is one of the best positioned in our coverage and our data checks support our view.”

The brokerage expects Walmart’s comp sales to rise by 6.8% in the quarter which is above the consensus estimates.

Walmart reported better-than-expected revenues and profits in the previous quarter. However, it spooked markets with its fiscal year 2024 guidance and forecast sales growth between 2.5%-3% and EPS between $5.90-$6.05 which fell short of estimates

Walmart’s CFO John David Rainey said, There’s still a lot of trepidation and uncertainty with the economic outlook. Balance sheets are continuing to get thinner, savings rate is roughly half of what it was at a pre-pandemic level and we’ve not been in a situation like this where the Fed is raising at the rate that it does.”

Jefferies expects Walmart to outperform

Tarlowe is meanwhile bullish on Walmart ahead of retail earnings and raised the company’s earnings estimates.

“We believe WMT’s initiatives (automation, advertising, Walmart+, etc) are helping to build an attractive and growing flywheel, and we are becoming more positive on WMT’s growth and profitability prospects ahead,” said Tarlowe in his note.

Jefferies is however “incrementally cautious” on Target and said, “According to our data, we are modeling TGT Q1 comps down 1% led by lower traffic.”

Home Depot was also circumspect about its outlook

Home Depot would be the first major retail earnings this week. The company saw a sales boom amid the pandemic as people spent heavily on home improvement. Now, as consumer behavior has reverted to pre-pandemic levels and outdoor spending has rebounded, companies like Home Depot are battling with slowing growth.

In the previous quarter, Home Depot’s sales rose only 0.3% YoY and trailed analysts’ estimates.

Notably, retail stocks fell after Walmart and Home Depot reported their earnings in the previous quarter.

Home Depot CFO Richard McPhail warned “So we work from kind of a fundamental assumption that consumer spending will be flat. We know that our market has seen a gradual shift that reflects the broader shift in the economy, in consumer spending from goods to services.”

Telsey Advisory Group analyst Joseph Feldman who has an outperform rating on Home Depot said, the company is “lapping difficult comparisons from the past three years fueled by heightened home-related spending as a result of the pandemic and government stimulus.”

Morgan Stanley likes Ross Stores heading into the earnings season

Morgan Stanley meanwhile likes Ross Stores heading into the earnings season. In his report, Morgan Stanley analyst Alex Straton said, “We see ample opportunity for ongoing positive EPS revisions to drive the stock higher, making it a particularly attractive opportunity in the Off-Price sub-sector. Given this dynamic, ROST has arguably become our preferred Off-Price name heading into the 1Q prints.”

Amazon warned of retail spending slowdown

Notably, the slowdown in retail spending has also hit Amazon which reported revenues of $127.4 billion in the first quarter of 2023 – up 9% YoY.

Looking at the different business segments, the company’s North America segment posted revenues of $76.9 billion – up 11% as compared to the corresponding quarter last year. Its international segment’s sales however rose only 1% to $29.1 billion.

Amazon CFO Brian Olsavsky said during the Q1 2023 earnings call, “The uncertain economic environment and ongoing inflationary pressures continue to be a factor and we believe, is continuing to drive cautious spending across consumers.”

He added, “This means our customers are looking to stretch their budgets further, and are focused on value.”

When retail majors release their earnings this week markets would get more insights into the health of US consumers as recent data points suggest that consumer activity is showing signs of weakening amid a slowing economy.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account