US stock futures are plunging ahead of Wall Street’s opening bell as last week’s tech sell-off appears to be gaining more traction during this morning futures trading session.

The front-month E-mini S&P 500 futures contract expiring in September is down 0.75%, so far trading at 3,392 on thin volume while the Nasdaq 100 tech-heavy index is down 2.47% trading at 11,262.

Futures of the Dow Jones Industrials Index are also heading down, losing 0.18% so far today, as sector rotation from tech to value stocks seems to be gaining some steam.

Although futures are not always an exact measure of how the stock market itself will be opening later in the morning, they do give traders a window through which they can take a peek of the market’s sentiment prior to the opening bell.

Meanwhile, oil and gold futures are also heading down with light crude futures losing a surprising 5.4% in one of their worst days since June 24 while the yellow metal is down 0.65% at 1,917 per ounce as the US dollar continues to perform positively for its six consecutive day as reflected by the US dollar index, which is up 0.3% this morning in early forex trading activity.

Are US stock futures lining up for more losses?

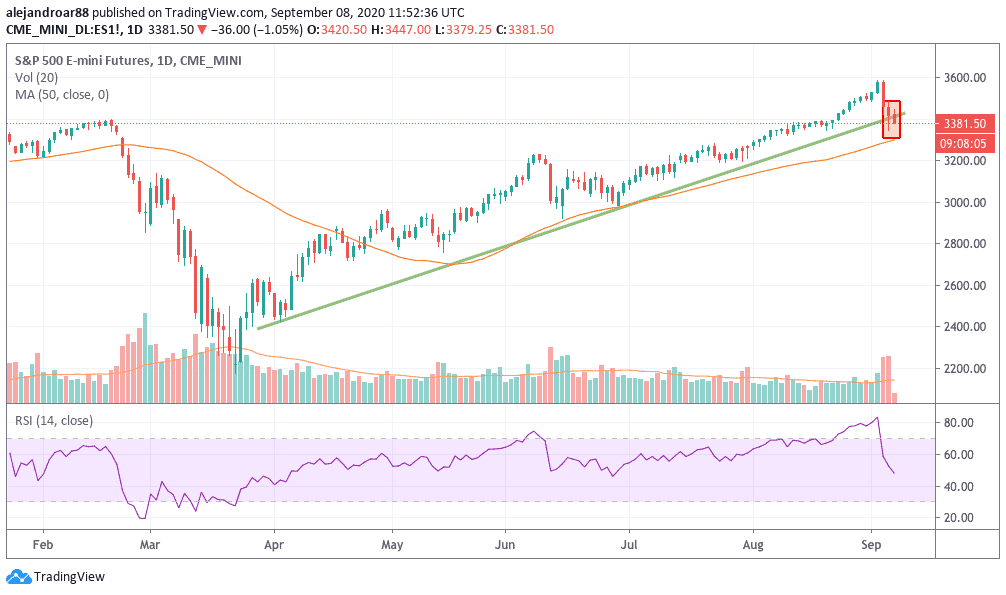

The chart above shows how the front-month futures contract of the S&P 500 has been behaving lately and the key element to watch at the moment is that break below the index’s lower trend line which is an indication that a trend reversal may be in play.

Given the absence of a strong negative catalyst, it would be difficult to argue that this is the beginning of a crash. Instead, it would be more plausible to assume that the index is taking a long-overdue breather following the strong rally it has been on since it touched bottom in March.

The RSI shows how the E-mini S&P 500 contract has already stepped off overbought territory, which is positive in the long-run, although this trend line break suggests that some more pain may be ahead while buyers regain their confidence.

That said, given the significant degree of uncertainty that surrounds the global economic landscape at the moment due to the virus situation and the lofty valuations seen in a handful of tech companies – which have been driving the market higher and higher for weeks – investors should keep an eye on how the market behaves in the next few days before jumping to conclusions.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account