US stock futures are falling sharply this morning amid news of a new COVID strain identified within the United Kingdom, with the city of London imposing Tier 4 restrictions – similar to those enforced in February-March – to prevent a spike in contagions.

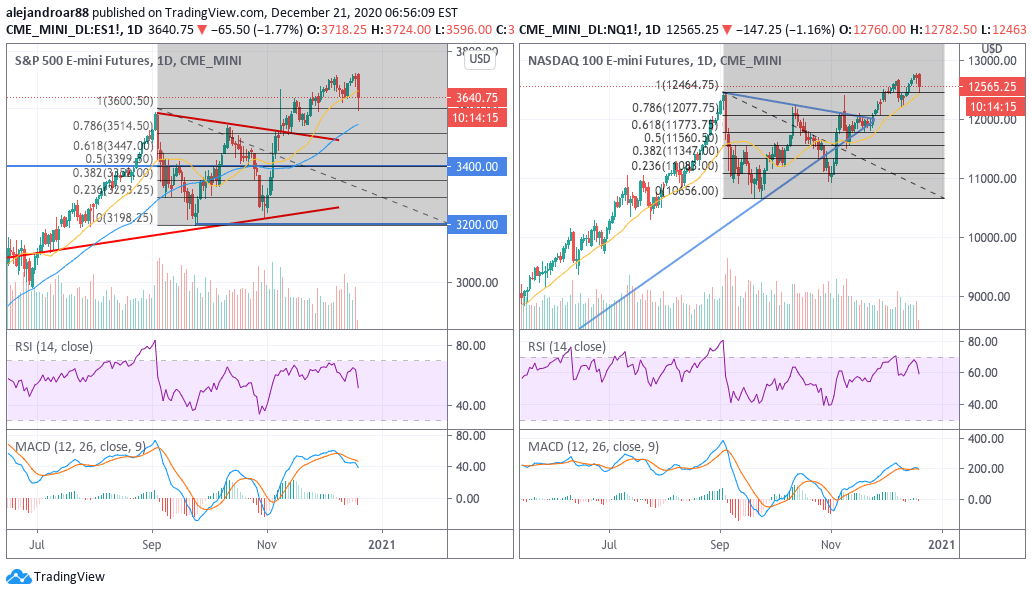

E-mini futures of the S&P 500 are leading the downtick this morning as they slide 74 points – or 2% – at 3,632, followed by futures of the value-focused Dow Jones Industrial Average, which are retreating 1.85% at 29,538.

Meanwhile, futures of the tech-heavy Nasdaq 100 index are seeing less pain in early futures trading activity, sliding only 1.3% at 12,547 as lockdowns have actually provided a tailwind for the tech industry around the world.

European countries have quickly moved to introduce a travel ban for passengers coming from the UK to prevent the strain from moving outside of the country’s borders, while European Union leaders are expected to meet today to coordinate the block’s response to the situation.

Meanwhile, the deadline to reach an agreement on Britain’s exit from the European economic block keeps approaching with leaders possibly having some busy days ahead if the COVID situation gets out of hand.

Today’s downtick, however, has probably been partially offset by positive news from the US Congress, as lawmakers managed to pass a $900 billion stimulus bill to further assist the country’s economic recovery.

This relief would include a direct payment of $600 to adult Americans and another $600 granted per child along with more funds for the Paycheck Protection Program (PPP), which aims to protect workers from being laid off by providing companies with the resources to cover their payroll while they emerge from the crisis.

Further resources are also being extended to the federal unemployment program to keep it running, as continuing jobless claims in the country remain three times higher than they were before the pandemic stroked.

Meanwhile, only two days ago, the US Food and Drug Administration (FDA) granted emergency-use approval for Moderna’s COVID-19 vaccine, with doses starting to be rolled out in the country as soon as this week to help the nation in fighting an outbreak that has so far taken the lives of almost 325,000 Americans.

What’s next for US stock futures?

Today’s downtick in US stock futures forced both the S&P 500 and the Nasdaq 100 index to revisit their early-September all-time highs, with the price bouncing off that particular level during intraday activity.

Whether that threshold holds during the American stock trading session or not will depend on how individual stocks react to the news about this novel COVID strain, although the plunge should be limited given that there are already two highly effective vaccines being rolled out in most developed countries.

That said, the efficacy of the vaccine in protecting individuals from this new strain of the virus could be determinant, as doubts about the treatment’s ability to provide the same level of inoculation could end up triggering a sharper correction with countries possibly contemplating the idea of reimposing travel bans and business shutdowns similar to those seen in February-March.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account