US stock futures are starting the week on an upbeat tone as investors appear to be optimistic about the impact that vaccinations will have on the country’s economic outlook.

E-mini futures of the value-focused Dow Jones Industrial Average are leading today’s uptick, advancing 244 points – or 0.82% – so far during the European futures trading session, followed by the E-mini futures of the S&P 500, which are climbing 0.7% today ahead of Tesla’s incorporation to the broad-market index.

Meanwhile, futures of the Nasdaq 100 tech-heavy index are up roughly 0.5% today at 12,428, as the rotation trade keeps favoring so-called “value” stocks while slightly shunning high-growth tech firms, which shined during the pandemic.

On 11 December, the Food and Drug Administration (FDA) issued an emergency-use approval for the Pfizer-BioNTech COVID-19 vaccine to fight the virus, at a moment when the country is seeing perhaps the worst days of the pandemic with the daily death toll briefly climbing above 3,000 in the past few days while the number of daily confirmed cases has reached almost 250,000 contagions per day.

Based on the guidelines issued by the Center for Disease Control and Prevention (CDC), the first subsets of the population that should get vaccinated include health care personnel, non-healthcare essential workers, adults with high-risk medical conditions, and people over 65 years old.

The responsibility of rolling out the vaccine will be assigned to each state, while US top health officials expect that the majority of the population should be inoculated by the end of the second quarter of 2021.

Given the forward-looking nature of financial markets, today’s reaction seen in US stock futures indicates that market players are pricing in that the virus situation will probably be a thing of the past by then, a situation that will favor riskier assets such as equities while low-risk securities like gold and US treasury bonds are being sold as investors’ risk-on appetite grows.

Meanwhile, the prospect of another round of economic stimulus from Congress before the year ends is also pushing indexes higher, as politicians could end up approving a bill of as much as $908 billion to keep propping the economy while it recovers from the virus fallout.

In the meantime, the Federal Reserve has continued to expand its balance sheet to provide further support to the financial markets, with the central bank’s total assets progressively moving above $7.2 trillion for the first time in the past few weeks – a fresh all-time high.

What’s next for US stock futures?

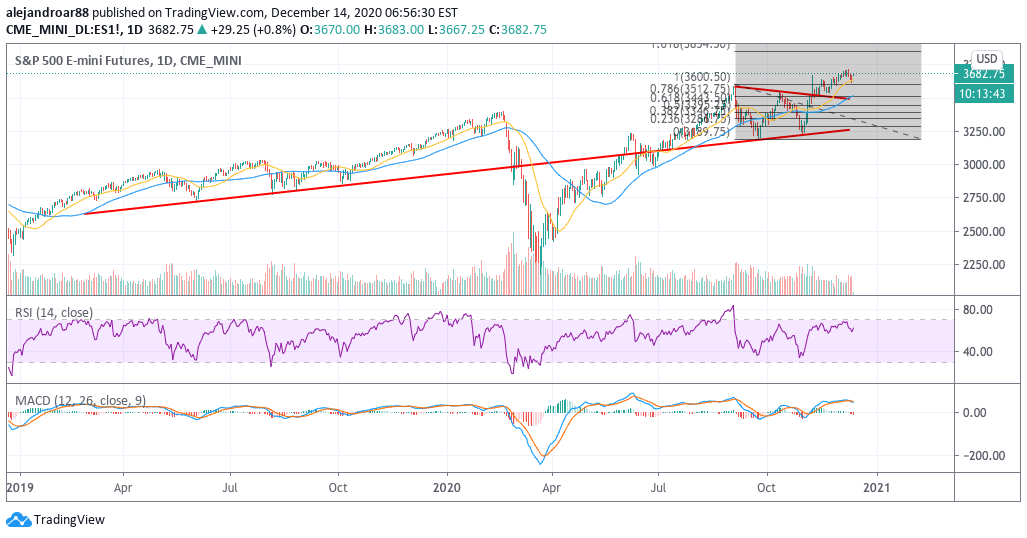

The S&P 500 has quietly climbed to all-time highs recently, moving past the 3,700 level for the first time on record, although the index has taken a breather in the past few days.

The chart above shows how the price action bounced off the 0.786 Fibonacci on Friday while the index is advancing today, which could mean that bulls are ready for another push towards the 3,700 level during the week as vaccines keep rolling.

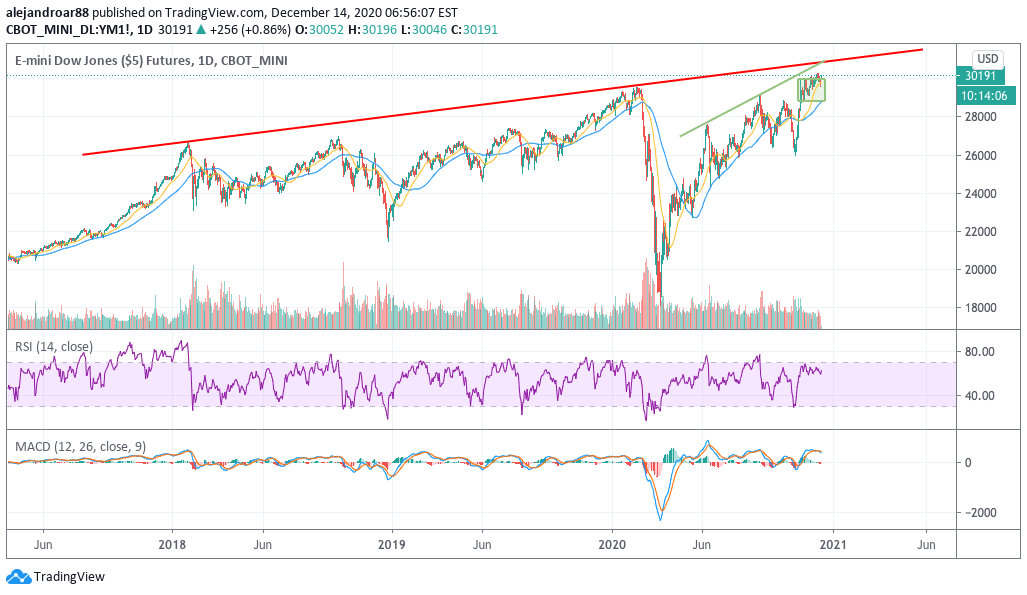

Meanwhile, the Dow Jones seems to be ready to move higher as well as the index is attempting to once again break the consolidation rectangle seen in the chart, although the benchmark will face some strong resistance once it attempts to move above the 31,000 level given the confluence of two long-dated upper trend lines.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account