The value of the US dollar could be about to take a U-turn as it approaches its lowest level since March, based on technical indicators.

The greenback – tracked by the US dollar index (DXY) – has been under downward pressure as a spike in coronavirus cases in the North American country and a massive liquidity injection from the Federal Reserve has impacted its standing as the world’s reserve currency.

This decline has been accompanied by a sharp rebound in US equities, as investors from overseas take advantage of a weaker dollar to buy US stocks.

However, over the past few weeks, a sharp increase in the price of gold – approaching its all-time highs and threatening to go above $1,900 – and a drop in US 10-year Treasury bond yields to their lowest level since 21 April seem to be pointing to a risk-off move from investors, as tensions between the US and China rise and the virus situation in America continues to worsen.

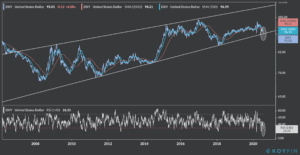

This flight-to-safety could be creating enough momentum for the US dollar to rebound from its lows, say some analysts, especially after considering that the value of the greenback has just touched its lower trend line, which has served as a strong support line in the past nine years

As seen in the chart (above), the US dollar has managed to jump back to a higher level every single time it has reached this support line, even though the strength of the rebound cannot be determined.

Moreover, the Relative Strength Index (RSI), a technical price action indicator, is pointing to an oversold level, which occurs when the price slips below its previous 14-day average gains and losses, indicating that the market may have gone too far in its selling.

Sven Henrich, a seasoned technical and macro analyst and the founder of research service Northman Trader, highlighted this situation, as the value of the US dollar has been negatively correlated with US stocks since the year started.

This means that as the value of the greenback goes up, stocks go down.

“The Fed has managed to bring about this big recovery rally as a result of their programs, and, with it, they weakened the dollar. But now the dollar has hit its key rising trend, a trend in place since 2011,” said Henrich in a note to clients earlier this month.

He added: “Sharp rallies in the dollar have generally not been kind to equities in recent years”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account