US stock markets have been the best performing major stock market this year, but some traders are advising clients to invest in overseas markets as they expect them to outperform in the second half of 2020.

Despite being the worst affected country from the coronavirus pandemic, US stock markets are outperforming global markets. While most major global markets are trading with sharp year to date losses, US stock markets have not only recouped their losses but are looking at new record highs.

The Nasdaq Index, up almost 25% for the year has already hit new record highs. The S&P 500 Index is only a tad short of its all-time highs and is up over 4% for the year. However, traders see some overseas stock markets to play catch up now.

Can Chinese stock markets outperform US stock markets?

“We have a global macro ETF strategy run by my partner Arthur Laffer Jr and he recently took position at the end of June in China, and though China has run up about 18-19% since then … we are still very optimistic about China as a trade going forward,” Nancy Tengler, chief investment officer at Laffer Tengler Investment said in an interview on CNBC’s Trading Nation on Friday.

She added: “Lastly, you have a country that was first in or first opened that has been supplying global demand as the rest of the world is reopening so we think there’s a lot of room to go in China.”

While the coronavirus originated in China, many would argue the country has handled the pandemic better than the western world. China’s Shanghai Composite Index is up over 10% for the year. It was trading with losses in the first quarter but has since recouped its losses. The Index has gained 17% over the last three months.

However, China is the only major global market that’s still below its 2007 highs. US stock markets were the best performing major stock market globally in the last decade. If US President Donald Trump escalates the rhetoric against Chinese companies, it could hit Chinese stocks.

US stock markets’ valuations could be getting overstretched

Like Tengler, JC O’Hara, chief market technician at MKM Partners also expects Asian stock markets to outperform US stock markets. “Investors should be looking at Asia for opportunities. And we’ve recently really warmed up to South Korea for several reasons, said O’Hara.

O’Hara likes South Korean stock markets due to their lower relative valuations. The S&P 500 trades near multi-year high forward price to earnings ratio of 23x while South Korea’s Kospi trades at 12 times forward earnings.

Many fund managers including Stanley Druckenmiller have expressed concern over the soaring valuations of US stock markets. Even Warren Buffett, who is known for his value investment principles, was a net seller of stocks in the second quarter. He, however, repurchased a record $5.1bn worth of Berkshire Hathaway shares in this period.

Should you consider South Korea ETF?

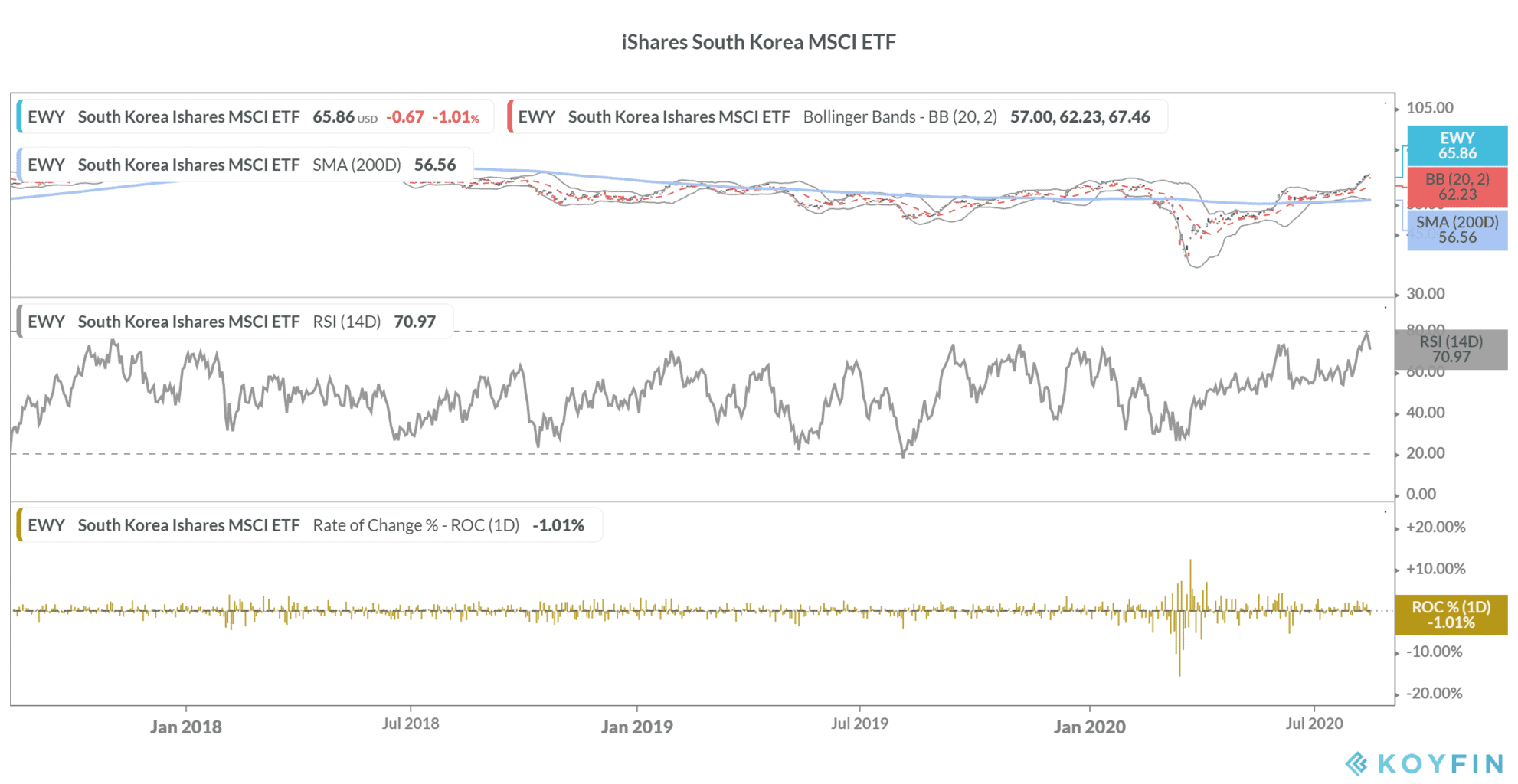

O’Hara said: “As a technician, the most important reason that we like South Korea is the simple fact that the chart is breaking out to multiyear highs. For the South Korean ETF, the EWY, the next level of resistance is 13% higher so there’s plenty of room to run.”

You can benefit from the expected upside in Asian stock markets by buying country-specific ETFs. By investing in an ETF, you can get returns that match the underlying index after accounting for the fees and other transaction costs. We’ve prepared a handy guide on how to trade in ETFs. You can also refer to our selection of some of the best online stockbrokers

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account