Tesla stock 3.7% yesterday and was trading almost 1% higher in US premarket trading today. The surge in bitcoin prices, which have hit a new record high seems to be helping Tesla even as competition seems to be increasing in the EV industry.

Earlier this year, Tesla invested $1.5 billion in bitcoins. Later it allowed consumers to buy its cars in bitcoins and said that it won’t convert these into fiat currencies, a term used for currencies issued by central banks.

Tesla invested in bitcoins

In the statement reporting its purchase of bitcoin, Tesla said: “In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity.”

It added, “We may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future.”

While many were critical of Tesla for investing in bitcoins, both Tesla and bitcoins had surged after the announcement. While Tesla stock has since looked weak, bitcoin has hit another record high ahead of Coinbase’s direct listing.

Bitcoin surges ahead of Coinbase IPO

Meanwhile, Tesla’s investment in bitcoins is paying off as the digital currency is surging amid increasing adoption. Apart from Tesla, several other companies including Square have invested in bitcoins while payment companies like PayPal are allowing users to use digital currencies on their platform.

Tesla deliveries rose to a record high

Coming back to Tesla’s core automotive business, things are looking strong. The company delivered 184,800 electric cars in the first quarter of 2021 which was a new record despite the first quarter being seasonally weak for the company.

In the first quarter, Tesla started delivering China-made Model Y to customers. It began the deliveries of China-made Model 3 towards the end of 2019 and ramped up the deliveries last year. “We are encouraged by the strong reception of the Model Y in China and are quickly progressing to full production capacity,” said the company in its release.

As for Model S/X, the company is revamping the models. “The new Model S and Model X have also been exceptionally well received, with the new equipment installed and tested in Q1 and we are in the early stages of ramping production,” it said in the release.

Competition in the EV industry

Meanwhile, ahead of the EQS sedan from Mercedes Benz, Deutsche Bank has said that the brand could change its perception to “Tesla fighter.” Deutsche Bank analysts see it as a “game changer” and said that it “has the potential to change investors’ view of what (some) traditional automakers are capable of in this new EV world, supporting stock multiples.”

Volkswagen stock has already seen a valuation rerating as the company outlined aggressive plans for electric cars and wants to be the leader in the industry by 2025.

UBS is also bullish on Volkswagen and expects the automotive industry to be a two-horse race led by Tesla and Volkswagen. The company expects both Tesla and Volkswagen to deliver 1.2 million electric cars each in 2022.

“The analysis of the ID.3 shows that Volkswagen has developed a pure electric platform which is cutting-edge. This enables the group to offer attractive electric vehicles (BEVs) across the entire product range, and to achieve positive earnings (EBIT),” said UBS in its note as it raised Volkswagen’s target price.”

Volkswagen has already dethroned Tesla as the market leader in the European electric car market even as it was late to the party. It has also launched it’s ID.4 which would compete with Tesla models.

Can legacy automakers challenge Tesla?

Ford and General Motors are also doubling down on their electric vehicle plans. General Motors became the first Detroit automaker to publicly admit that it would sell only zero-emission cars by 2035 and called upon peers to step up their zero-emission vehicle plans.

“General Motors is joining governments and companies around the globe working to establish a safer, greener and better world,” said General Motors CEO Mary Barra said in a statement. She added, “We encourage others to follow suit and make a significant impact on our industry and on the economy as a whole.”

Ford would sell only zero-emission cars in Europe by the end of this decade. The company started delivering all-electric Mustang Mach-E to US customers late last year which is believed to be snatching market share from Tesla.

Lucid Motors

Apart from new models from legacy automakers, Tesla would also face competition from startup electric vehicle companies especially Lucid Motors which is led by a former Tesla engineer. While Lucid Motors is targeting the premium electric car market, to begin with it would soon pivot towards affordable models as Tesla did.

Competition is also intensifying in the Chinese electric vehicle market where domestic companies like NIO, BYD, XPeng Motors, and Li Auto compete with Tesla. Apple is also expected to launch its electric car by the middle of this decade.

Tesla stock in 2021

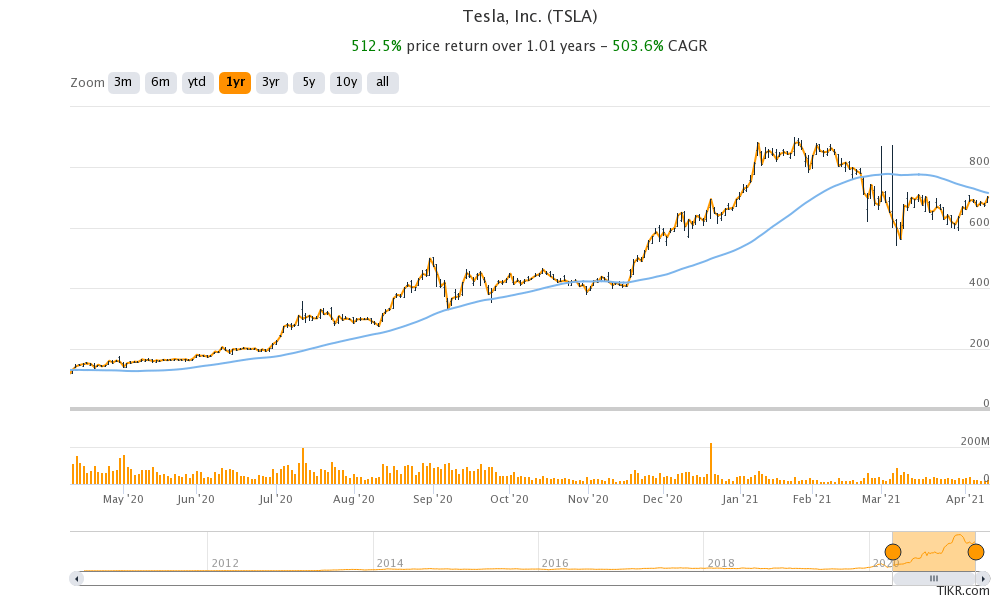

2020 was an incredible year not only for Tesla but for all the companies in the electric vehicle ecosystem. The stock rose 740% in 2020 while NIO gained over 1,100%. The S&P 500 also added Tesla to the prestigious index last year which helped bring some legitimacy to the company.

However, 2021 hasn’t been good for electric vehicle companies. While the year began on a positive note and Tesla stock made new record highs, it has since looked weak. It is now down 22% from its 52-week highs. There has been an even steeper fall in Chinese electric vehicle stocks like NIO, XPeng Motors, and Li Auto.

Meanwhile, Tesla stock has recovered from its recent lows. You can invest in electric vehicle stocks like Tesla through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account