Tesla has been raising prices for its electric cars amid a massive increase in input costs. Apart from higher input costs, automakers are also battling a severe chip shortage that is hurting production.

There has been cost-push inflation for automakers with prices of key raw materials like steel, copper, and aluminum rising. Steel prices are in the US are near their record highs while global copper prices have risen to a new record, breaching the previous record that they had hit in 2011. Also, as gas prices have risen, logistics costs have also gone up.

Automakers are grappling with higher input costs

The issue of rising input prices cropped up during leading automotive companies’ earnings calls. The rise in copper prices is especially negative for electric car companies as the copper intensity of electric cars is higher than that of traditional ICE (internal combustion engine cars).

According to a study from the International Copper Association, the average copper intensity in an ICE car is about 23 kilograms, while it’s 83 kilograms for a battery-electric vehicle. While that may not sound like much, it should be seen in the light of Tesla’s low profit margins.

Tesla profit margins

Despite making millions every quarter from the sales of carbon credit, Tesla’s net profit margin was only about 4% in the March quarter. Incidentally, if we remove the carbon credits and the $102 million gain that Tesla made on the sales of bitcoins in the quarter, the company actually would have posted a GAAP net loss in the quarter.

Meanwhile, over the last few years, Tesla has been gradually lowering car prices as its focus has been on increasing the adoption of electric vehicles. Electric cars are priced higher than comparative ICE cars even as over the lifecycle, the electric car can turn out to be cheaper. Electric cars have low running costs as compared to ICE cars and also have low maintenance.

Also, Tesla tries to keep the vehicle prices affordable and then tries to make revenues from other avenues like insurance and FSD (full self-driving). Earlier this year, it also lowered the price of Model Y in China which raised fears of a price war in the country.

Tesla raises car prices

However, the massive increase in input costs seems to have prompted Tesla to do a rethink of its strategy. The company has increased vehicle prices five times over the last few months and the company attributed it to higher input prices. “Prices increasing due to major supply chain price pressure industry-wide. Raw materials especially,” said Musk in a tweet in response to the price hikes.

It has also taken some other cost-cutting initiatives and has done away with the lumbar support in Tesla Model Y. According to Musk, “Moving lumbar was removed only in front passenger seat of 3/Y (obv not there in rear seats). Logs showed almost no usage. Not worth cost/mass for everyone when almost never used.”

Global chip shortage

Meanwhile, apart from the higher costs for materials and logistics, there is a severe chip shortage also. During their first-quarter earnings call, Tesla also alluded to the chip shortage situation. Ford is among the worst affected by the shortage as a fire at a supplier’s facility has amplified the company’s problems.

Ford

Ford expects to lose half of its second-quarter production after having lost 17% of the first quarter production due to the chip shortage. The company expects things to get better in the second half of the year but is still forecasting a 10% production loss.

According to consulting firm AlixPartners, the global automotive industry would lose $60.6 billion in revenues in 2021 due to the chip shortage. Apart from the automotive industry, while goods, gaming, and smartphone companies are also grappling with the chip shortage.

Meanwhile, the chip shortage has also been a boon for many chip companies. The Auto and power unit of STMicroelectronics NV reported a 280% increase in first-quarter profits.

The chip shortage is expected to persist at least for the new few quarters. “The second quarter is going to be worse for automakers than the first quarter,” said Song Sun-jae, an analyst at Hana Daetoo Securities Co. in Seoul. He added, “The chip-shortage problem could end up lasting longer, maybe into next year.

Tesla contemplating advance payment for chips

Tesla meanwhile is reported to be contemplating paying in advance for the chips. The company is flush with cash after it raised $13 billion through three rounds of stock issuance in 2020. Also, there are rumors that the company might buy a chip plant even as it could be a complicated exercise and might not bode well for the company’s valuation multiples.

Tesla is also planning to set a factory in Russia Musk recently said. The company is also rumored to be looking at a manufacturing facility in the UK.

Tesla stopped accepting bitcoins

Tesla has been in the news over the last month due to Musk’s views on cryptocurrencies. Last month the Musk said that Tesla would no longer accept bitcoins as payments. He said that the electric vehicle maker has “suspended vehicle purchases using Bitcoin” as the company is “concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

Elon Musk

Musk added, “Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment. Tesla will not be selling any Bitcoin and we intend to use it for transactions as soon as mining transitions to more sustainable energy. We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

Tesla will not sell bitcoins

However, he later said that Tesla does not intend to sell the bitcoins that it is holding. Musk has instead embraced dogecoins and also started accepting that as payment on his privately held SpaceX. He also held a Twitter poll on whether Tesla should also accept dogecoins.

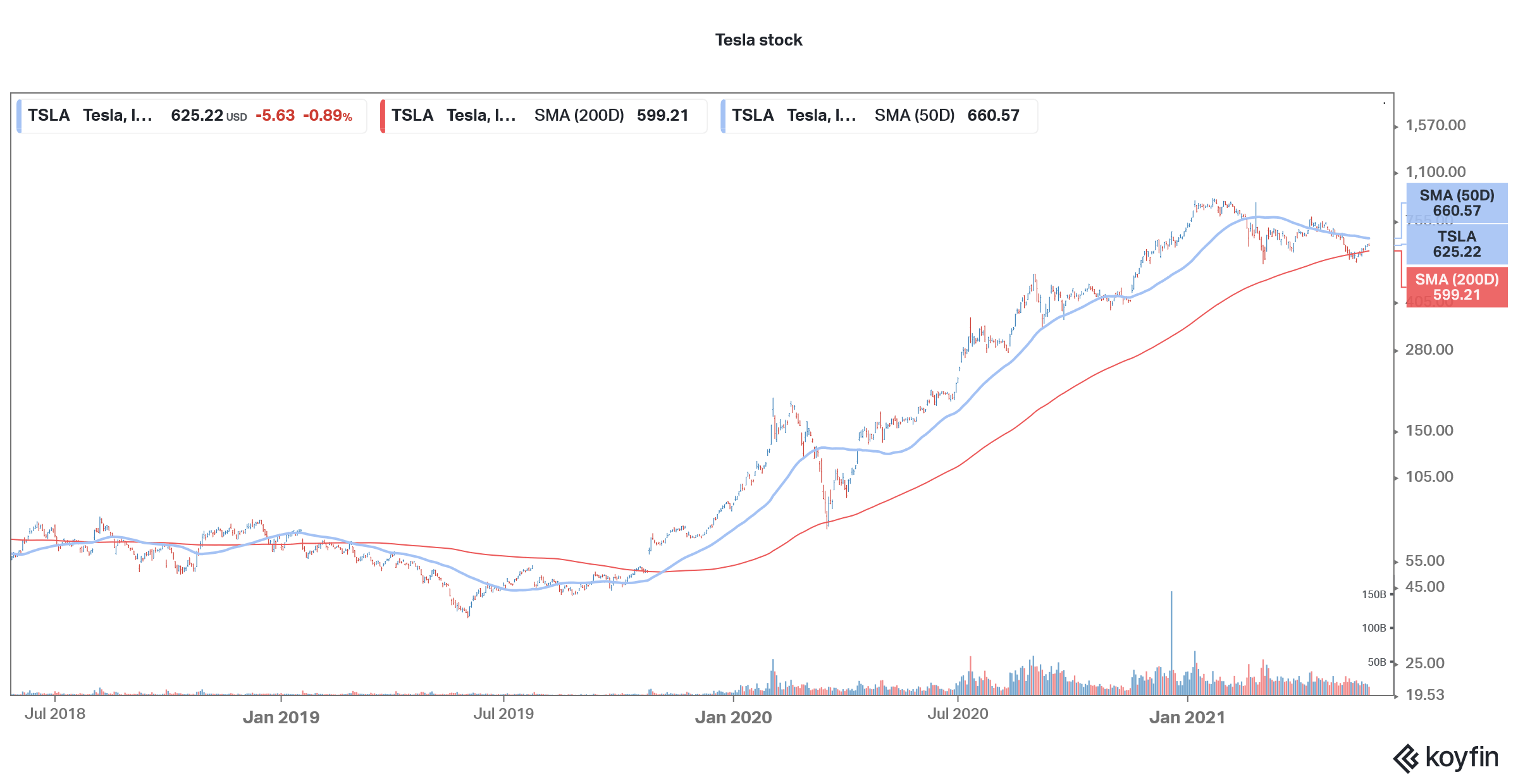

Tesla stock is now down sharply from the peaks. While valuation purists would find the still unattractive even now, some investors might see the fall as an opportunity to do some bottom fishing in the stock.

You can trade in Tesla stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account