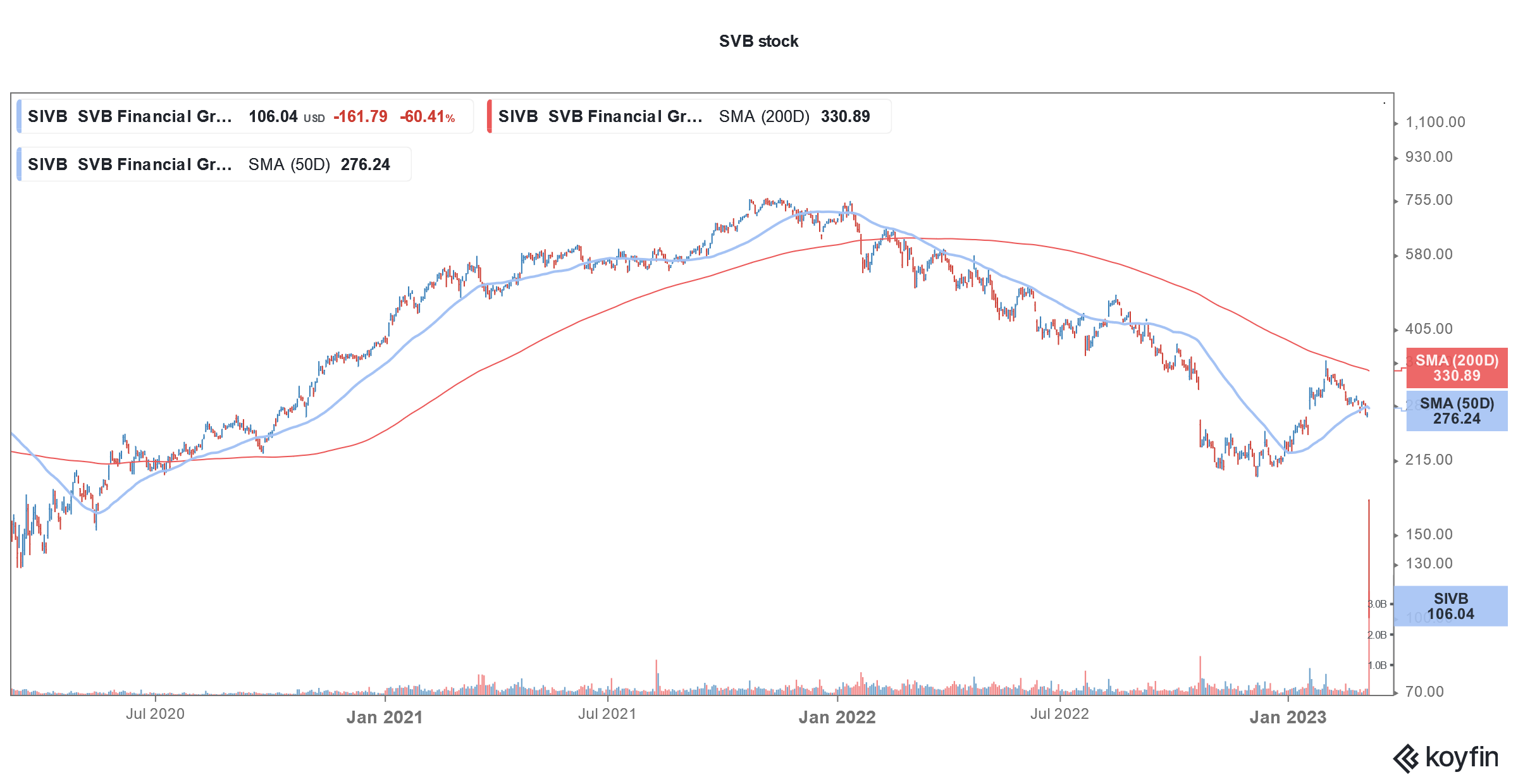

SVB Financial (NYSE: SIVB) stock fell over 60% yesterday and had its worst performance since its 1987 listing. The stock is down sharply in aftermarkets today after it announced a fire sale of bonds.

In a mid-quarter update yesterday, SVB said that it has sold all of its AFS (available for sale) securities valued at $21 billion. The transaction would lead to a post-tax loss of $1.8 billion. Notably, US interest rates have spiked over the last year. Bond prices are inversely related to the yields and as a result bond prices have fallen sharply since the Fed started its monetary policy tightening in 2022.

In its securities filing, SVB said that it held mostly US Treasury as part of its AFS portfolio. It had another $90 billion in held-to-maturity securities.

SVB Financial stock falls after the fire sale of bonds

In its release, SVN said, “The sale of substantially all of our AFS securities will enable us to increase our asset sensitivity, partially lock in funding costs, better insulate net interest income (NII) and net interest margin (NIM) from the impact of higher interest rates, and enhance profitability.”

The company would invest the proceeds ‘into a more asset-sensitive, short-term AFS Portfolio.” SVB said that while the transaction would lead to a one-time loss, it would be immediately accretive to its NII and NIMs and would have a payback period of around three years. The company expects an annual post-tax improvement of $450 million in its NII as a result of its actions.

SVB also announced a capital raise

SVB also announced that it would increase its term borrowings by $15 billion to $30 billion. It added, “We expect these actions to better support earnings in a higher-for-longer rate environment, providing the flexibility to support our business, including funding loans, while delivering improved returns for shareholders.”

SVB also announced a $2.25 billion capital raise. Of this, it would raise around $1.75 billion in a mix of stock and mandatory convertible preferred stocks. General Atlantic has also committed another $500 million at the same terms as its stock offering.

Tech and venture capital slowdown took a toll on SVB

In its letter, SVB said, “While VC deployment has tracked our expectations, client cash burn has remained elevated and increased further in February, resulting in lower deposits than forecasted.”

The company also lowered its Q1 2023 guidance and expects an NII of between $880 million to $900 million. Previously, the company forecast NII between $925 million-$955 million.

It also warned of a credit rating downgrade as a result of these actions. In the presentation, SVB said, “We have been in dialogue with Moody’s, who we understand are in the process of considering potential ratings actions with respect to SVB, which could include a negative outlook, a downgrade of one or potentially two notches and/or placing our ratings on review for such a downgrade.”

It added that it is “possible” that S&P also takes an action on SVB’s credit ratings.

Bank stocks crashed yesterday

SVB stock plummeted yesterday and its market cap is now just above $6 billion. The fallout from SVB’s selloff was visible in other bank stocks also. While Bank of America fell 6.2%, JPMorgan Chase also lost 5.4%. The broader US markets also crashed and the tech-heavy Nasdaq Composite lost 2.05%. The S&P 500 and Dow Jones respectively fell 1.85% and 1.66%.

Powell’s testimony took a toll on US stocks

The SVB saga comes after Fed chair Jerome Powell’s Congressional testimony where he talked about the possibility of interest rates rising higher than previously envisioned.

In his prepared remarks for the Congressional testimony, Powell said, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

In his remarks, Powell said, “Although inflation has been moderating in recent months, the process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy.”

He reiterated his previous stance and said that the Fed would be data-dependent. In his Congressional testimony, Powell said, “We will continue to make our decisions meeting by meeting, taking into account the totality of incoming data and their implications for the outlook for economic activity and inflation.”

Startup tech companies have been in trouble

Higher interest rates have worked to the nemesis of tech companies in particular which is the target audience for SVB. Tech companies, especially in the startup space, have been facing trouble raising money both through public markets as well as through venture capital financing.

SVB has been trying to assure clients

Reuters reported that sources said that SVB’s CEO Greg Becker has been calling clients to assure them of the safety of their money in the bank. However, some startups have been pulling out their funds from the bank.

In its letter, SVB said, “Our conversations with clients give us confidence that activity will accelerate when entrepreneurs reset expectations on valuations, cash burn normalizes, and the public markets and interest rates both stabilize. At that point – when we see a return to balance between venture investment and cash burn –we will be well positioned to accelerate growth and profitability.”

However, despite the commentary, markets seem concerned over SVB’s health as is visible in yesterday’s price action.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account