The British FTSE 100 index is attempting to cross the 7,000 mark for a second time this week led by stocks in the most virus-battered sector including financials, consumer cyclical, energy, and industrials.

The index has failed to settle above this level in the three previous stock trading sessions primarily due to the weak performance of the American stock market. However, today could be the day for the FTSE 100 to finally break above this psychological resistance as traders keep believing that the country is ready to emerge from the economic slump caused by the virus.

A weaker pound has aided the advance of the FTSE 100 lately, as even though the British currency continues to trade near its recent two-year high, it has retreated a bit to give the British stock index a breather.

Just yesterday, the widely-followed Purchasing Managers Index (PMI) compiled by IHS Markit for the country’s manufacturing sector was released, displaying a 60.9 reading for April – the highest in the past 321 months.

This reading surpassed analysts’ estimates of 60.7 for the month and indicates the strength of the recovery and the positive sentiment coming from corporate executives in regards to the future.

According to the press release, two-thirds of the companies surveyed indicated that they believe their output will be higher a year from now. Meanwhile, the report revealed that confidence is at the highest levels in the past seven years with most of that optimism coming from expectations that the disruptions caused by COVID-19 and Brexit will be milder than expected moving forward.

Meanwhile, inflation has emerged as one of the primary concerns among corporations, with the report pointing to worries in regards to rising commodity prices and supply chain disruptions.

So far this morning, the FTSE 100 is reacting positively to news on the economic front, with the index advancing 1.2% at 7,005 after slipping 0.67% yesterday. Other European indexes including the German DAX and the French CAC 40 index are also up 1.4% and 0.9% respectively as positive sentiment is spreading across Europe on the back of faster deployment of vaccines in the continent.

Shares of Tailor Wimpey (TW), HSBC (HSBA), and Sainsbury (SBRY) are leading the index higher with gains above 2% while Anglo American (AAL) is emerging as the indisputable winner this morning as it is advancing 4.1% at $3204p per share.

The market will be keeping an eye on the upcoming readings of the Composite PMI and Services PMI for the country, which are scheduled to be released tomorrow. Moreover, the Bank of England’s Monetary Policy Committee will be meeting on Thursday as well, with the consensus being that the central bank will hold the benchmark interest rate unchanged at 0.10%.

Moreover, the size of the bank’s quantitative easing program should also remain unchanged at £895 billion. Any meaningful changes to those policies or views about the future that reveal potential modifications to the status quo could affect the course of the FTSE 100 index moving forward.

What’s next for the FTSE 100 index?

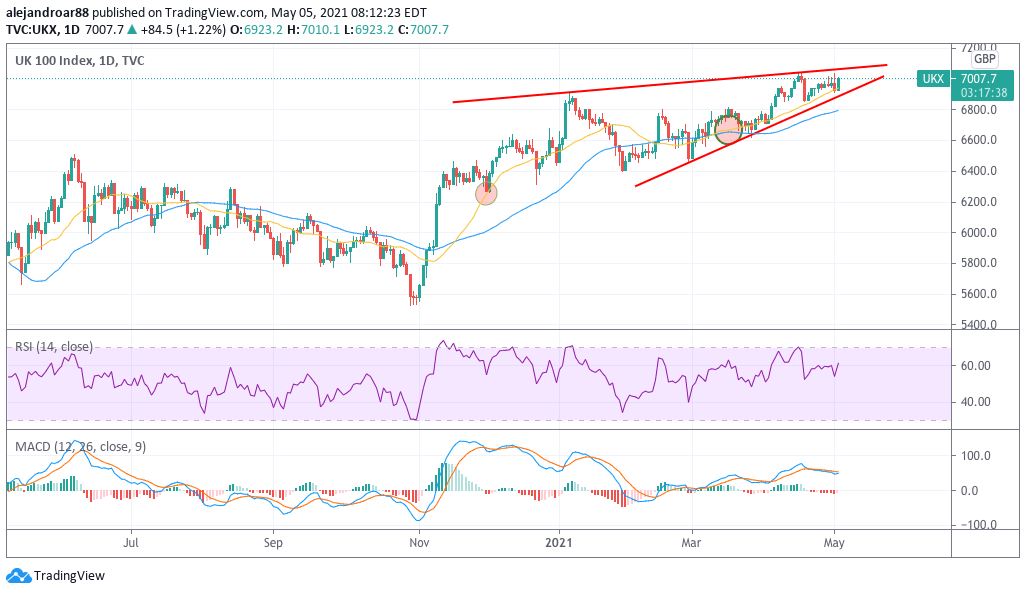

The latest price action in the ‘footsie’ indicates that the index could be about to break past that 7,000 marker for good, as a series of higher lows and higher highs are pointing in that direction.

Reinforcing this view, we can see that the RSI is in positive momentum territory while there was also a golden cross in the index’s short-term moving averages a few weeks ago. Since then, the 20-day MA has been serving as support, which points to the fact that traders are ready to ride the uptrend as it continues to unfold.

Based on the positive economic catalysts outlined above and the current technical setup, chances are that the FTSE 100 will soon break above that 7,000 threshold, with a first target set at 7,250 based on a Fibonacci extension.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account