Commercial real estate giant Simon Property Group is seeking to raise $2bn in corporate bonds from investors to roll forward two bonds set to mature this year and to further strengthen the company’s balance sheet amid the pandemic.

The $2bn bond issue will be divided into three tranches consisting of a 3.5% senior note due in 2025, a 2.65% bond due in 2030, and a 3.8% note due in June 2050.

The proceeds from the sale will be used to repay two bonds with a combined aggregate principal of $875 million that are set to mature in September and October 2020, while the remaining funds will be employed to strengthen Simon’s balance sheet.

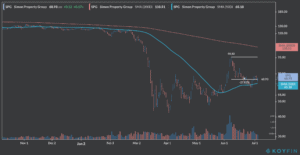

Simon Property Group (SPG) shares seem to have taken foothold in the company’s 50-day moving average of $65 per share after losing nearly 28% since their post-pandemic peak of $95.5 in early June.

As of this morning, shares of the Indianapolis-based commercial real estate investment group are trading at $68 on pre-market stock trading activity, down 1.3% from yesterday’s closing price of $68.9.

Simon provided an update on the situation of its real estate properties on late May when the company said that around 95% of its properties had successfully reopened, while also pointing to a strong liquidity position comprised of $3.5bn in cash on hand and nearly $5bn in revolving credit facilities available.

However, a recent spike in virus cases in the United States has raised concerns about another wave of lockdowns that could again threaten the financial stability of retail establishments and their ability to pay rent.

Some of the most affected states in the country like Texas, Florida, and Arizona already decided to put a pause on their reopening efforts after virus cases and hospitalizations started to surge, which could end up pushing Simon’s stock price down even further.

Meanwhile, the company recently decided to terminate a merger with Taubman Centers, another real estate investment trust, after saying that the company had breached some of its obligations under the merger agreement including failing to cut its operating expenses and capital expenditures amid the pandemic.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account