Chinese e-commerce giant Alibaba would release its fiscal fourth-quarter 2021 earnings later this week. What to expect from the company’s quarterly report and should you buy the stock before the earnings release.

Alibaba would report its fiscal fourth-quarter 2021 earnings for the quarter ended in March on Thursday before the US markets open. Analysts polled by TIKR expect the company’s revenues to rise 74.1% to $27.9 billion in the quarter. While the expected topline growth is impressive it should be read with the tepid growth in the corresponding quarter in 2020.

Alibaba earnings estimates

Alibaba’s revenues had increased only about 18% year-over-year in the first quarter of 2020 as the COVID-19 pandemic had hit the Chinese market in that quarter. It was the lowest revenue growth rate for Alibaba since it went public in 2016 in what was the biggest IPO of all time. Analysts expect Alibaba’s adjusted EPS to rise 42% year-over-year to $1.83 in the March quarter.

Notably, Alibaba is growing at a faster pace than Amazon. However, it has underperformed Amazon over the last year by a wide margin. Also, while e-commerce companies have skyrocketed, Alibaba stock is up only about 15% over the last year. The anomaly could be attributed to China’s crackdown on its tech giants, especially against Alibaba.

China imposes fine on Alibaba backed company

In the most recent salvo, China’s State Administration for Market Regulation (SAMR) has imposed a fine of 2.5 million yuan on Alibaba-backed online education company Zuoyebang. A similar fine has been imposed on Tencent-backed Yuanfudao. The companies have been fined for misleading claims and fake reviews. Both accepted the penalties and agreed to sort out the problems cited by the regulator.

China slapped a massive fine on Alibaba

Last month, China slapped a $2.8 billion fine on Alibaba in the antitrust probe. The company was accused of using its market dominance to pressure merchants to choose one platform. A merchant selling on Alibaba was not allowed to sell on other platforms.

SAMR called the practice anti-competitive and said that it “infringes on the businesses of merchants on the platforms and the legitimate rights and interests of consumers.”

China’s antitrust probe

The fine is 4% of Alibaba’s 2019 revenues and the company would have to file a self-compliance report with the SAMR for three years. Meanwhile, the company accepted the verdict. “Alibaba would not have achieved our growth without sound government regulation and service, and the critical oversight, tolerance and support from all of our constituencies have been crucial to our development,” said the company. But then, companies in the communist country have few options when indicted by regulators.

In fact, Alibaba’s troubles with the Chinese regulators started when its co-founder Jack Ma criticized them. Ma had called Chinese banks “pawn shops” in a speech. He also said, “As the Chinese like to say, if you borrow 100,000 yuan from the bank, you are a bit scared; if you borrow a million yuan, both you and the bank are a little nervous; but if you take a 1 billion yuan loan, you are not scared at all, the bank is.” Ma was also missing for weeks amid the crackdown by Chinese regulators.

Ant Financial IPO

China also blocked the IPO of Ant Financial which is backed by Alibaba. The IPO attracted bids worth over $3 trillion and was set to list in Shanghai and Hong Kong. The company gave US markets a miss amid the new regulations that could lead to the delisting of foreign companies in the US if they don’t comply with the regulations. While the regulations were country neutral one need not be a financial wizard to understand that they are targeted specifically against China.

Earlier this year, there were reports that suggested that China was set to clear the Ant Financial IPO. However, there hasn’t been any forward movement for the IPO so far.

What to watch in Alibaba’s earnings call?

Alibaba’s cloud operations turned EBITDA positive in the previous quarter and it would be interesting to see how much the performance improves in the quarter. Also, the company might face questions on the crackdown by China and the timeline for Ant Financial IPO.

Alibaba target price

Alibaba has a median target price of $319.72 according to the estimates compiled by CNN Business. This implies a potential upside of 42% over the next 12 months. The stock’s lowest target price of $265.11 is a premium of 17.6% while the highest target price of $393.45 is almost 75% higher than the current stock price.

Of the 56 analysts covering Alibaba stock, only one has a hold rating while the remaining 55 rate it as a buy or higher. None of the analysts has a sell rating.

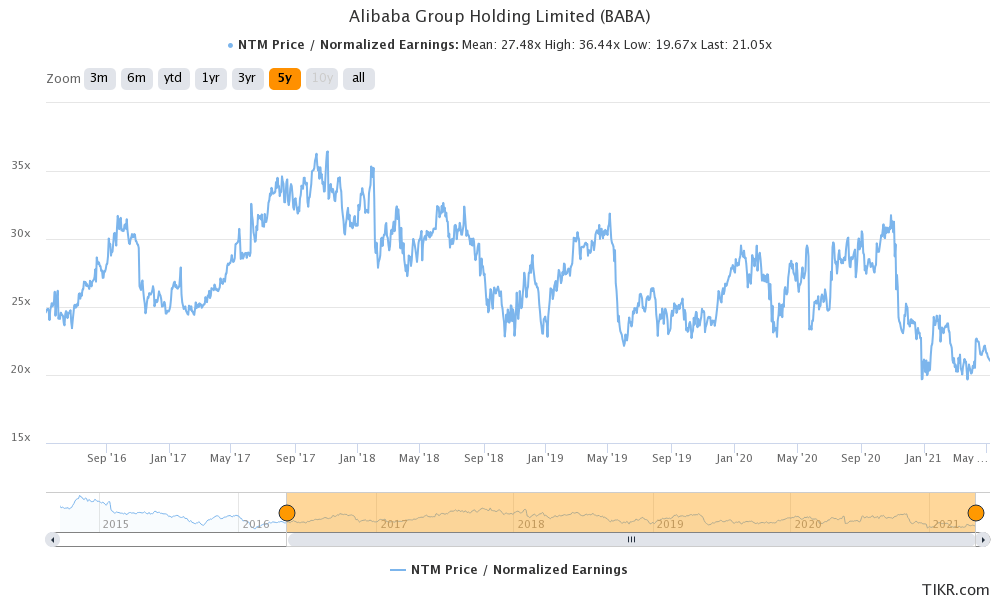

Analysts seem bullish on the stock considering its high growth and tepid valuations. The stock trades at an NTM (next-12 months) PE multiple of 21x. The multiples have averaged 27.5x over the last five years.

That said, given China’s continued crackdown on tech stocks, Alibaba stock has been trading at depressed valuations. If the company can settle the issues with regulators, it could offer good returns to investors.

There are several ways to trade and invest in Chinese companies. Some of the brokers let you trade in Chinese market stocks. Since Alibaba trades on the US markets, you can buy it with any of the best online stock brokers

You can also invest in the Chinese market indices through binary options. There is a list of some of the best binary options brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account