The price of Brent crude futures approached its highest level in nearly 22 months as tensions in the Middle East continue to rise after a missile from Yemeni rebel forces hit multiple oil infrastructures in Saudi Arabia.

The attack targeted an oil storage compound located at Ras Tanura – the world’s largest oil loading facility – yet the country’s energy minister Abdulaziz bin Salman Al Saud emphasized that there were no casualties while no properties were damaged as a result of the strike.

Meanwhile, the United States diplomatic mission in the kingdom has alerted US citizens about potential attacks in the Dharhran, Dammam, and Khobar areas, all of which are located in the Eastern Province of the country – the home of most of the country’s crude production and exporting infrastructure.

These rising tensions between Saudi Arabia – the world’s largest oil producer – and Yemen amid the country’s intervention in the civil war that is taking place in the aforementioned country pushed the price of Brent crude futures above the $71 level for the first time in 22 months during early commodity trading action, although the move lost its steam later with the benchmark now seeing a milder 0.14% gain at $69.46 per barrel.

A total of 14 drones and eight ballistic missiles were deployed by Houthi forces as part of a “broad joint offensive operation” that targeted strategic military and oil infrastructure within the kingdom as retaliation for the kingdom’s continuous intervention.

A spokesman for the rebels commented on his official Twitter (TWTR) account: “We promise the #Saudi regime painful operations as long as it continues its aggression and blockade on our country”.

What’s next for Brent crude futures?

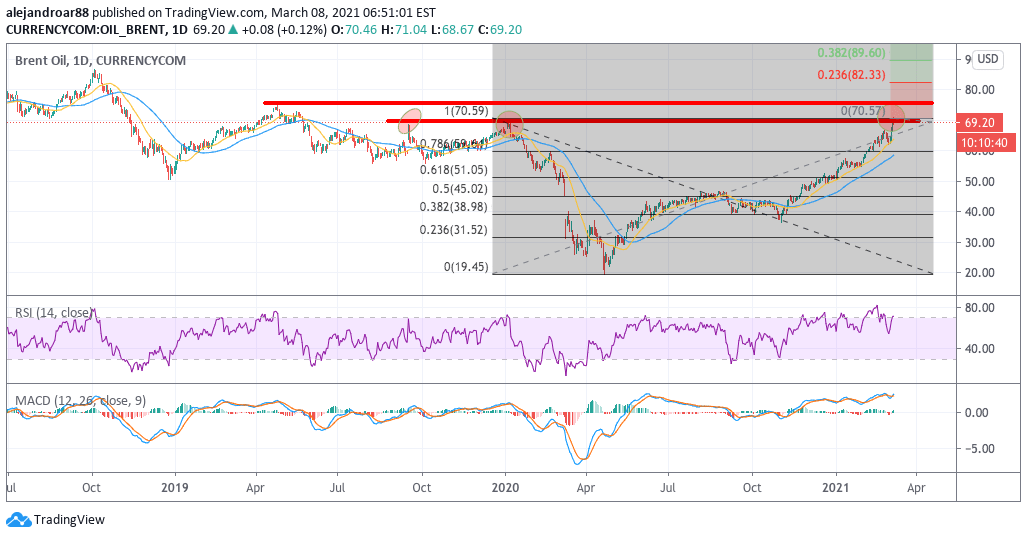

Today is the first time that Brent crude futures move above their pre-pandemic levels and even though the uptrend lost momentum in intraday action this move is opening the door for either the continuation of the current uptrend or for a sharp pullback as market participants could take some profits off the table.

At this point, we have both the RSI and the MACD sitting at heavily stretched levels, which increases downside risks, while this would be the third tag of this particular resistance in the past 18 months at least, which reinforces the thesis that Brent crude prices could be heading to break this threshold in short notice.

If a pullback were to take place, a 10% correction would result in a plunge to the $63 level. After that happens, a bullish thesis could see the price ripping above the $70 mark in the next few weeks on the back of OPEC’s recent decision to prolong cuts along with the progressive rollout of COVID vaccines in the developed world.

If that were to happen, a first short-term target for oil could be set at $75 per barrel, representing an 8.6% upside potential based on today’s prices.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account