The pound sterling is diving this morning in early forex trading activity as Brexit talks have stalled during the weekend, increasing the risk of a no-deal scenario as the December due date approaches.

The British currency is losing over 1% against most major currencies, with the GBP/USD pair leading today’s downtick as the pound is retreating 1.3% against the greenback at 1.3261 while also losing 1.15% against the euro at 1.0953.

This would be the worst single-day loss for the pound against both currencies since 10 September and it would mark a reversal from the latest rally, which pushed the value of the British currency above the 1.35 mark for the first time since the pandemic started.

Today’s downtick is being driven by a stalemate seen in the negotiations between the United Kingdom and the European Commission in regards to the Kingdom’s exit from the economic block, as the parties failed to reach an agreement over the weekend on matters including fishery, competition rules, and governance.

Although the media reported earlier this morning that some advance has been made in the topic of fisheries, the EU top negotiator later denied the news, while a meeting between UK’s Prime Minister Boris Johnson and EU President Ursula Von der Leyen on Saturday proved unproductive as the head of the economic block said that “differences remain”, while adding that no agreement was “feasible if these [differences] are not resolved”.

Traders reacted negatively to the news by selling off the pound, as the due date for negotiations approaches, which increases the risk of a no-deal Brexit.

The timetable for Brexit talks is very tight at this point, with the 10-11 December EU Summit being a key moment for talks as failing to secure a deal by then could implicitly end up pushing the UK to a messy exit out of the European economic block.

That said, the actual due date for a deal could be prolonged to 17 December, which is the last day in which the European Parliament is scheduled to meet this year.

Failing to strike a deal would have a big impact on exporters on both sides of the border since tariffs will immediately be increased, while the day-to-day operations of border-control agencies might be disrupted as both governments struggle to quickly respond to the changes in their respective legislations.

Where is the pound sterling headed from here?

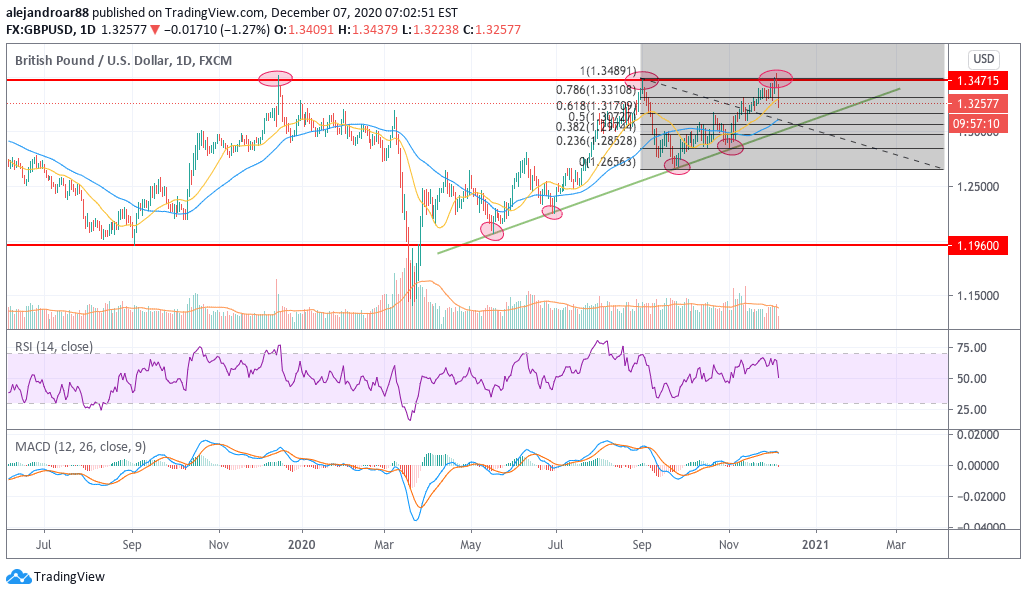

A look at the daily charts shows that today’s plunge in the pound sterling comes right after a rejection of a push above the 1.35 mark – which has remained a strong threshold for the British currency since the late 2019s as the risk of a no-deal Brexit have kept capping its advance.

At this point, and given how difficult the situation seems and how close we are to the due dates, today’s downtick could be just be beginning of a bigger drop unless the negotiations suddenly take a U-turn.

The chart shows how the price action has already broken below the 61.8% Fibonacci retracement level, with the 1.307 mark now potentially in sight if bears remain in control during the next sessions.

Meanwhile, if negotiations remain stalled over the next few days, it would be plausible to see the British currency diving below the 1.30 level – the trend line support – and things could get even uglier if that threshold is broken.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account