The price of gold has moved below the psychological $1,900 per ounce level in the past few days but UBS seems to think that the yellow metal is likely to surge to $2,000 by the end of the year on the back of a positive backdrop.

Kelvin Tay, Regional Chief Investment Officer for the Swiss bank, told CNBC earlier today that UBS is long on gold due to the uncertainty created by both the upcoming US election and the COVID-19 pandemic, with investors likely to seek refuge in the yellow metal as a hedge against a potential market downturn.

“In (the) event of uncertainty over the U.S. election and the Covid-19 pandemic, gold is a very, very good hedge. And its recent weakness represents a great entry point for investors”, said Tay.

Tail risks and low interest rates likely to drive gold higher

UBS comments appear to support the thesis that tail risks continue to provide support to the price of gold, which remains muted during the European commodity trading session at $1,900 per ounce, advancing 0.04% on the back of a weaker US dollar.

Some of those risks would include a negative development on the health situation of US President Donald Trump – who recently tested positive for COVID-19 – ahead of the election and a potential second wave of lockdowns in Europe, while other elements like a global low interest rate environment and more stimulus coming from US Congress continue to create a floor for gold prices.

The favorable backdrop makes the current drop in the price of the precious metal a potential buying opportunity for investors, while technical indicators seem to suggest that a short-term jump may be ahead as well.

Gold’s price action shows a bullish pattern in the making

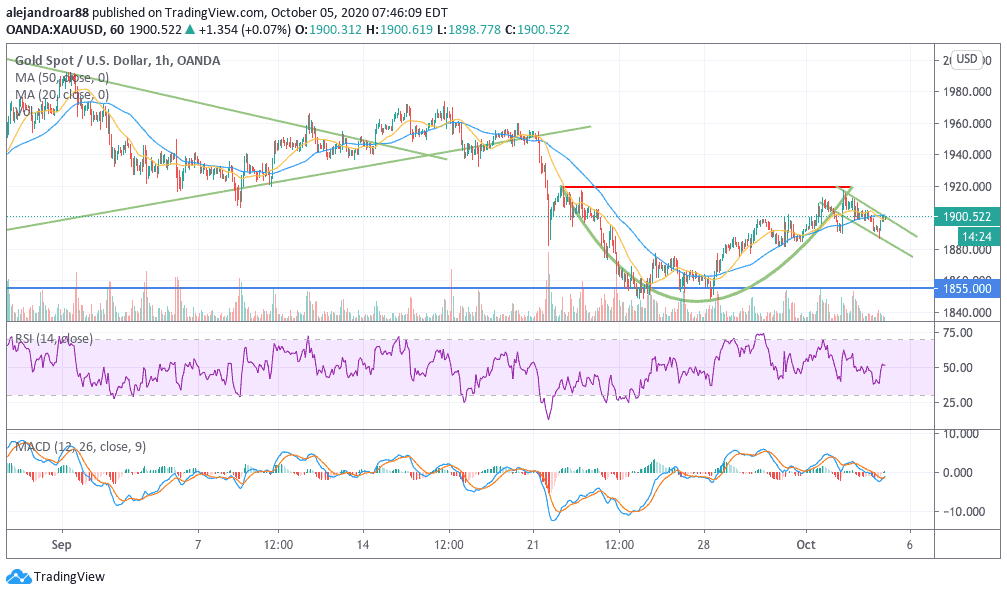

The latest price action seen by gold since 21 September seems to be forming a cup and handle pattern – a bullish formation that could lead to a break above the $1,980 if the pattern is confirmed.

Confirmation would be provided if the price surges above the handle in the next few sessions, a situation that should be accompanied by higher trading volumes.

Meanwhile, traders should keep their stop-losses on a short leash, as the recent bullishness seen in the US dollar combined with a risk-on attitude from investors could continue to depress gold prices below the $1,850 level.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account