Household goods giant Procter & Gamble (PG) saw sales surges as shoppers stockpiled toilet paper and cleaning products as a result of being lockdown by the coronavirus outbreak.

The Cincinnati-based group said organic sales jumped 10% in the US and 6% across western Europe as consumers bought more of its brands such as Charmin toilet paper and Safeguard soap while government restrictions forced them to stay at home.

Chief executive David Taylor (pictured) said: “The strong results we delivered this quarter are a direct reflection of the integral role our products play in meeting the daily health, hygiene and cleaning needs of consumers around the world”.

Overall, P&G said net sales in its third quarter to the end of March lifted 5% to $17.2bn. Net income came in at $2.96bn, a rise of 7% and equivalent to diluted earnings per share of $1.12.

The group said its sales in the US, the highest in decades, were partially offset by an 8% drop China, where the virus first emerged in December.

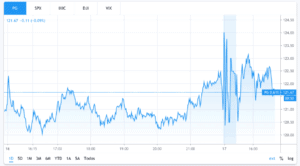

P&G shares rose as much as 1.4% to $123.23 during Friday stock trading activity in New York. The group’s stock has slid 2.7% this year, well ahead of the 13% decline across the S&P 500. Rival Kimberly Clark, the maker of Cottonelle and Kleenex, is up 2.2% this year.

Procter & Gamble is one of the largest consumer goods manufacturers in the world and the owner of a range of personal and household care brands such as Crest, Dash, Tide, Pampers, and Gillette. The company has a presence in almost 100 countries and employs around 138,000 people.

P&G maintained its full-year 2020 adjusted sales guidance, which predicts a 3% to 4% growth in global sales, down from 5% it previously expected, as a result of “stronger headwinds from foreign exchange”.

Meanwhile, the maker of Pampers diapers and Gillette razors also maintained its full-year forecast for per-share profit gains, excluding some items, of 8% to 11%.

You can buy shares of Procter & Gamble through a stock broker or you can also trade CFDs that track the price of P&G shares.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account