The price of Pfizer shares moved higher yesterday while it is also on the way up in early pre-market stock trading action today after the company posted strong financial results during the first quarter of the year resulting from higher revenues from its vaccine segment.

The American pharmaceutical giant reported revenues of $14.58 billion during the three months ended on March 31 which results in a 45% jump compared to a year ago. Meanwhile, excluding the revenues added by Pfizer’s COVID-19 vaccine, revenues grew only 8%, which means that the firm brought in around $3.7 billion during the period via COVID vaccine sales.

The vaccine segment as a whole experienced the strongest growth during the quarter, moving from $1.6 billion in 2020 to $4.9 billion this year. That said, the company’s oncology, internal medicine, and hospital streams posted low double-digit growth as well. Pfizer’s first-quarter revenues topped analysts’ estimates of $13.51 billion.

Meanwhile, the company reported GAAP diluted earnings per share of $0.86 and adjusted diluted EPS of $0.93, also surpassing analysts’ estimates of 77 cents for the quarter while resulting in a 47% expansion compared to the same period last year.

As a result of stronger-than-expected vaccine revenues, the management team lifted its revenue guidance for the full 2021 fiscal year to a range between $70.5 and $72.5 billion while adjusted EPS are expected to land between $3.55 and $3.65. This would result in a significant improvement compared to 2020 figures as revenues ended last year at $41.9 billion while adjusted EPS landed at $2.22 per share.

Pfizer (PFE) stated that it plans to deliver a total of 1.6 billion doses of its BNT162b2 COVID vaccine this year under contracts it has signed through mid-April 2021. However, the company stated that this guidance may be modified if more contracts are signed in the following months.

The New York-based pharmaceutical firm further stated that it has not executed share buybacks during this year even though it still has a total of $5.3 billion authorized funds for the program. The management’s guidance assumes that no buybacks will be performed for what remains of the year either.

The company also announced that it plans to obtain full approval from the Federal Drug Administration (FDA) for its COVID vaccine. This would allow Pfizer to sell the vaccine directly to consumers.

What’s next for Pfizer?

The US stock market is reacting quite positively to today’s financial report with shares jumping 1.6% in pre-market action after surging 3% yesterday at $39.8 per share.

Based on the company’s full-year guidance, at the indicated opening price of $40.45, Pfizer is being valued at around 11 times this year’s forecasted earnings per share (EPS) which is a fairly conservative valuation for a company that could reap the benefits of developing one of the most effective COVID vaccines for years.

Analysts estimates for the subsequent years show that the market is expecting a deceleration in earnings after 2021, with adjusted EPS landing at $3.1 and $3.18 per share on 2022 and 2023 respectively, according to data from Koyfin.

Pfizer is a conservatively financed company and one that produces a strong stream of $10 billion or more in free cash flows every year. Based on the firm’s historical performance and the management’s guidance, free cash flows could land above $20 billion this year, which would put the company’s valuation at around 10 times its annual FCF.

By all means, the valuation seems fairly conservative and the dividend yield of 4% seems safe and attractive based on these forecasts and current market conditions.

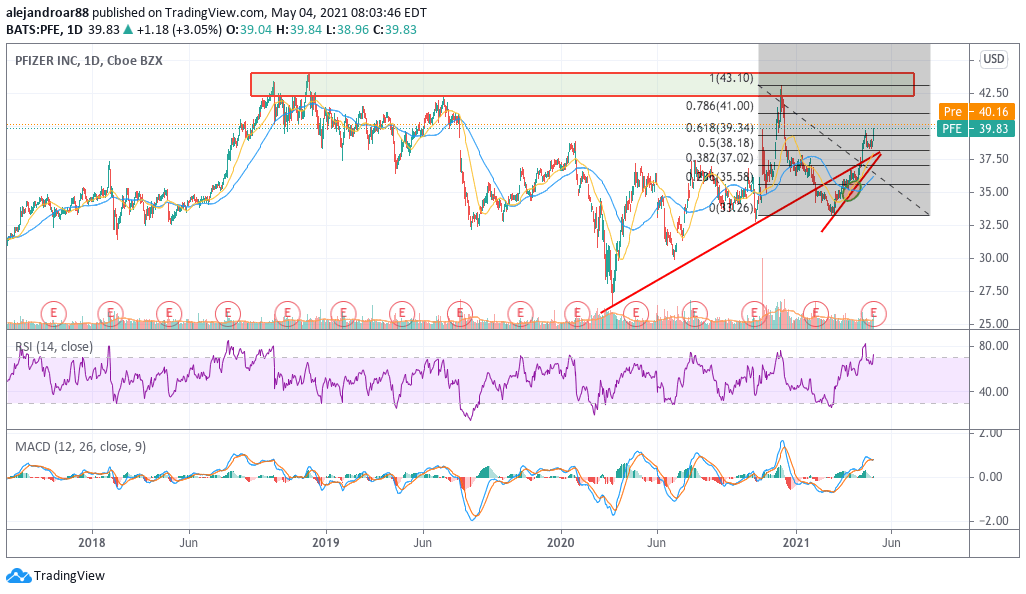

Meanwhile, from a technical standpoint, Pfizer shares seem to have reversed a previous trend line break and could be heading to a first target of $43 on short notice as these positive results could lift’s the market’s sentiment toward the company.

This view is reinforced by the RSI and is also supported by a golden cross in the stock’s short-term moving averages that occurred in late March.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account