Grupeer Review 2020 | Features And Benefits | LearnBonds

Investors have started moving a portion of their investment portfolio’s towards P2P lending amid higher yields and diversification.  The higher level of security in the form of buyback guarantees and the availability of multiple alternative assets has been adding to investors sentiments. These platforms have made it easier for small businesses to raise funds while opening alternative investment opportunities to retail investors – which were previously only available to big investors.

The higher level of security in the form of buyback guarantees and the availability of multiple alternative assets has been adding to investors sentiments. These platforms have made it easier for small businesses to raise funds while opening alternative investment opportunities to retail investors – which were previously only available to big investors.

However, it’s essential to understand that every investment carries risk. In the case of P2P lending, 75% of the risks are related to what platform you are choosing for investment purpose. This is because the P2P lending industry is immature and requires more regulatory concentration. Therefore, choosing the right platform for P2P lending is significantly important.

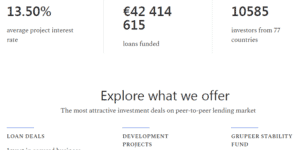

To help you with that – we review Grupeer, which is among the most popular peer to peer lending platforms.

What is Grupeer?

Grupeer is an online P2P lending platform that connects the borrower with lenders. The platform is different from others because its management carefully evaluates each loan and developments project to gauge the risk factors and potential returns. The platform claims that an investor can earn a 14% return on invested capital.

What are the Pros And Cons of Grupeer?

Pros:

✅High-interest rates

✅A large number of available loans

✅Automatic investing available

✅Only collateral backed loans (business or property)

Cons:

❌ High risk

❌ No secondary market or sell back (early exit)

❌ Only indirect investment structure

How Grupeer Works?

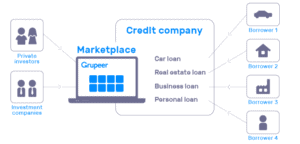

Grupeer connects the borrower with lenders. It mainly provides investment opportunity in business and real estate loans with the potential yield in the range of 10% and 15% annually. They are offering numerous investment options; the platform also permits an investor to take their own decisions according to their investment criteria.

They also don’t offer long-term loans; the management only selects loans that mature within three years. Its experienced strategic management team of bankers, financial experts, marketing gurus, real estate professionals, and IT developers closely evaluate each loan before listing it on website. The investors can also invest in the already issued loan. All loans are secured by collaterals as well. Investments in development projects are available on this platform.

It has also developed auto investment feature and stability funds to offer a steady stream of income to investors – who don’t have extensive time for evaluating each investment offers listed on the website.

What is Account Opening Process?

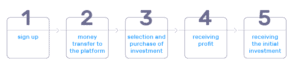

Account Opening Process

- Step 1: Account creation process is easy as it requires little personal data. You need to provide data related to name, country, email address, telephone number and password for registration. You can reach the registration form by clicking on “Start investing” or “Register” on the home page. The platform will send you a confirmation email once your account is successfully created.

- Step 2: After the completion of the registration form, the investors are required to verify the identity. For verification purpose, the platform will ask you to provide a scan of Identity card as well as tax documents.

- Step 3: Although you can use its dashboard after registration and verification, but you need to fund your account for investing purpose. The investors can easily add funds to his Grupeer account by clicking on the “Add funds” button. Once you click the add funds button, you will see a new screen where you see deposit method options to top up your account. Unfortunately, they only offer banks transfers in order to comply with anti-money laundering policies.

How to Start Investing through Grupeer?

Once you have created your profile and funded the account, you are free to invest in any product that is offered on its website. For instance, you decide to invest in loans, development projects or stability funds, just click on the “Invest” tab in the main menu of the site.

On this page, you can see all the available and filterable investments at the top of the page. Once you have identified the investment, just click on invest, enter the amount, and click on the briefcase next to the figure to add the investment to the “cart”. Once you selected the desired loan, simply confirm it by clicking on the briefcase at the top of the page.

What Products Grupeer Offers?

Grupeer has been seeking to diversify its product portfolio over the years. It is a P2P marketplace, where lending companies can also sell the claim rights on their loan portfolio to a network of independent investors. This is one of the best ways to offer risk-free loans to investors. In addition, the loan portfolio that the originator wants to place on this platform always goes through Grupeer in-house scoring model along with the due diligence. Below are the types of investment options they currently offer through this platform:

Loans

- Business Loans: Business loans are generally offered to small to medium-sized businesses that have the potential to return higher interest along with the principal amount. These loans could be either issued or new.

- Mortgage Loans: Mortgage loans are one of the easiest ways of lending money to borrowers. These loans are secured by collaterals. This means borrower home will be used as collateral until the borrower fully pays the debt and interest amount. Mortgage loans offer interest rate in the range of 10% to 15%.

Development Projects

Grupeer has developed a special section called Development Projects. These are real estate development projects. However, these loans require a higher amount when compared to business and mortgage loans. The rate of return and time duration of development projects vary according to the agreement.

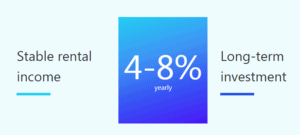

Grupeer Stability Fund

Grupeer Stability Fund is different from the above investment types. This stability fund will permit investors to literally buy a square meter in a real estate property, which will make you an owner of a fraction in the development project or office building. After investing in this product, client will receive a stable rental income from 4% to 8% yearly.

The Auto Invest Feature

Like many other P2P lending platforms and brokers, Grupeer has also developed auto invest feature. This feature is perfectly designed for individuals who don’t have time to take a close look at each investment opportunity. The investor is eligible to design an auto-Invest strategy according to his investment criteria. By default, this feature can invest in projects that are relatively new for an investor, unless the investor specifies otherwise. The platform also permits the investor to set a limit on how much funds you want to be invested through Auto-Invest.

What is GruPeer Deposit & Withdrawal Process?

Like other P2P platforms, Grupeer only accepts bank transfers. This is due to compliance with anti-money laundering laws. They do not accept payments from online payment services companies. Your funds will be available for investment within three days. Once the platform receives the funds, they will notify you through email.

The platform also only permits investors to withdraw funds to a bank account. The process is simple, you just need to click the “withdraw funds”, and enter the amount you seek to withdraw. It could take three business days to reach your bank account.

What Countries are Accepted on this Platform?

The platform accepts investors from the European Economic Area as well as Switzerland. The restriction on other countries is due to AML (Anti-Money Laundering) laws. The platform only accepts money transfers from licensed payment institutions and credit institutions operating in the European Economic Area. Clients from the following countries can invest through this platform:

- Austria

- Belgium

- Bulgaria

- Croatia

- Italy

- Netherlands

- Norway

- Poland

- Cyprus

- Czech Republic

- Denmark

- Finland

- Greece

- Hungary

- Ireland

- Malta

What is Grupeer Buyback and Contract Modification Strategy?

The platform offers buyback Guarantee on all offerings. This is because they carefully select loans before placing them on the platform. They also get buyback guarantee from loan originators. In the case of borrowers default or delayed payment for 60 days, the loan originator is liable to refund the invested capital.

The buyback guarantee is an integral part of the agreements between the credit organizations and platform. This type of agreement between credit organizations and platform gives significant confidence to investors.

Unfortunately, the investor cannot cancel or modify investment. This is because the platform automatically exchanges information with credit companies. The investment cannot be sold or modified once you have purchased it.

What is Grupeer Referral Program?

Grupeer offers one of the best referral programs. The referral is available to all the registered members. This program permits investors to earn additional income by referring this platform to a friend or other internet users. Instead of a one-time bonus for referring this platform, Grupeer offers a bonus of 0.5% to 1.25% on all investments made by the person who joined this platform through your individual link. This income is not dependent on your investments so you don’t possess any risks.

The amount that you can earn varies with the loans that the recipient invests in. If the recipient invests in loans of:

- Less than 3 months, you earn 0.5% of the investment.

- Between 3 and 6 months, you earn 0.70% of the investment.

- Between 6 and 12 months, you earn 1% of the investment.

- <12 months, you earn 1.25% of the investment.

Is Grupeer Safe?

- Grupeer offers three-step-protection to clients with regards to their investments. The platform claims that they are complying with legal requirements of regulators regarding transaction control and the due diligence procedures. The platform thoroughly researches and analyzes loan originators and each credit transaction before presenting it to investors.

- Secondly, Grupeer’s strategy of offering a buyback guarantee makes lending completely safe for investors. The loan originator will be responsible for payback funds along with interest if the borrower goes bust.

- Thirdly, the loan originators always hold some amount of the loan.

- Finally, the platform is strictly complying with anti-money laundering policies.

Is Grupeer Customer Support Good?

Grupeer customer support is good. The support team responds to emails within three days. The investors can also make a phone call if they have an urgent issue. However, the live chat feature is not available for investors. Investors can also easily search answers from its FAQ section.

In addition, the company is looking to improve their customer service as it gives significant importance to providing a better investment environment and experience. This is evident from its team’s reply to the investor when he complained about poor communication.

Commenting on Trust Pilot the investor said, “Looks like it works, but the service is not the best. A lot of emails are unanswered, answered only after certain calls. My Company verification took extremely long, all documents from my side are provided, but I got no information/communication that there is something missing – only after a lot of emails. I hope this will be not a daily business.”

Replying to the investor the Grupeer team said, “Thank you for your feedback! We are extremely sorry for being late with your company verification as well as answering to you. We will improve our service provided!”

Conclusion

Grupeer is one of the best P2P lending platforms both in terms of returns and safety. The platform currently offers average returns of 14% while it’s all loans are secured with a buyback guarantee. The buyback feature reduces the risk of borrowers default. In addition, the investors are free to select the loans and projects according to their investment criteria. The platform also offers auto investing feature and stability funds. These features are perfect for investors who are seeking stable returns with low risk.

FAQ:

What are the necessary steps to start making deals on the Platform?

What types of investments in loans offered at Grupeer?

When did the deal confirm legally?

Who can legally close deals on the Platform?

What is a user identification number?

How to activate my profile?

Peer 2 Peer – A-Z Directory