Peer Street Loan Review 2021 – READ THIS BEFORE Applying!

FinTech has been disrupting the financial services industry in recent ![]() years by bringing aboard new players who were previously denied entry to markets that required high capital such as real estate. One section with the most impact is peer-to-peer investing.

years by bringing aboard new players who were previously denied entry to markets that required high capital such as real estate. One section with the most impact is peer-to-peer investing.

In this PeerStreet review, we look at one of the platforms that are changing how people invest in the real estate market. Read on!

-

-

What is PeerStreet?

PeerStreet is an online peer-to-peer investing platform that was founded in 2013 by three partners among them Brett Crosby, the founder of Urchin Software, which was acquired by Google and rebranded as Google Analytics. It offers real estate loans for crowdfunding as an intermediary between loan originators and investors. The company is based in El Segundo California.

As of March 2019, the company claims to have transacted over $2 billion and over $1 billion in asset under its management. The company has transacted on over 4,700 loans since inception with fewer than 3% (136 loans) going into default. However, that does not mean that investors have lost their money, 40% were paid off before completing foreclosure and others are actively in the foreclosure process.

PeerStreet uses the same concept used by other peer-to-peer lenders, but in this case, borrowers place real estate as collateral. If the borrower cannot pay the loan, your money will be recovered, but this can take months and sometimes years.

Also, try out Fundrise as an alternative to peer street

PeerStreet Pros- Automated investing feature for those who like hands free investing

- PeerStreet loans are often in the first lien – should the loan go into foreclosure, they are the first in line to get money back if liquidation occurs.

- Interests are paid twice monthly (1st and 15th after repayments)

- Low minimum investment ($1000)

- Excellent transparency

- Short term maturity

PeerStreet Cons- Investment is only open to accredited investors

- High service fee (1%)

- There is no secondary market – you have to hold your loan until it matures.

How PeerStreet works

Unlike other peer-to-peer platforms, PeerStreet does not originate its own loans. Instead, it teams with regional loan originators who source loans from borrowers, often real estate developers and investors who want to flip a property. This purchase of loans from third parties removes a potential conflict of interest as firms that originate their own loans find it hard to stop originating loans when they earn an origination fee. However, this means it is more expensive because they still have to make money, in this case, only from you, the investor.

The investments they offer can also be called ‘hard money lending’. The investors are usually looking for short-term loans, mostly up to 24 months and they need the financing quickly as soon as they identify a project. Traditional lenders are usually not interested in quick turn around and short-term loans, the investors, therefore, turn to loan originators who fund the projects and sells the loans in parts to lenders on a platform like PeerStreet.

PeerStreet vets originators by reviewing their track records, licensing and their adherence to state usury laws, legal and underwriting process, financials and running background checks before adding them to their list of originators. They also perform independent underwriting of all loans using big data analysis, independent valuation, review the legal documentation and ensure that each loan complies with their set underwriting guidelines.

Note that the loans are already funded by originators before they are sold on the platform.What exactly are you investing in?

By investing on the platform, you are not directly investing in the commercial real estate. You are investing in the loans that are secured by the property. These loans are divided into notes to reduce your exposure and help you diversify your portfolio. The minimum amount you can invest in each note manually is $1000. Institutions are however allowed to purchase whole loans.

You must be aware that your note is not secured by real estate, the underlying loan is.

PeerStreet Features

Multiple accounts available – Self-directed IRA accounts, trusts, joint and individual accounts

Income tax reporting – the platform provides investors on the platform with IRS form 1099 reporting their income since the earnings from the platform are taxable.

Interests are paid twice monthly, on the first and fifteenth of each month. Interests can either be reinvested or withdrawn. Principle and other distributions are paid to investors as they are received

No secondary market – this means no liquidity. If you invest in PeerStreet loans, you have to hold them until the loans mature. You also cannot resell them in private transactions.

Available in all 50 states

Types of loans offered by PeerStreet

The platform offers the following loans for investment:

Bridge loans – these are short term loans, usually 3 months to 3 years that are used to ‘bridge the gap’ between financing and a future event such as refinancing, sale, or removal of an existing obligation. Bridge loans on the PeerStreet platform are for an investment or a business purpose only. Bridge loans provide the capital needed to fix and flip the property or buy to rent.

30-Day Note – this is a short-term investment that provides investors with more liquidity. In 30 days, the principal and interest are repaid to the investor who can then decide to reinvest in another or the same note. The underlying loan is secured by real estate. PeerStreet will repay the loan, principal and interest in full regardless of whether the loan payment is made on time by the borrower.

Cash Offer Loans – these are short term loans that enable buyers to give their sellers an all-cash offer instead of waiting for mortgage finalization. The homebuyer identifies the home and engages an agent or service provider to purchase it on their behalf. A bridge loan is made to the agent or service provider using the new home as collateral; the buyer puts down an earnest money deposit and moves in as a tenant in the new home. When the homebuyer finalizes mortgage or sells the current home, the agent or service provider sells the home to them and repays the loan.

Why would borrowers consider hard money loans?

Here are some reasons why borrowers take loans such as those on PeerStreet

- Quick closing – the real estate investor wants to purchase the undervalued property immediately, most traditional lenders take up to 90 days to issue a loan. By the time it is funded, it may be too late.

- Short–term financing – the investor wants to fix the home and sell it as first as possible at a profit. A 30-year mortgage plan may not be helpful here.

- Nature of the property – the fix and flip property may need some work, traditional lenders shy away from such investments as they see the flaws as additional risk.

- No cash flow – the property is not generating cash which raises the lender’s risk considerably, especially if the property was trashed or abandoned by its previous owner.

Do How to start investing in PeerStreet

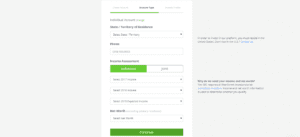

As with most platforms, the first step is opening an account. The process is not complicated on PeerStreet, the first form requires you to fill in your name, working email and setting a password.

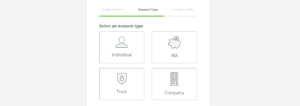

The next step is choosing the account type you are opening. Currently, the platform has four types of accounts including individual, trust, IRA, and company.

Once you select, you have to provide additional details such as state of residence, phone number and income assessment to prove that you are an accredited investor. You also have to choose your risk tolerance, experience and investment objective on the next page. You can complete your profile including verifying and funding the account on the platform

Choosing investments on PeerStreet

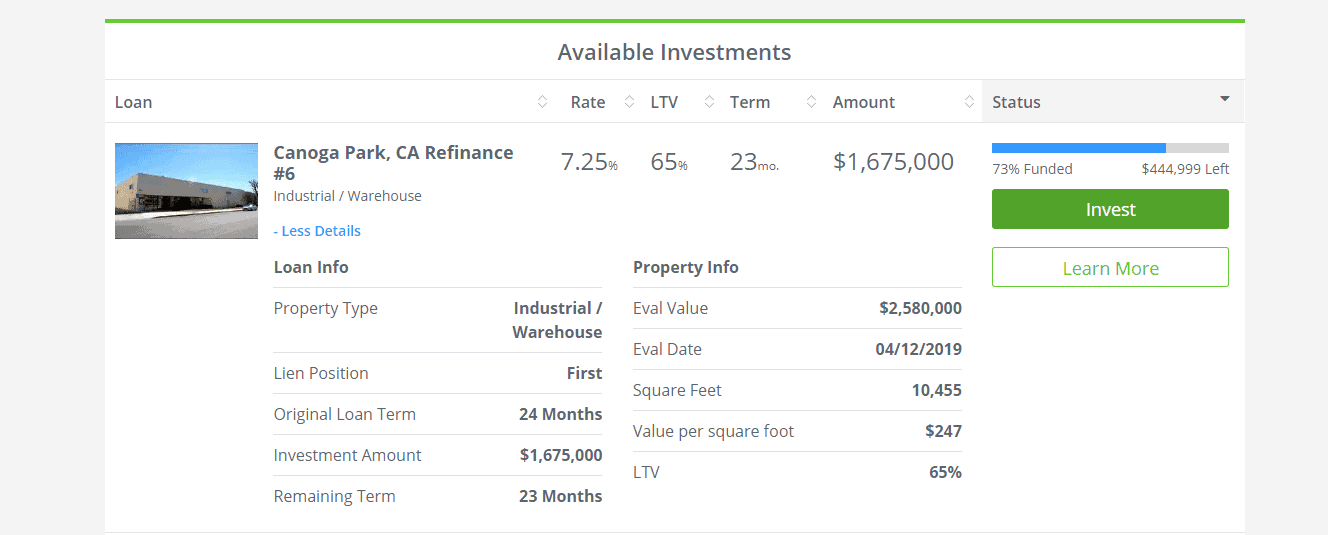

The platform allows you to invest in loans that match your risk appetite. The offering page presents the loans available for investing including details such as property photos, location, LTV ratio, term, interest rates and total loan amount.

You can click on ‘more info’ to view additional information about the property including bed/baths, appraisal value and date, square feet, value per square feet, rate details and PeerStreet fees.

The ‘learn more’ button takes to a separate page where details of the originator and their skin in the game are provided in addition to loan purpose and strategy, maps showing the property and nearby projects and their value, projected return calculator and payment terms.

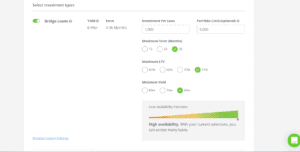

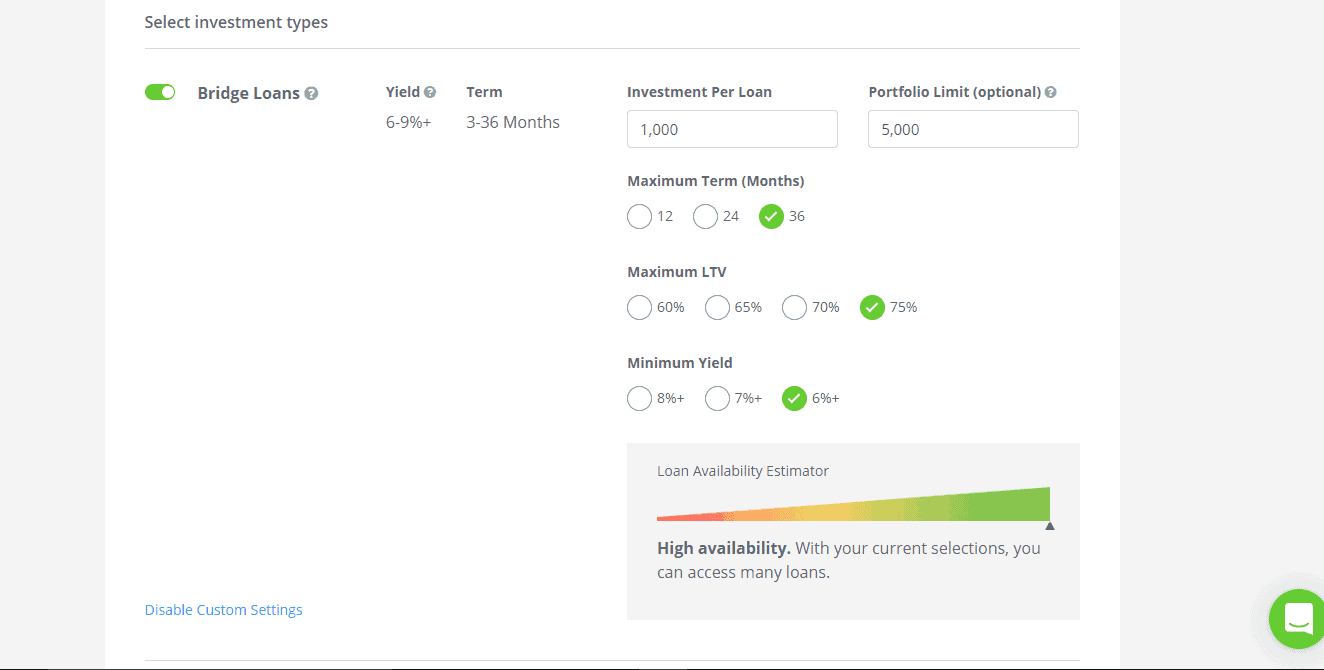

Automated investing

The platform provides an auto invest tool that allows you to set your loan preferences. It enables you to set interest rates, LTV, loan terms and investment per loan. The tool matches your investment criteria to loans and if it matches, a pending purchase is made.

In case a loan is oversubscribed, such as loans with higher interests and lower risk, a queue is formed in the system. The selections made by the auto invest tool are displayed in the ‘loan positions awaiting closing’ section where you can back out within 24 hours.

The auto invest tool can be turned on or off at any time.

Risks associated with investing in PeerStreet

Default – There is always a risk of the loan going into default or becoming delinquent. The loans on PeerStreet are backed by property but that is not a guarantee that all your money will be recovered. If the loan is recovered, PeerStreet first pays legal fees and other related fees then distributes the rest to investors on a pro rata basis. PeerStreet distributes 50% of default interest to investors

Early repayment of loans – PeerStreet does not penalize borrowers for repaying their loans before the term ends. This means you may lose some of the interest you would have earned if the loan made it to maturity.

Liquidity problems – The platform does not offer a secondary market where you can sell your notes before the term ends. It is therefore impossible to raise quick cash if you want to opt out of the loan early.

How much can I earn on PeerStreet?

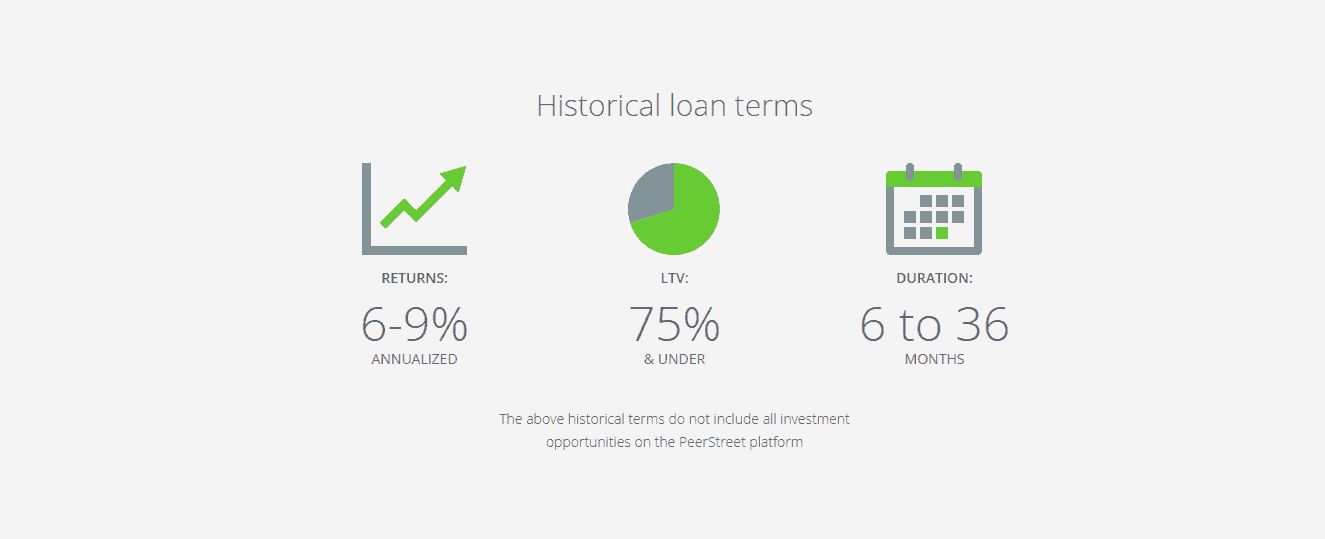

Your earnings depend on the loans you pick, invested amount, risk tolerance among other factors. The historical loan statistics on the platform put the returns between 6% and 9% for loans between 6 to 36 months. However, most loans on the platform currently offer interest rates from 7% to 8%.

The platform also charges a servicing fee on each loan. The fee represents the difference between the interest payable on the loan and the interest you will receive. It ranges from 0.25% to 1% and is disclosed for each loan.

Who is eligible to be an investor?

To be eligible for a loan on the platform, you must:

- Be above the age of 18 and have a social security number

- Be an accredited investor (Have earnings exceeding $200,000 or $300,000 with a spouse for each of the last 2 years and be expecting the same this current year, have a net worth of more than $1 million).

PeerStreet Review: Verdict

PeerStreet is worth considering if you are an accredited investor. The platform offers an opportunity to earn much higher interests than you would get in other fixed-rate investments. However, the returns offered are still lower than other crowdfunding platforms.

Investing on the platform won’t hold your money for years since the loan terms range from 6 to 36 months, also, the nature of the investments offered by PeerStreet make them less risky than those on other platforms.

Glossary Of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

Does PeerStreet make loans to borrowers directly?

No, PeerStreet sources loans from regional real estate lenders who know their market well. All that PeerStreet does is offer them a secondary market where they can sell their loans. Borrowers have to go to their network of lenders

Can you reinvest balances less than $1000?

Yes, you can, if you are using auto invest. Payments from interests can be reinvested automatically when they reach $100. Manually it is not possible.

Does PeerStreet offer loan extensions?

Yes, extensions can be granted on a case-by-case basis where the borrowers request the extension of the loan term. PeerStreet charges an extension fee, of which you will receive 50%.

Can I have multiple accounts on PeerStreet?

Yes, you can have different types of accounts (IRA, Individual, Company, Trust) as long as they are all accredited and set up with different emails.

What are the fees for opening an account?

Signing up for PeerStreet is free.

Are there fees for opening a self-directed IRA?

Yes, the platform charges $50 for account set up, $100 annual account fee and $50 processing fee. You are also required to fund the account with $5000 or more.

Peer-to-peer Sites - A-Z Directory

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up