Oil futures are posting their fourth consecutive day of gains in early commodity trading action today while they seem poised to close the week with mid-single-digit jumps on the back of positive economic data and a beyond-expected drop in US crude inventories.

So far this morning, futures of the West Texas Intermediate (WTI) – the US benchmark price for oil – are advancing 0.6% at $67.25 per barrel while accumulating a 5.8% gain so far this wee. Meanwhile, Brent futures are up 0.4% at $69.48 per barrel in early oil trading activity while posting a 4.8% weekly gain.

Oil prices have been moving higher for four days in a row after they went down sharply last week amid worries that negotiations between the United States and Iran could lead to the lifting of sanctions that have prevented the country from selling its crude output freely.

Analysts estimate that Iran could pour between 500,000 and 1.5 million barrels per day to the global oil market, which represents around 1.6% of 2021 supply levels as estimated by the US Energy Information Administration (EIA).

However, these concerns appear to have taken the back seat this week, as oil traders focused on a beyond-expected drop in US crude build-ups as reported by the agency this Wednesday.

Data from Koyfin indicates that the drop in crude oil stocks exceeded analysts’ forecasts by 667,000 barrels as the North American country saw its reserves drop by a total of 1.66 million barrels during the week ended on 23 May. Meanwhile, distillate and gasoline reserves also reported beyond-expected drops.

Moreover, durable good orders excluding transportation items came in 20 basis points above the consensus estimates of 0.8% for April while both initial and continuing jobless claims in the United States were also lower than expected. These positive readings about the economy have possibly sealed the deal for oil futures this week as they point to a sustained improvement in overall conditions.

“Boosted by good economic data and risk appetite among investors on the financial markets, Brent is making a renewed bid for the psychologically important $70 per barrel mark”, commented an analyst from Commerzbank to Reuters this morning in regards to the price action in oil futures.

Meanwhile, as the US enters the summer season, analysts expect that higher demand for jet fuel could propel crude prices higher in the coming weeks, with Brent futures possibly eyeing the $80 level as indicated by the latest forecasts from investment banks including Goldman Sachs.

An important event for oil will take place next week, as the Organization of the Petroleum Exporting Countries (OPEC) will be meeting via videoconference on 1 June. The cartel’s decisions and plans concerning the potential reintroduction of the Iranian output to the markets will be crucial to determine the direction of oil for weeks to come.

What’s next for oil futures?

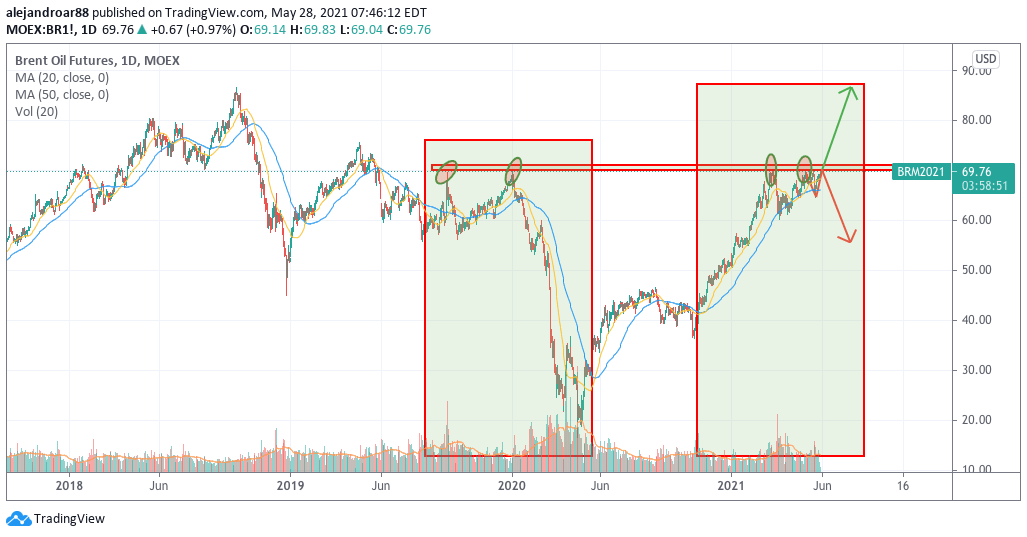

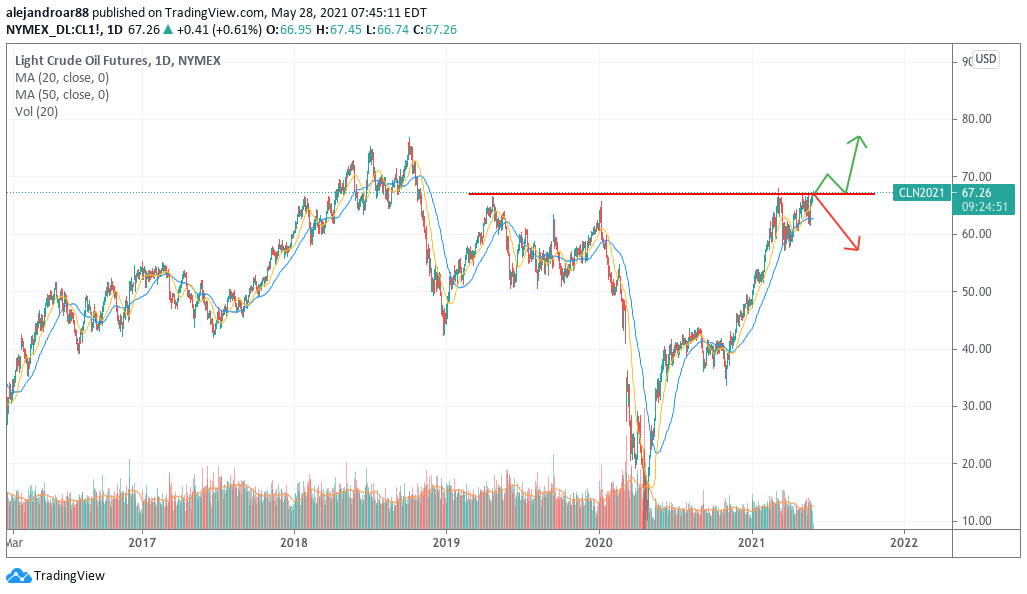

Both WTI and Brent futures are tagging key resistances today after they slid the previous week due to Iran-related concerns. This could be a tipping point for oil as the latest rally could either accelerate or go bust if oil traders believe that higher crude prices are unjustified based on the current outlook. The two charts below summarize the scenarios for both the WTI and Brent.

The reward-to-risk ratio here is not necessarily attractive as a rejection of these long-dated resistances could lead to a sharp correction in crude prices on short notice – possibly as market participants show the real extent of their concerns about the Iranian situation.

In this regard, a key catalyst for a sharp move in crude prices could be the actions and decisions taken by OPEC in response to this scenario. In that context, traders should be cautious in hedging their exposures to potentially sharp turns in the direction of oil prices.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account